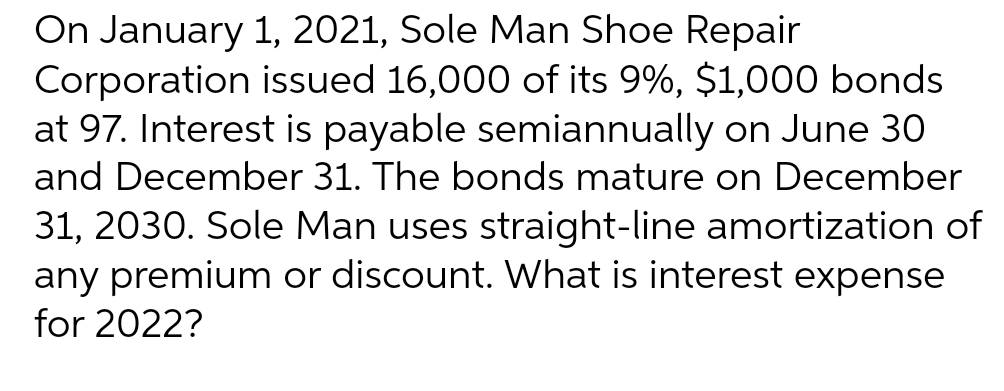

On January Corporation 1, 2021, Sole Man Shoe Repair issued 16,000 of its 9%, $1,000 bonds at 97. Interest is payable semiannually on June 30 and December 31. The bonds mature on December 31, 2030. Sole Man uses straight-line amortization of any premium or discount. What is interest expense for 2022?

Q: Catena's Marketing Company Adjusted Trial Balance End of the Current Year Cash Accounts receivable…

A: An income statement is a company's revenues, expenses, and profitability over a period of time.

Q: Travel Ltd provides tourism services to both local and foreign tourists in New Zealand. On 1 January…

A: Revaluation model - Under the revaluation model, the carrying value of fixed assets is adjusted as…

Q: Complete the missing information in the various columns of the worksheet below: Unadjusted trial…

A: Trial balance is the statement which is prepared by the entity to summarize the balances of all the…

Q: unt balances listed above and the information given below, prepare the annual adjusting entries…

A: Adjusting Entries are entries recorded at the end of a given period to adjust the profit or loss for…

Q: which of the following items appear within multiple financial statements? a). net income(or net…

A: Financial statements are interlinked because of some items. Financial statements includes income…

Q: A construction company agreed to lease payments of $425 76 on construction equipment to be made at…

A: As per the given information: Lease payments - $425.76Period - 3.25 yearsFinancing rate -…

Q: Job A3B was ordered by a customer on September 25. During the month of September, Jaycee Corporation…

A: The process by which manufacturing costs are moved from one stage of production to another is…

Q: 11. Rubium Micro Devices currently manufactures a subassembly for its main product. The costs per…

A: Disclaimer : “Since you have asked multiple questions, we will solve the first question for you. If…

Q: Sunland Corporation showed the following information on its financial statements on December 31,…

A: Common stock: The total equity of a company is divided into small parts, known as common stock.…

Q: Your COGS$=$35,250 Total Labor = $26,000 Controllables = $5,750 Minimum Rent = $6,500 Advertising =…

A: INTRODUCTION Controllable costs are subtracted from Controllable Revenues to determine Controllable…

Q: Exercise 3-6 (Algo) Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement…

A: The schedule used to determine the cost of producing things over a certain length of time is…

Q: Lawson Consulting had the following accounts and amounts on December 31. Cash $ 5,000 Dividends $…

A: Retained earnings are the part of earnings that are not distributed by the company among the…

Q: Sandhill Company sells goods to Blossom Company during 2025. It offers Blossom the following rebates…

A: Revenue is the total amount generated by a company after selling its products to its clients or…

Q: augeted salv Budgeted sales Budgeted cash payments for Direct materials Direct labor Overhead July…

A: Answer:- 1. Schedule Of Cash Receipt S.NO…

Q: Skysong Inc. issued $3,120,000 of convertible 10-year bonds on July 1, 2020. The bonds provide for…

A: Working : (1) Calculation of Unamortized discount on bonds payable : Amount to be amortized over…

Q: ABC and CVP Analysis: Multiple Products Good Scent, Inc., produces two colognes: Rose and Violet. Of…

A: The overhead is allocated to the production on the basis of pre-determined overhead rate. The…

Q: Kirit Devi’s employer receives a creditor garnishment order to withhold $100 from Devi’s paycheck…

A: Disposable Earnings The income remains after adjusting the applicable deductions under the federal…

Q: Your client has made previous lifetime gifts that have fully exhausted his applicable credit amount.…

A: Estate tax refers to the federal tax which is being levied on the transfer of estate of the person…

Q: On 1 January 20X1, Tyler Trading Corp. was incorporated by Jim Tyler, who owned all the common…

A: The accounting income refers to the earned income. The company purchases goods and sell at higher to…

Q: accounting policies

A: Accounting policies mean the set of principles laid down by a venture’s management. These policies…

Q: (Preferred stock valuation) Pioneer's preferred stock is selling for $18 in the market and pays a…

A: Preferred stock is that stock which is being issued by the company for raising finance. Dividend…

Q: Crane Company issues $26400000, 8.0%, 5-year bonds dated January 1, 2024 on January 1, 2024. The…

A: Time Value of Money :— According to this concept, value of money in present day is greater than the…

Q: Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E Accumulated…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Harper is considering three alternative investments of $10,000. Assume that the taxpayer is in the…

A: Investment alternatives are the number of options available to the investor so that the individual…

Q: S Use the May 31 fiscal year-end information from the following ledger accounts (assume that all…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Chloe's Cafe bakes croissants that it sells to local restaurants and grocery stores. The average…

A:

Q: List and explain the objectives of Financial Reporting.

A: Financial reporting is providing detailed financial information to all relevant parties on the…

Q: Simpson Glove Company has made the following sales projections for the next six months. All sales…

A: A cash budget is a document produced to help a business manage its cash flow.

Q: Assume Down, Incorporated, was organized on May 1 to compete with Despair, Incorporated-a company…

A: Balance sheet is one of most important financial statements under double entry accounting system.…

Q: Sunland Inc., is currently under protection of the U. S. bankruptcy court. As a "debtor in…

A: Bankruptcy seems to be a legal procedure that allows people or organizations to be free of their…

Q: A Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E…

A: When goods are purchased by a company, the vendor charges sales tax at a specific percentage of the…

Q: Zoolander Inc. manufacturers high end fashion accessories and has provided the following data for…

A: The cost of goods sold includes the cost of goods manufactured and beginning finished goods…

Q: Oriole Company manufactures products ranging from simple automated machinery to complex systems…

A: A performance obligation is a commitment made in a legally enforceable agreement with a buyer to…

Q: compute the total carrying amount of Oriole's patents on its December 31, 2025, balance sheet.…

A: Patents refers to the rights that one have on their own unique invention and which ristrict others…

Q: The Foundational 15 (Algo) [LO3-1, LO3-2, LO3-3, LO3-4] [The following information applies to the…

A: Working Note : Manufacturing overhead applied to production = Predetermined overhead rate * Actual…

Q: You work as a freelance accounting professional and have been recently engaged by the auditors of…

A: DPS (Dividend per share) of the corporation is determined by dividing the dividend declared or…

Q: projected unit sales of Western Company, which manufactures casual wear. Each unit sells for $25.…

A: CASH COLLECTION FROM CUSTOMER Cash Collection is the Function of Accounts Receivable. There is Two…

Q: A B 28 29 Homework 14-2 30 Sunset has 10,000 outstanding shares of 4%, $10 par preferred stock and…

A: Cumulative preferred stock is the type of stock where stock holders have right to receive arrears…

Q: Required 1. Compute the break-even point in dollar sales for next year assuming the machine is…

A: Solution

Q: Before the year began, Brookville Manufacturing estimated that manufacturing overhead for the year…

A: The overheads are the cost that are not related directly to the production of goods and services.…

Q: Lann works for Talbert Electronics. As a shared employee, Lann works in the manufacturing department…

A: The company hires workers to do work in the organization such as manufacturing, sales, etc. The…

Q: When you undertook the preparation of the financial statements for Sheridan Company at January 31,…

A: Inventory is the goods or merchandise of the company which are ready to be sold in the market to…

Q: On January 4, 2019, Columbus Company purchased new equipment for $693,000 that had a useful life of…

A: INTRODUCTION: The value of a fixed asset is diminished over the course of its useful life using a…

Q: On 1/1/2020, the merchant Ahmed imported goods at a cost of 880,000 dinars, and the customs duties…

A: Sales tax payable will be reduced by sales tax paid i.e. Input tax credit in order to calculate net…

Q: Cash and cash equivalents Advertising Trade receivables Gross revenue Trade and other payables…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: Sarasota Corporation had the following stockholders' equity accounts on January 1, 2022: Common…

A: Treasury Stock: Treasury stock is formerly outstanding stock that has been repurchased and is now…

Q: Stellar Inc., is currently under protection of the U.S. bankruptcy court. As a "debtor in…

A: A journal entry is the initial process of entering a commercial transaction into the books of…

Q: A Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E…

A: Straight line method of Depreciation: Depreciation and amortisation, often known as the process of…

Q: A new store manager has been provided with performance measures for his evaluation. As he reviews…

A: There are many types of cost incurred during manufacturing process. Such as direct cost ,…

Q: The following information relates to the William Brown Company. Date December 31, 2021 December 31,…

A: "Last-In, First-Out" is an abbreviation for LIFO. It is a technique used in the computation of the…

Ee 112.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $540,000. Interest is payable annually. The premium is amortized using the straightline method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. June 30, 2019: entry to record payment of interest to bondholders C. June 30, 2019: entry to record amortization of premium D. June 30, 2020: entry to record payment of interest to bondholders E. June 30, 2020: entry to record amortization of premiumOn January 1, 2019, Brewster Company issued 2,000 of its 5-year, 1,000 face value, 11% bonds dated January 1 at an effective annual interest rate (yield) of 9%. Brewster uses the effective interest method of amortization. On December 31, 2023, Brewster extinguished the 2,000 bonds early through acquisition in the open market for 1,980,000. On July 1, 2022, Brewster issued 5,000 of its 6-year, 1,000 face value, 10% convertible bonds dated July 1 at an effective annual interest rate (yield) of 12%. The bonds are convertible at the option of the investor into Brewsters common stock at a ratio of 10 shares of common stock for each bond. Brewster uses the effective interest method of amortization. On July 1, 2023, an investor in Brewsters convertible bonds tendered 1,500 bonds for conversion into 15,000 shares of Brewsters common stock, which had a market value of 105 per share at the date of the conversion. Required: 1. Using the information about Brewster, answer the following questions: a. Were the 11% bonds issued at par, at a discount, or at a premium? Why? b. Is the amount of interest expense for the 11% bonds using the effective interest method of amortization higher in the first or second year of the life of the bond issue? Why? 2. Using the information about Brewster, explain the following: a. How is a gain or loss on early extinguishment of debt determined? Does the early extinguishment of the 11% bonds result in a gain or loss? Why? b. How does Brewster report the early extinguishment of the 11% bonds on the 2023 income statement? 3. Based on the information provided about Brewster, answer the following questions: a. Does recording the conversion of the 10% convertible bonds into common stock under the book value method affect net income? What is the rationale for the book value method? b. Does recording the conversion of the 10% convertible bonds into common stock under the market value method affect net income? What is the rationale for the market value method?Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018, and received $540,000. Interest is payable semi-annually. The premium is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of premium

- On July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9% U.S. Treasury notes for 194,000. The notes mature July 1, 2020, and pay interest semiannually on January 1 and July 1. The notes were sold on December 1, 2019, for 199,000. Aldrich normally uses straight-line amortization on all of its notes. In its income statement for the year ended December 31, 2019, what amount should Aldrich report as a gain on the sale of the available-for-sale security? a. 2,500 b. 3,500 c. 5,000 d. 6,000Disclosure of Debt On May 1, 2019, Ramden Company issues 13% bonds with a face value of 2 million. The bond contract calls for retirement of the bonds in periodic installments of 200,000, starting on May 1, 2020, and continuing on each May 1 thereafter until all bonds are retired. Required: How would the preceding information appear in Ramdens balance sheets on December 31, 2019, and 2020?Wilbury Corporation issued 1 million of 13.5% bonds for 985,071.68. The bonds are dated and issued October 1, 2019, are due September 30, 2020, and pay interest semiannually on March 31 and September 30. Assume an effective yield rate of 14%. Required: 1. Prepare a bond interest expense and discount amortization schedule using the straight-line method. 2. Prepare a bond interest expense and discount amortization schedule using the effective interest method. 3. Prepare adjusting entries for the end of the fiscal year December 31, 2019, using the: a. straight-line method of amortization b. effective interest method of amortization 4. If income before interest and income taxes of 30% in 2020 is 500,000, compute net income under each alternative. 5. Assume the company retired the bonds on June 30, 2020, at 98 plus accrued interest. Prepare the journal entries to record the bond retirement using the: a. straight line method of amortization b. effective interest method of amortization 6. Compute the companys times interest earned (pretax operating income divided by interest expense) for 2020 under each alternative.

- Edward Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $480,000. Interest is payable semiannually. The discount is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of discountBats Corporation issued 800,000 of 12% face value bonds for 851,705.70. The bonds were dated and issued on April 1, 2019, are due March 31, 2023, and pay interest semiannually on September 30 and March 31. Bats sold the bonds to yield 10%. Required: 1. Prepare a bond interest expense and premium amortization schedule using the straight-line method. 2. Prepare a bond interest expense and premium amortization schedule using the effective interest method. 3. Prepare any adjusting entries for the end of the fiscal year, December 31, 2019, using the: a. straight-line method of amortization b. effective interest method of amortization 4. Assume the company retires the bonds on June 30, 2020, at 103 plus accrued interest. Prepare the journal entries to record the bond retirement using the: a. straight-line method of amortization b. effective interest method of amortizationDixon Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $480,000. Interest is payable annually. The discount is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. June 30, 2019: entry to record payment of interest to bondholders C. June 30, 2019: entry to record amortization of discount D. June 30, 2020: entry to record payment of interest to bondholders E. June 30, 2020: entry to record amortization of discount