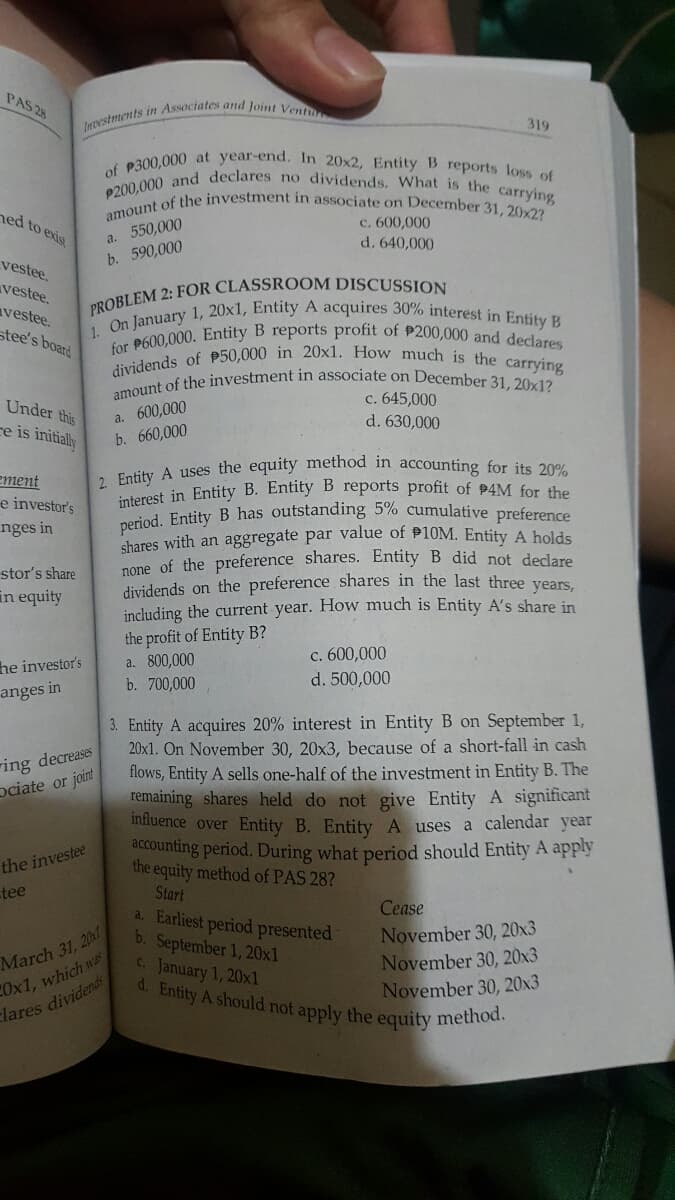

P200,000 and declares no dividends. What is the carrying amount of the investment in associate on December 31, 20x2? of a. 550,000 b. 590,000 c. 600,000 d. 640,000 PROBLEM 2: FOR CLASSROOM DISCUSSION 1. On January 1, 20x1, Entity A acquires 30% interest in Entity B for P600,000. Entity B reports profit of P200,000 and declares dividends of P50,000 in 20x1. How much is the carrying amount of the investment in associate on December 31, 20x1? a. 600,000 b. 660,000 c. 645,000 d. 630,000 2 Entity A uses the equity method in accounting for its 20% interest in Entity B. Entity B reports profit of P4M for the period. Entity B has outstanding 5% cumulative preference shares with an aggregate par value of P10M. Entity A holds none of the preference shares. Entity B did not declare dividends on the preference shares in the last three vears. including the current year. How much is Entity A's share in the profit of Entity B? r's a. 800,000 b. 700,000 c. 600,000 d. 500,000 3. Entity A acquires 20% interest in Entity B on September 1,

P200,000 and declares no dividends. What is the carrying amount of the investment in associate on December 31, 20x2? of a. 550,000 b. 590,000 c. 600,000 d. 640,000 PROBLEM 2: FOR CLASSROOM DISCUSSION 1. On January 1, 20x1, Entity A acquires 30% interest in Entity B for P600,000. Entity B reports profit of P200,000 and declares dividends of P50,000 in 20x1. How much is the carrying amount of the investment in associate on December 31, 20x1? a. 600,000 b. 660,000 c. 645,000 d. 630,000 2 Entity A uses the equity method in accounting for its 20% interest in Entity B. Entity B reports profit of P4M for the period. Entity B has outstanding 5% cumulative preference shares with an aggregate par value of P10M. Entity A holds none of the preference shares. Entity B did not declare dividends on the preference shares in the last three vears. including the current year. How much is Entity A's share in the profit of Entity B? r's a. 800,000 b. 700,000 c. 600,000 d. 500,000 3. Entity A acquires 20% interest in Entity B on September 1,

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:1. On January 1, 20x1, Entity A acquires 30% interest in Entity B

d. Entity A should not apply the equity method.

amount of the investment in associate on December 31, 20x2?

interest in Entity B. Entity B reports profit of 94M for the

amount of the investment in associate on December 31, 20x1?

dividends of P50,000 in 20x1. How much is the carrying

P200,000 and declares no dividends. What is the carrying

2. Entity A uses the equity method in accounting for its 20%

period. Entity B has outstanding 5% cumulative preference

for P600,000. Entity B reports profit of P200,000 and declares

of P300,000 at year-end. In 20x2, Entity B reports loss of

PAS 28

319

ned to exist

a. 550,000

b. 590,000

c. 600,000

d. 640,000

vestee.

vestee.

avestee.

stee's board

c. 645,000

Under this

ce is initially

600,000

a.

d. 630,000

b. 660,000

ement

e investor's

nges in

chares with an aggregate par value of P10M. Entity A holds

none of the preference shares. Entity B did not declare

dividends on the preference shares in the last three vears.

including the current year. How much is Entity A's share in

stor's share

in equity

he investor's

anges in

the profit of Entity B?

a. 800,000

b. 700,000

c. 600,000

d. 500,000

3. Entity A acquires 20% interest in Entity B on September 1,

20x1. On November 30, 20x3, because of a short-fall in cash

flows, Entity A sells one-half of the investment in Entity B. The

remaining shares held do not give Entity A significant

influence over Entity B. Entity A uses a calendar year

accounting period. During what period should Entity A apply

the equity method of PAS 28?

Start

a. Earliest period presented

b. September 1, 20x1

C. January 1, 20xl

ring decreases

ociate or joint

the investee

tee

March 31, 20

COx1, which was

clares dividends

Cease

November 30, 20x3

November 30, 20x3

November 30, 20x3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT