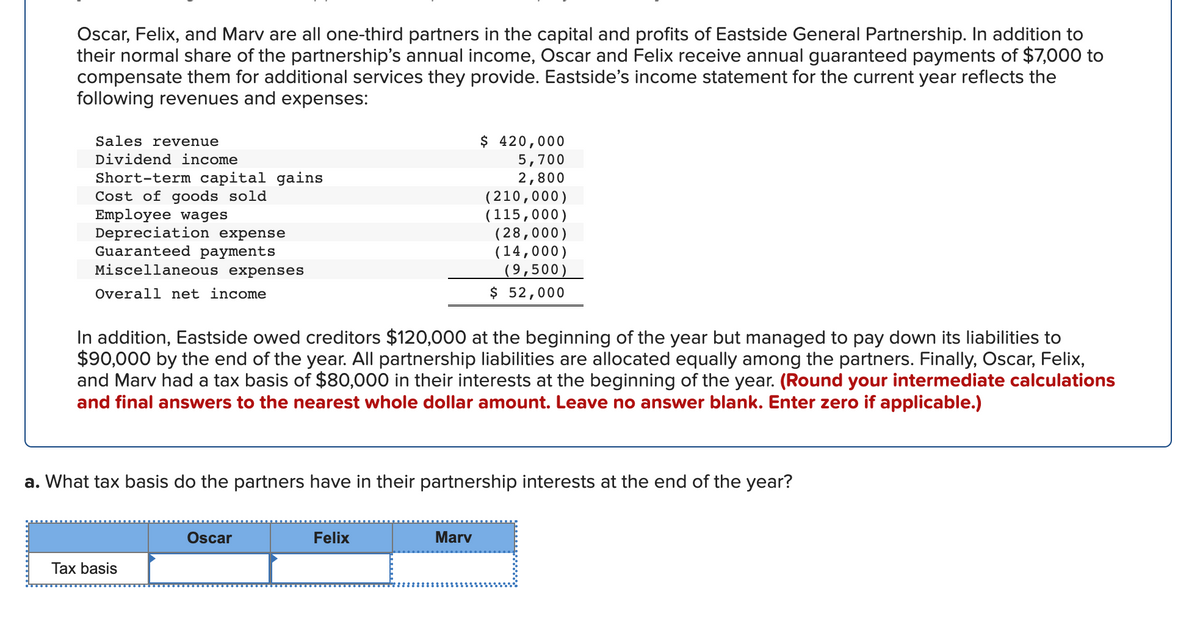

Oscar, Felix, and Marv are all one-third partners in the capital and profits of Eastside General Partnership. In addition to their normal share of the partnership's annual income, Oscar and Felix receive annual guaranteed payments of $7,000 to compensate them for additional services they provide. Eastside's income statement for the current year reflects the following revenues and expenses: $ 420,000 5,700 2,800 (210,000) (115,000) (28,000) (14,000) (9,500) Sales revenue Dividend income Short-term capital gains Cost of goods sold Employee wages Depreciation expense Guaranteed payments Miscellaneous expenses Overall net income $ 52,000 In addition, Eastside owed creditors $120,000 at the beginning of the year but managed to pay down its liabilities to $90,000 by the end of the year. All partnership liabilities are allocated equally among the partners. Finally, Oscar, Felix, and Marv had a tax basis of $80,000 in their interests at the beginning of the year. (Round your intermediate calculations and final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.)

Oscar, Felix, and Marv are all one-third partners in the capital and profits of Eastside General Partnership. In addition to their normal share of the partnership's annual income, Oscar and Felix receive annual guaranteed payments of $7,000 to compensate them for additional services they provide. Eastside's income statement for the current year reflects the following revenues and expenses: $ 420,000 5,700 2,800 (210,000) (115,000) (28,000) (14,000) (9,500) Sales revenue Dividend income Short-term capital gains Cost of goods sold Employee wages Depreciation expense Guaranteed payments Miscellaneous expenses Overall net income $ 52,000 In addition, Eastside owed creditors $120,000 at the beginning of the year but managed to pay down its liabilities to $90,000 by the end of the year. All partnership liabilities are allocated equally among the partners. Finally, Oscar, Felix, and Marv had a tax basis of $80,000 in their interests at the beginning of the year. (Round your intermediate calculations and final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.)

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

100%

Transcribed Image Text:Oscar, Felix, and Marv are all one-third partners in the capital and profits of Eastside General Partnership. In addition to

their normal share of the partnership's annual income, Oscar and Felix receive annual guaranteed payments of $7,000 to

compensate them for additional services they provide. Eastside's income statement for the current year reflects the

following revenues and expenses:

$ 420,000

5,700

2,800

(210,000)

(115,000)

(28,000)

(14,000)

|(9,500)

$ 52,000

Sales revenue

Dividend income

Short-term capital gains

Cost of goods sold

Employee wages

Depreciation expense

Guaranteed payments

Miscellaneous expenses

Overall net income

In addition, Eastside owed creditors $120,000 at the beginning of the year but managed to pay down its liabilities to

$90,000 by the end of the year. All partnership liabilities are allocated equally among the partners. Finally, Oscar, Felix,

and Marv had a tax basis of $80,000 in their interests at the beginning of the year. (Round your intermediate calculations

and final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.)

a. What tax basis do the partners have in their partnership interests at the end of the year?

Oscar

Felix

Marv

Tax basis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT