Other relevant information about the company follows: The 20-year Treasury Bond rate is currently 4.5 percent and you have estimated market-risk premium to be 6.75 percent using the returns on stocks and Treasury bonds from 2010 to 2019. Pharmos Incorporated has a marginal tax rate of 25 percent. Required: Answer the following questions given the information above Calculate to the following for Pharmos considering its tax rate of 25%: i. Total Market Value for the Firm ii. After-tax cost of Loan NO EXCEL SPREADSHEETS SHOW FULL WORKINGS WITHOUT EXCEL

Other relevant information about the company follows: The 20-year Treasury Bond rate is currently 4.5 percent and you have estimated market-risk premium to be 6.75 percent using the returns on stocks and Treasury bonds from 2010 to 2019. Pharmos Incorporated has a marginal tax rate of 25 percent. Required: Answer the following questions given the information above Calculate to the following for Pharmos considering its tax rate of 25%: i. Total Market Value for the Firm ii. After-tax cost of Loan NO EXCEL SPREADSHEETS SHOW FULL WORKINGS WITHOUT EXCEL

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

Other relevant information about the company follows:

The 20-year Treasury Bond rate is currently 4.5 percent and you have estimated market-risk premium to be 6.75 percent using the returns on stocks and Treasury bonds from 2010 to 2019. Pharmos Incorporated has a marginal tax rate of 25 percent.

Required: Answer the following questions given the information above

Calculate to the following for Pharmos considering its tax rate of 25%:

i. Total Market Value for the Firm

ii. After-tax cost of Loan

NO EXCEL SPREADSHEETS

SHOW FULL WORKINGS WITHOUT EXCEL

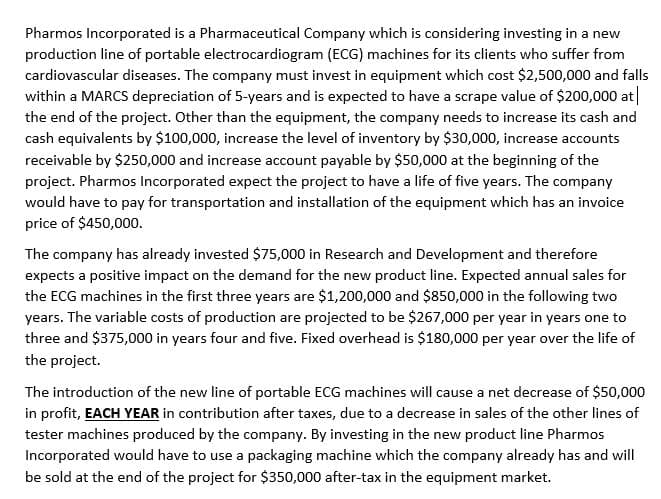

Transcribed Image Text:Pharmos Incorporated is a Pharmaceutical Company which is considering investing in a new

production line of portable electrocardiogram (ECG) machines for its clients who suffer from

cardiovascular diseases. The company must invest in equipment which cost $2,500,000 and falls

within a MARCS depreciation of 5-years and is expected to have a scrape value of $200,000 at|

the end of the project. Other than the equipment, the company needs to increase its cash and

cash equivalents by $100,000, increase the level of inventory by $30,000, increase accounts

receivable by $250,000 and increase account payable by $50,000 at the beginning of the

project. Pharmos Incorporated expect the project to have a life of five years. The company

would have to pay for transportation and installation of the equipment which has an invoice

price of $450,000o.

The company has already invested $75,000 in Research and Development and therefore

expects a positive impact on the demand for the new product line. Expected annual sales for

the ECG machines in the first three years are $1,200,000 and $850,000 in the following two

years. The variable costs of production are projected to be $267,000 per year in years one to

three and $375,000 in years four and five. Fixed overhead is $180,000 per year over the life of

the project.

The introduction of the new line of portable ECG machines will cause a net decrease of $50,000

in profit, EACH YEAR in contribution after taxes, due to a decrease in sales of the other lines of

tester machines produced by the company. By investing in the new product line Pharmos

Incorporated would have to use a packaging machine which the company already has and will

be sold at the end of the project for $350,000 after-tax in the equipment market.

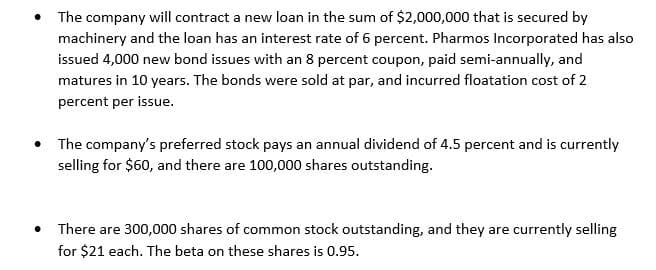

Transcribed Image Text:The company will contract a new loan in the sum of $2,000,000 that is secured by

machinery and the loan has an interest rate of 6 percent. Pharmos Incorporated has also

issued 4,000 new bond issues with an 8 percent coupon, paid semi-annually, and

matures in 10 years. The bonds were sold at par, and incurred floatation cost of 2

percent per issue.

The company's preferred stock pays an annual dividend of 4.5 percent and is currently

selling for $60, and there are 100,000 shares outstanding.

• There are 300,000 shares of common stock outstanding, and they are currently selling

for $21 each. The beta on these shares is 0.95.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT