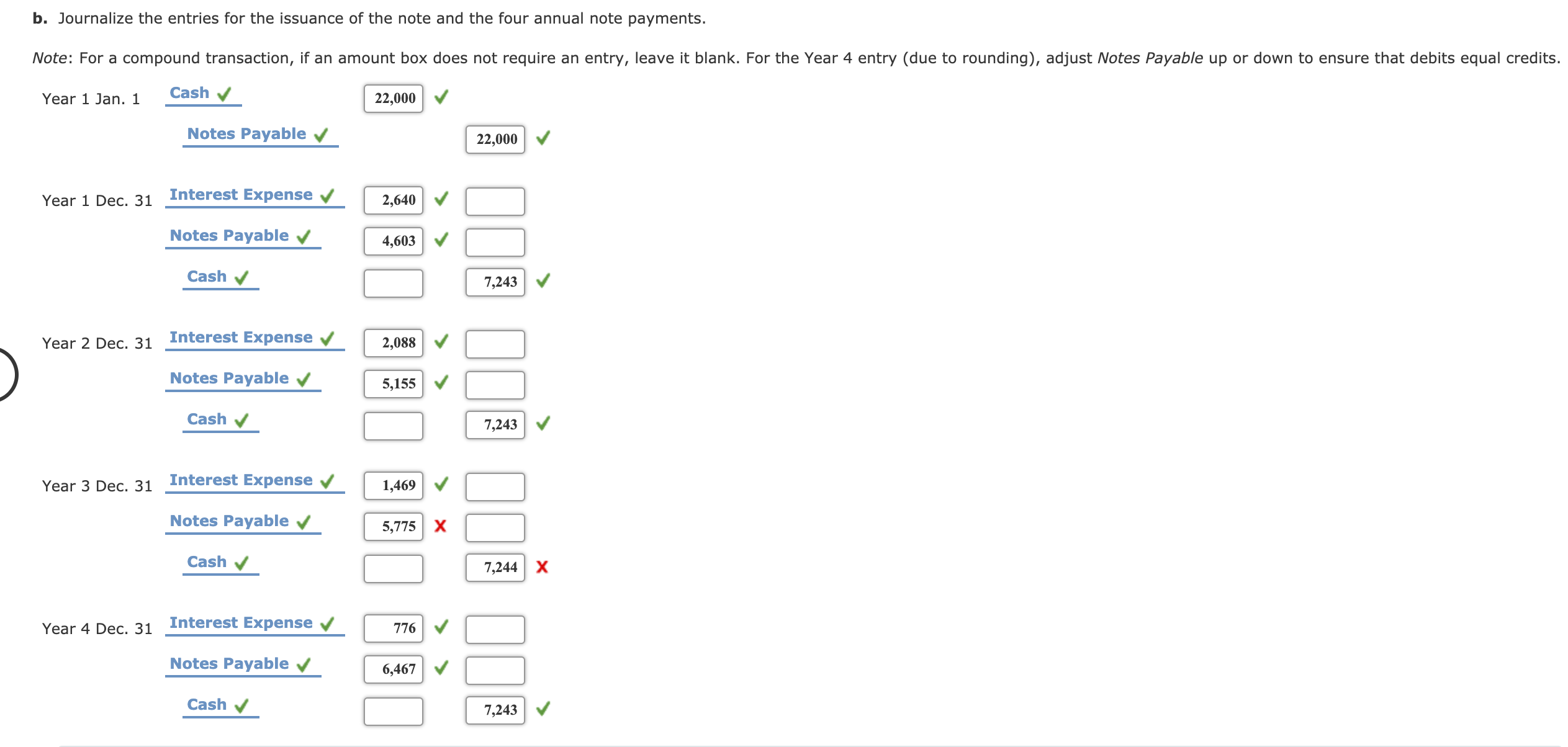

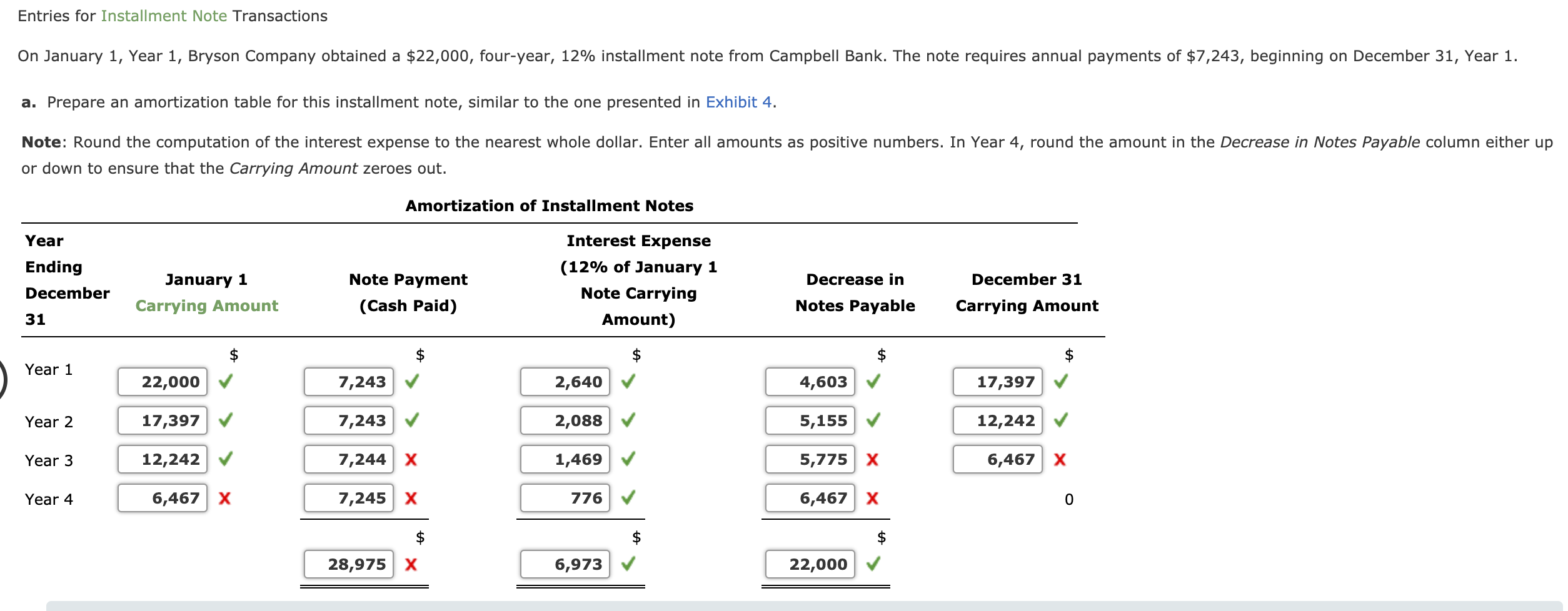

On January 1, Year 1, Bryson Company obtained a $22,000, four-year, 12% installment note from Campbell Bank. The note requires annual payments of $7,243, beginning on December 31, Year 1. a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4. Note: Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers. In Year 4, round the amount in the Decrease in Notes Payable column either up or down to ensure that the Carrying Amount zeroes out. Amortization of Installment Notes Year Interest Expense Ending (12% of January 1 January 1 Note Payment Decrease in December 31 December Note Carrying Carrying Amount (Cash Paid) Notes Payable Carrying Amount 31 Amount) $ $ $ Year 1 22,000 V 7,243 2,640 4,603 17,397 V Year 2 17,397 V 7,243 2,088 5,155 12,242 V Year 3 12,242 V 7,244 X 1,469 5,775 X 6,467 X Year 4 6,467 X 7,245 X 776 6,467 28,975 X 6,973 22,000

On January 1, Year 1, Bryson Company obtained a $22,000, four-year, 12% installment note from Campbell Bank. The note requires annual payments of $7,243, beginning on December 31, Year 1. a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4. Note: Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers. In Year 4, round the amount in the Decrease in Notes Payable column either up or down to ensure that the Carrying Amount zeroes out. Amortization of Installment Notes Year Interest Expense Ending (12% of January 1 January 1 Note Payment Decrease in December 31 December Note Carrying Carrying Amount (Cash Paid) Notes Payable Carrying Amount 31 Amount) $ $ $ Year 1 22,000 V 7,243 2,640 4,603 17,397 V Year 2 17,397 V 7,243 2,088 5,155 12,242 V Year 3 12,242 V 7,244 X 1,469 5,775 X 6,467 X Year 4 6,467 X 7,245 X 776 6,467 28,975 X 6,973 22,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 11E

Related questions

Question

I need help figuring out how I got certain parts of the question wrong

Transcribed Image Text:On January 1, Year 1, Bryson Company obtained a $22,000, four-year, 12% installment note from Campbell Bank. The note requires annual payments of $7,243, beginning on December 31, Year 1.

a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4.

Note: Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers. In Year 4, round the amount in the Decrease in Notes Payable column either up

or down to ensure that the Carrying Amount zeroes out.

Amortization of Installment Notes

Year

Interest Expense

Ending

(12% of January 1

January 1

Note Payment

Decrease in

December 31

December

Note Carrying

Carrying Amount

(Cash Paid)

Notes Payable

Carrying Amount

31

Amount)

$

$

$

Year 1

22,000 V

7,243

2,640

4,603

17,397 V

Year 2

17,397 V

7,243

2,088

5,155

12,242 V

Year 3

12,242 V

7,244 X

1,469

5,775 X

6,467 X

Year 4

6,467 X

7,245 X

776

6,467

28,975 X

6,973

22,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub