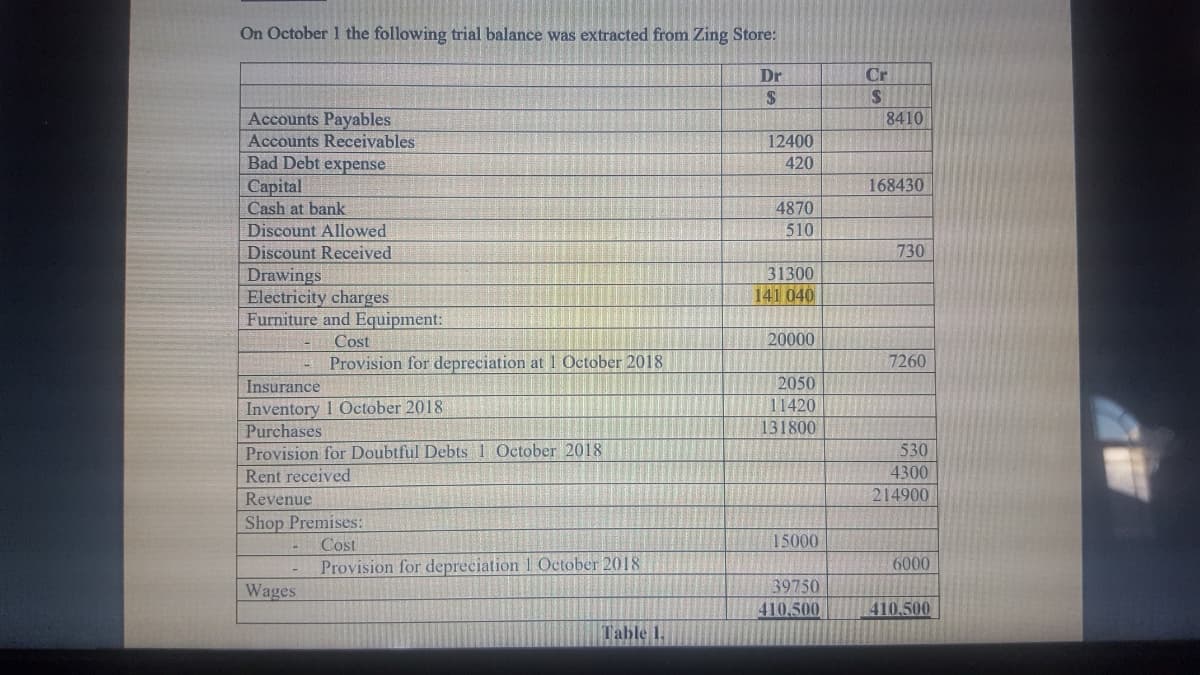

On October 1 the following trial balance was extracted from Zing Store: Dr Cr Accounts Payables Accounts Receivables Bad Debt expense Capital Cash at bank Discount Allowed 8410 12400 420 168430 4870 510 Discount Received 730 Drawings Electricity charges Furniture and Equipment: 31300 141 040 Cost 20000 Provision for depreciation at 1 October 2018 7260 Insurance 2050 Inventory 1 October 2018 Purchases 11420 131800 Provision for Doubtful Debts 1 October 2018 530 Rent received 4300 Revenue 214900 Shop Premises: Cost 15000 Provision for depreciation 1 October 2018 6000 Wages 39750 410.500 1410 500

On October 1 the following trial balance was extracted from Zing Store: Dr Cr Accounts Payables Accounts Receivables Bad Debt expense Capital Cash at bank Discount Allowed 8410 12400 420 168430 4870 510 Discount Received 730 Drawings Electricity charges Furniture and Equipment: 31300 141 040 Cost 20000 Provision for depreciation at 1 October 2018 7260 Insurance 2050 Inventory 1 October 2018 Purchases 11420 131800 Provision for Doubtful Debts 1 October 2018 530 Rent received 4300 Revenue 214900 Shop Premises: Cost 15000 Provision for depreciation 1 October 2018 6000 Wages 39750 410.500 1410 500

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.1DC: Reading 3M Companys Balance Sheet: Accounts Receivable The following current asset appears on the...

Related questions

Question

100%

Please be quick, I have corrected the income statement as requested

Transcribed Image Text:On October 1 the following trial balance was extracted from Zing Store:

Dr

Cr

2$

Accounts Payables

Accounts Receivables

Bad Debt expense

8410

12400

420

168430

Capital

Cash at bank

Discount Allowed

4870

510

Discount Received

730

31300

Drawings

Electricity charges

Furniture and Equipment:

141 040

Cost

20000

Provision for depreciation at1 October 2018

7260

Insurance

Inventory 1 October 2018

Purchases

Provision for Doubtful Debts 1 October 2018

2050

11420

131800

530

Rent received

4300

Revenue

214900

Shop Premises:

Cost

15000

Provision for depreciation 1 October 2018

6000

Wages

39750

410.500

410 500

Table 1.

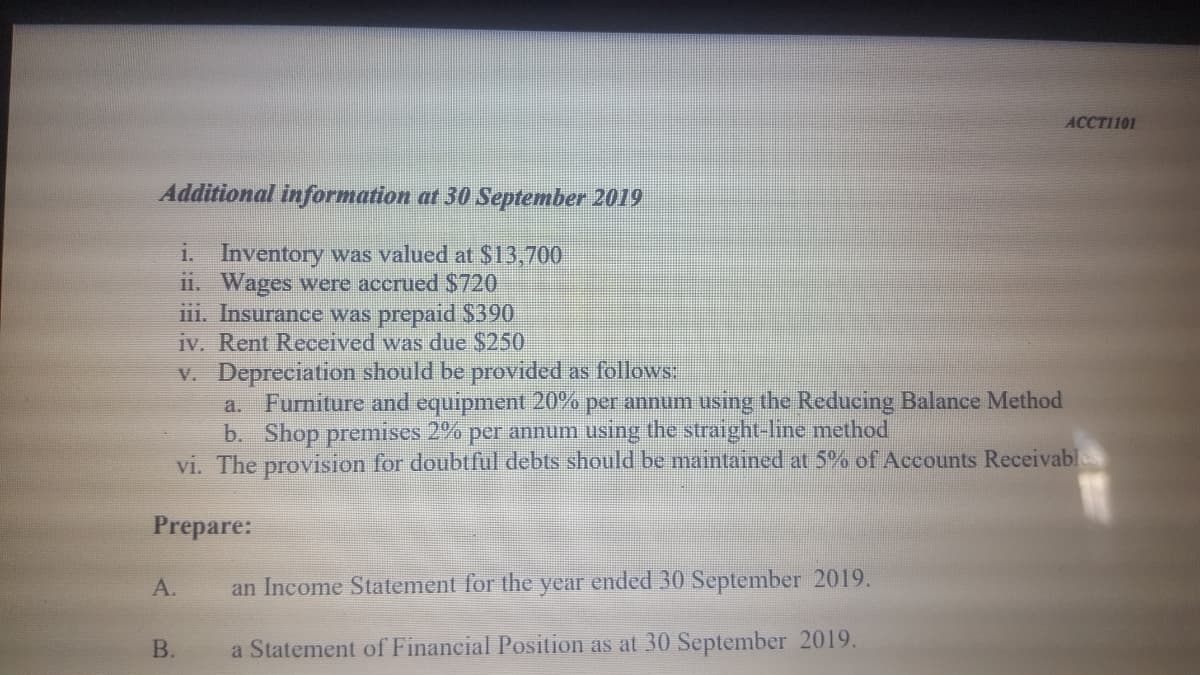

Transcribed Image Text:ACCT1101

Additional information at 30 September 2019

i. Inventory was valued at $13,700

11. Wages were accrued $720

iii. Insurance was prepaid S390

iv. Rent Received was due $250

V. Depreciation should be provided as follows

a. Furniture and equipment 20% per annum using the Reducing Balance Method

b. Shop premises 2% per annum using the straight-line method

vi. The provision for doubtful debts should be maintained at 5% of Accounts Receivabl

Prepare:

А.

an Income Statement for the

year

ended 30 September 2019.

В.

a Statement of Financial Position as at 30 September 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning