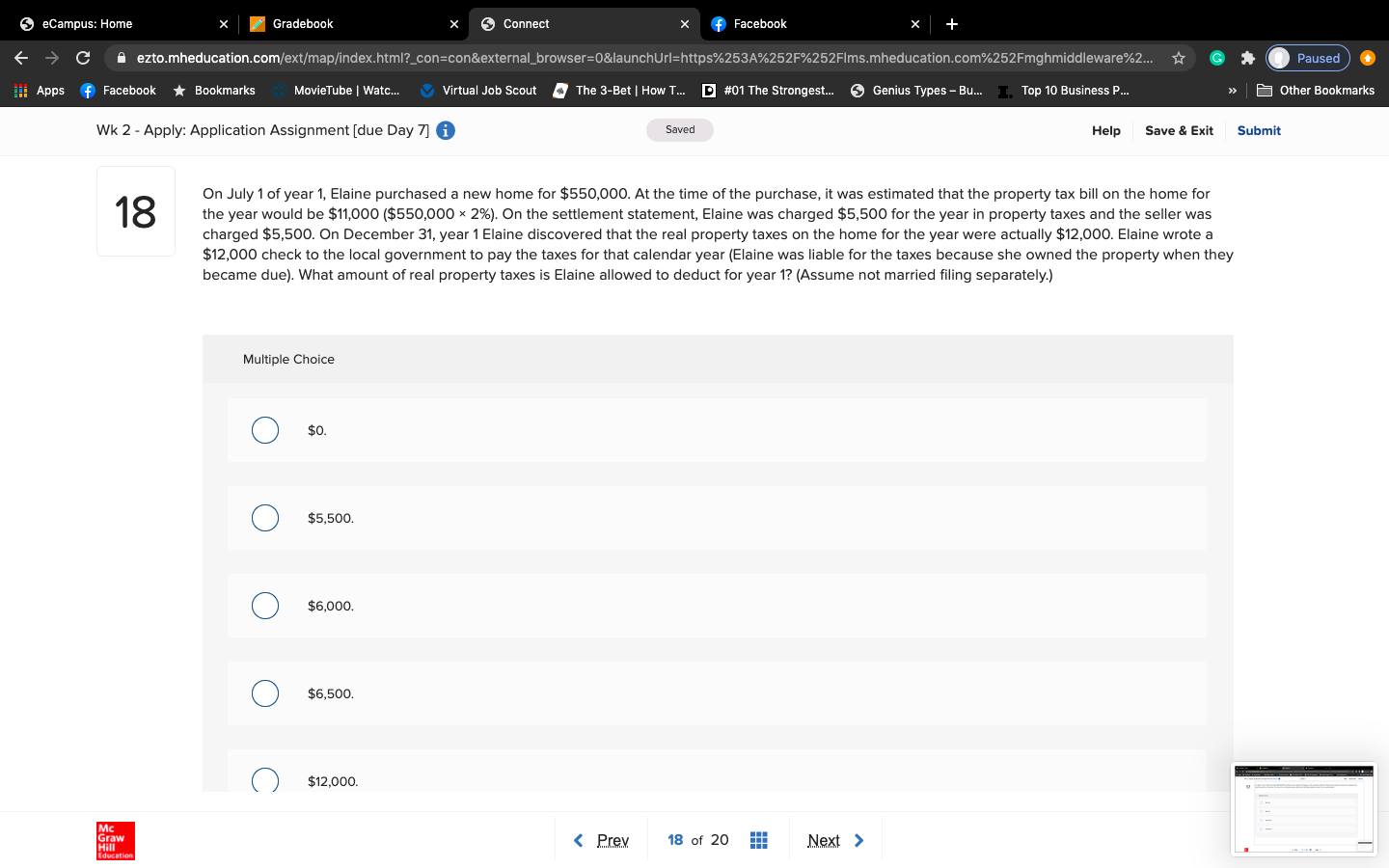

On July 1 of year 1, Elaine purchased a new home for $550,000. At the time of the purchase, it was estimated that the property tax bill on the home for the year would be $11,000 ($550,000 × 2%). On the settlement statement, Elaine was charged $5,500 for the year in property taxes and the seller was charged $5,500. On December 31, year 1 Elaine discovered that the real property taxes on the home for the year were actually $12,000. Elaine wrote a $12,000 check to the local government to pay the taxes for that calendar year (Elaine was liable for the taxes because she owned the property when they became due). What amount of real property taxes is Elaine allowed to deduct for year 1? (Assume not married filing separately.)

On July 1 of year 1, Elaine purchased a new home for $550,000. At the time of the purchase, it was estimated that the property tax bill on the home for the year would be $11,000 ($550,000 × 2%). On the settlement statement, Elaine was charged $5,500 for the year in property taxes and the seller was charged $5,500. On December 31, year 1 Elaine discovered that the real property taxes on the home for the year were actually $12,000. Elaine wrote a $12,000 check to the local government to pay the taxes for that calendar year (Elaine was liable for the taxes because she owned the property when they became due). What amount of real property taxes is Elaine allowed to deduct for year 1? (Assume not married filing separately.)

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 55P

Related questions

Topic Video

Question

Hello, I need help solving this accounting problem.

Transcribed Image Text:On July 1 of year 1, Elaine purchased a new home for $550,000. At the time of the purchase, it was estimated that the property tax bill on the home for

the year would be $11,000 ($550,000 × 2%). On the settlement statement, Elaine was charged $5,500 for the year in property taxes and the seller was

charged $5,500. On December 31, year 1 Elaine discovered that the real property taxes on the home for the year were actually $12,000. Elaine wrote a

$12,000 check to the local government to pay the taxes for that calendar year (Elaine was liable for the taxes because she owned the property when they

became due). What amount of real property taxes is Elaine allowed to deduct for year 1? (Assume not married filing separately.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT