ount rate and a 50 year time period. ey will have to pay $280,000 immedia and per year for visiting the beach is ar, but when the new parking spaces et present value of building the extra

ount rate and a 50 year time period. ey will have to pay $280,000 immedia and per year for visiting the beach is ar, but when the new parking spaces et present value of building the extra

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 13P

Related questions

Question

!

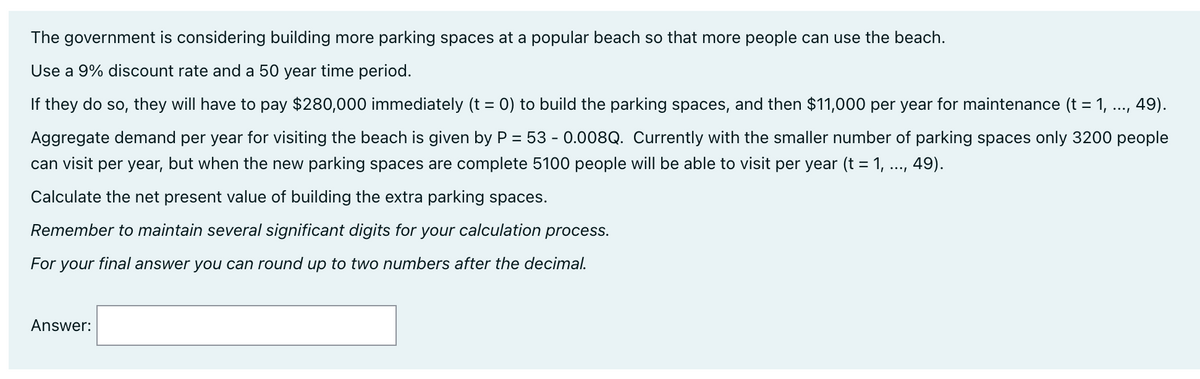

Transcribed Image Text:The government is considering building more parking spaces at a popular beach so that more people can use the beach.

Use a 9% discount rate and a 50 year time period.

If they do so, they will have to pay $280,000 immediately (t = 0) to build the parking spaces, and then $11,000 per year for maintenance (t = 1, ..., 49).

Aggregate demand per year for visiting the beach is given by P = 53 - 0.008Q. Currently with the smaller number of parking spaces only 3200 people

can visit per year, but when the new parking spaces are complete 5100 people will be able to visit per year (t = 1, ..., 49).

Calculate the net present value of building the extra parking spaces.

Remember to maintain several significant digits for your calculation process.

For your final answer you can round up to two numbers after the decimal.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning