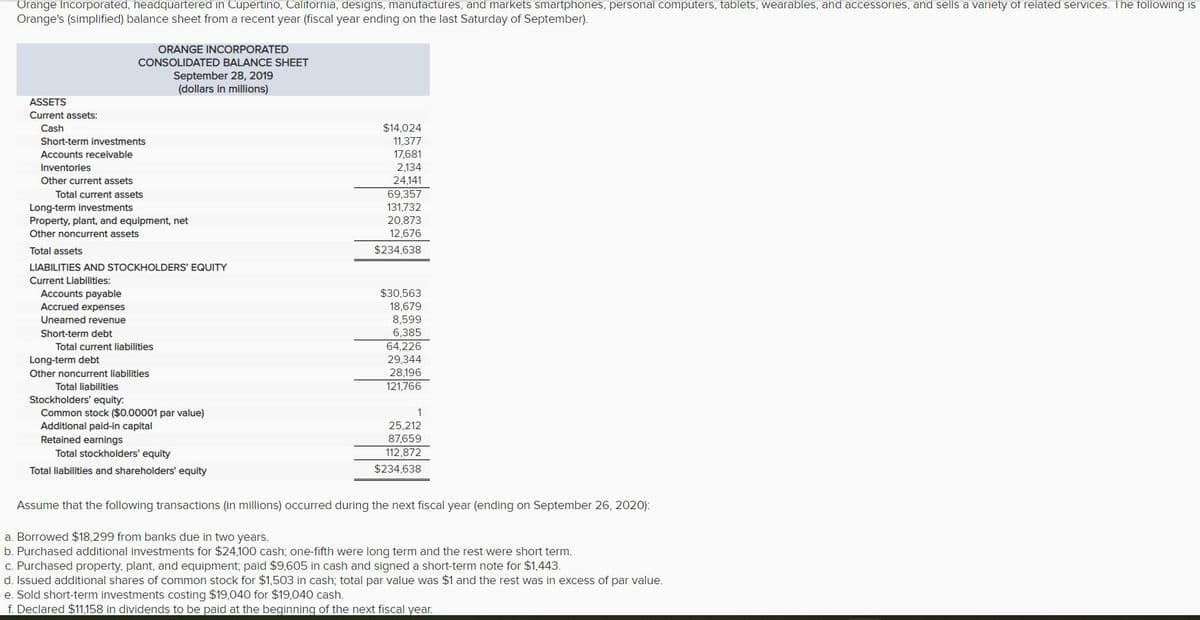

Orange Incorporated, headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and sells a variety of related services. The Orange's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September). ASSETS Current assets: Cash ORANGE INCORPORATED CONSOLIDATED BALANCE SHEET September 28, 2019 (dollars in millions) Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue Short-term debt Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity. Common stock ($0.00001 par value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $14,024 11,377 17,681 2,134 24,141 69,357 131,732 20,873 12,676 $234,638 $30,563. 18,679 8,599 6,385 64,226 29,344 28,196 121,766 1 25,212 87,659 112,872 $234,638 Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020); Borrowed $18,299 from banks due in two years. Purchased additional investments for $24,100 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment, paid $9,605 in cash and signed a short-term note for $1,443. Issued additional shares of common stock for $1,503 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,040 for $19,040 cash. Declared $11.158 in dividends to be paid at the beginning of the next fiscal year.

Orange Incorporated, headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and sells a variety of related services. The Orange's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September). ASSETS Current assets: Cash ORANGE INCORPORATED CONSOLIDATED BALANCE SHEET September 28, 2019 (dollars in millions) Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue Short-term debt Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity. Common stock ($0.00001 par value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $14,024 11,377 17,681 2,134 24,141 69,357 131,732 20,873 12,676 $234,638 $30,563. 18,679 8,599 6,385 64,226 29,344 28,196 121,766 1 25,212 87,659 112,872 $234,638 Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020); Borrowed $18,299 from banks due in two years. Purchased additional investments for $24,100 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment, paid $9,605 in cash and signed a short-term note for $1,443. Issued additional shares of common stock for $1,503 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,040 for $19,040 cash. Declared $11.158 in dividends to be paid at the beginning of the next fiscal year.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 60P

Related questions

Topic Video

Question

Please do not give solution in image format thanku

Transcribed Image Text:Orange Incorporated, headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and sells a variety of related services. The following is

Orange's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September).

ASSETS

Current assets:

Cash

Short-term investments

Accounts receivable

Inventories

Other current assets

ORANGE INCORPORATED

CONSOLIDATED BALANCE SHEET

Total current assets

Long-term investments

Property, plant, and equipment, net

Other noncurrent assets

Total assets

Accounts payable

Accrued expenses

Unearned revenue

Short-term debt

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

September 28, 2019

(dollars in millions)

Total current liabilities

Long-term debt

Other noncurrent liabilities

Total liabilities

Stockholders' equity:

Common stock ($0.00001 par value)

Additional paid-in capital

Retained earnings

Total stockholders' equity

Total liabilities and shareholders' equity

$14,024

11,377

17,681

2,134

24,141

69,357

131,732

20,873

12,676

$234,638

$30,563

18,679

8,599

6,385

64,226

29,344

28,196

121,766

1

25,212

87,659

112,872

$234,638

Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020):

a. Borrowed $18,299 from banks due in two years.

b. Purchased additional investments for $24,100 cash; one-fifth were long term and the rest were short term.

c. Purchased property, plant, and equipment; paid $9,605 in cash and signed a short-term note for $1,443.

d. Issued additional shares of common stock for $1,503 in cash; total par value was $1 and the rest was in excess of par value.

e. Sold short-term investments costing $19,040 for $19,040 cash.

f. Declared $11,158 in dividends to be paid at the beginning of the next fiscal year.

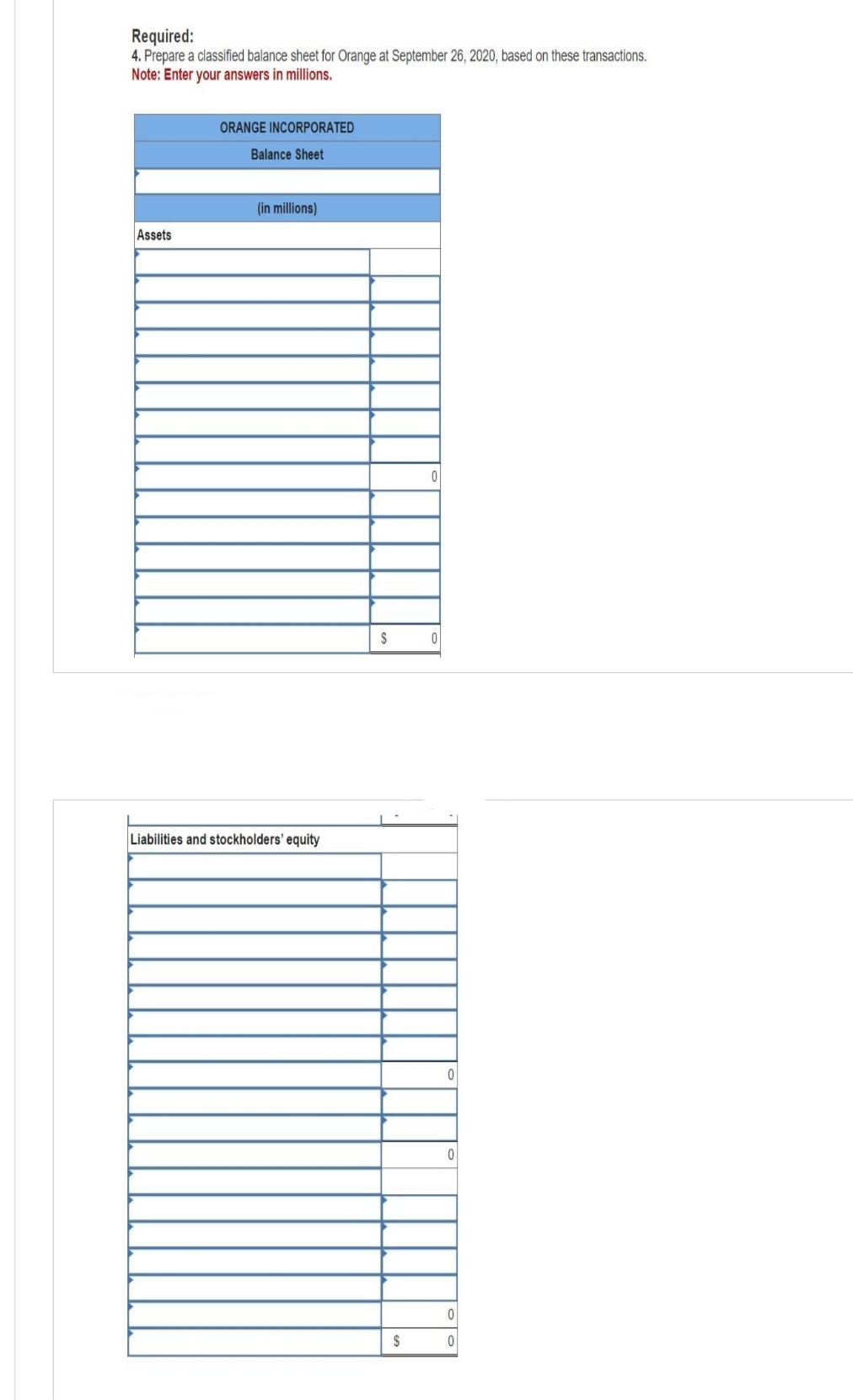

Transcribed Image Text:Required:

4. Prepare a classified balance sheet for Orange at September 26, 2020, based on these transactions.

Note: Enter your answers in millions.

Assets

ORANGE INCORPORATED

Balance Sheet

(in millions)

Liabilities and stockholders' equity

$

$

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,