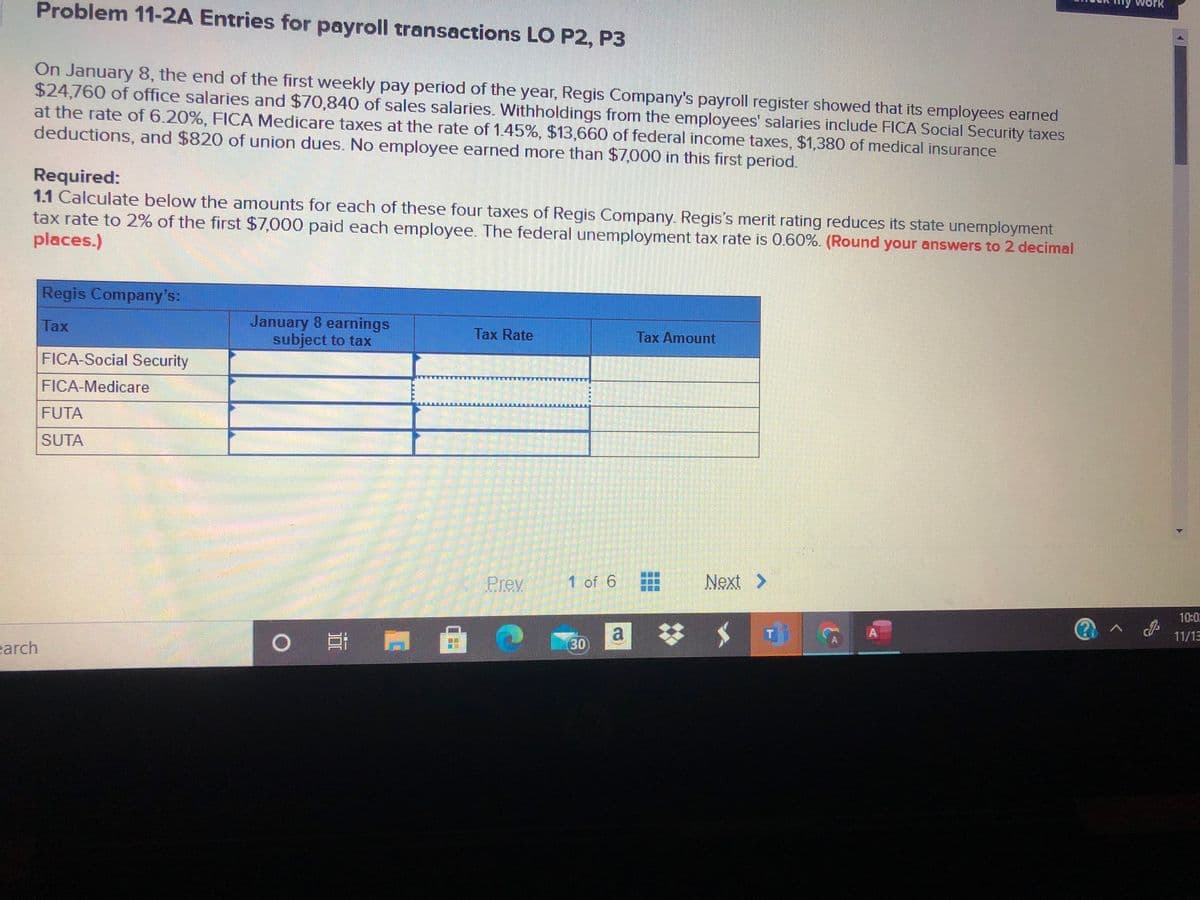

P2, P3 On January 8, the end of the first weekly pay period of the year, Regis Company's payroll register showed that its employees earned $24,760 of office salaries and $70,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.20%, FICA Medicare taxes at the rate of 1.45%, $13,660 of federal income taxes, $1,380 of medical insurance deductions, and $820 of union dues. No employee earned more than $7,000 in this first period. Required: 1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's merit rating reduces its state unemployment tax rate to 2% of the first $7,000 paid each employee. The federal unemployment tax rate is 0.60%. (Round your answers to 2 decimal places.) Regis Company's: January 8 earnings subject to tax Tax Tax Rate Tax Amount FICA-Social Security FICA-Medicare FUTA SUTA

P2, P3 On January 8, the end of the first weekly pay period of the year, Regis Company's payroll register showed that its employees earned $24,760 of office salaries and $70,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.20%, FICA Medicare taxes at the rate of 1.45%, $13,660 of federal income taxes, $1,380 of medical insurance deductions, and $820 of union dues. No employee earned more than $7,000 in this first period. Required: 1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's merit rating reduces its state unemployment tax rate to 2% of the first $7,000 paid each employee. The federal unemployment tax rate is 0.60%. (Round your answers to 2 decimal places.) Regis Company's: January 8 earnings subject to tax Tax Tax Rate Tax Amount FICA-Social Security FICA-Medicare FUTA SUTA

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.12EX: Payroll entries The payroll register for D. Salah Company for the week ended May 18 indicated the...

Related questions

Question

Transcribed Image Text:Problem 11-2A Entries for payroll transactions LO P2, P3

work

On January 8, the end of the first weekly pay period of the year, Regis Company's payroll register showed that its employees earned

$24,760 of office salaries and $70,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes

at the rate of 6.20%, FICA Medicare taxes at the rate of 1.45%, $13,660 of federal income taxes, $1,380 of medical insurance

deductions, and $820 of union dues. No employee earned more than $7,000 in this first period.

Required:

1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's merit rating reduces its state unemployment

tax rate to 2% of the first $7,000 paid each employee. The federal unemployment tax rate is 0.60%. (Round your answers to 2 decimal

places.)

Regis Company's:

January 8 earnings

subject to tax

Tax

Tax Rate

Tax Amount

FICA-Social Security

FICA-Medicare

FUTA

SUTA

Prev

1 of 6

Next>

10:0

a *

A

11/13

earch

OE)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning