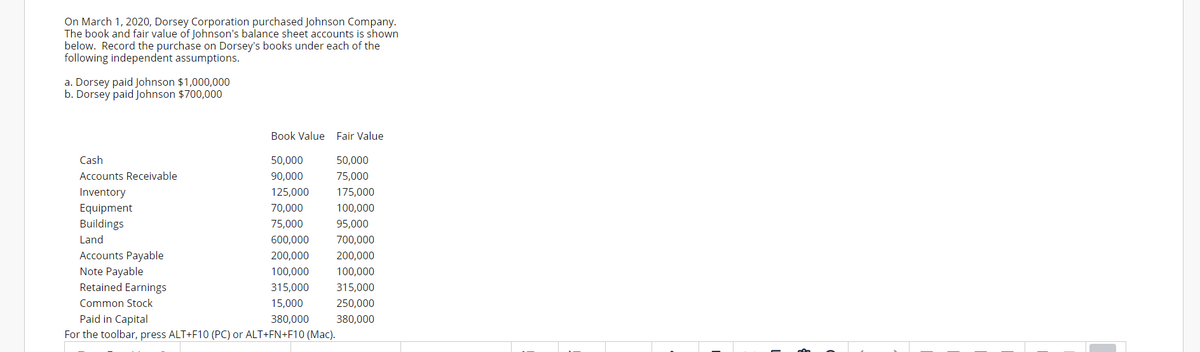

On March 1, 2020, Dorsey Corporation purchased Johnson Company. The book and fair value of Johnson's balance sheet accounts is shown below. Record the purchase on Dorsey's books under each of the following independent assumptions. a. Dorsey paid Johnson $1,000,000 b. Dorsey paid Johnson $700,000 Book Value Fair Value Cash 50,000 50,000 Accounts Receivable 90,000 75,000 Inventory Equipment Buildings 125,000 175,000 70,000 100,000 75,000 95,000 Land 600,000 700,000 Accounts Payable Note Payable Retained Earnings 200,000 200,000 100,000 100,000 315,000 315,000 Common Stock 15,000 250,000 Paid in Capital 380,000 380,000

On March 1, 2020, Dorsey Corporation purchased Johnson Company. The book and fair value of Johnson's balance sheet accounts is shown below. Record the purchase on Dorsey's books under each of the following independent assumptions. a. Dorsey paid Johnson $1,000,000 b. Dorsey paid Johnson $700,000 Book Value Fair Value Cash 50,000 50,000 Accounts Receivable 90,000 75,000 Inventory Equipment Buildings 125,000 175,000 70,000 100,000 75,000 95,000 Land 600,000 700,000 Accounts Payable Note Payable Retained Earnings 200,000 200,000 100,000 100,000 315,000 315,000 Common Stock 15,000 250,000 Paid in Capital 380,000 380,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:On March 1, 2020, Dorsey Corporation purchased Johnson Company.

The book and fair value of Johnson's balance sheet accounts is shown

below. Record the purchase on Dorsey's books under each of the

following independent assumptions.

a. Dorsey paid Johnson $1,000,000

b. Dorsey paid Johnson $700,000

Book Value Fair Value

Cash

50,000

50,000

Accounts Receivable

90,000

75,000

Inventory

125,000

175,000

Equipment

70,000

100,000

Buildings

75,000

95,000

Land

600,000

700,000

Accounts Payable

200,000

200,000

Note Payable

Retained Earnings

100,000

100,000

315,000

315,000

Common Stock

15,000

250,000

Paid in Capital

For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

380,000

380,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning