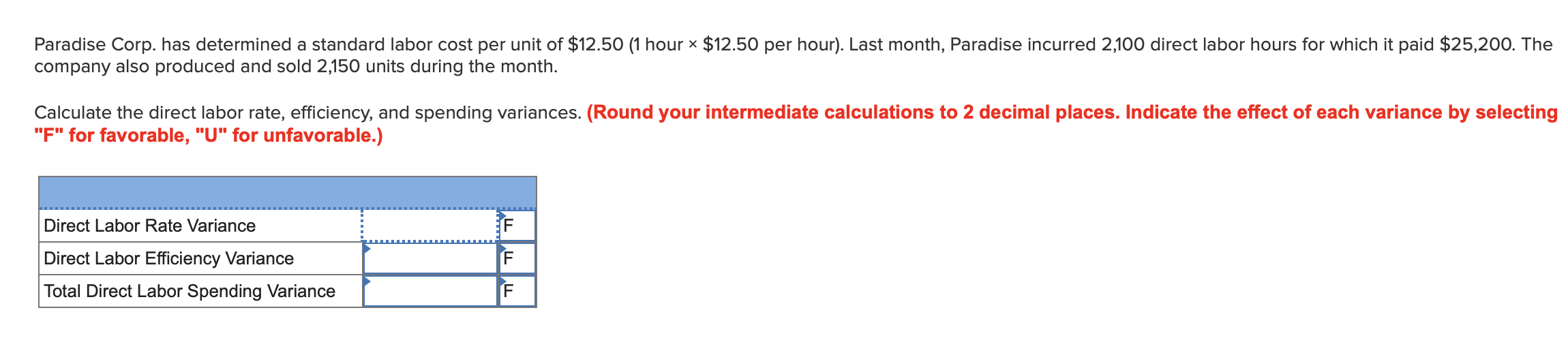

Paradise Corp. has determined a standard labor cost per unit of $12.50 (1 hour x $12.50 per hour). Last month, Paradise incurred 2,100 direct labor hours for which it paid $25,20O. The company also produced and sold 2,150 units during the month. Calculate the direct labor rate, efficiency, and spending variances. (Round your intermediate calculations to 2 decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) Direct Labor Rate Variance Direct Labor Efficiency Variance Total Direct Labor Spending Variance F F F

Paradise Corp. has determined a standard labor cost per unit of $12.50 (1 hour x $12.50 per hour). Last month, Paradise incurred 2,100 direct labor hours for which it paid $25,20O. The company also produced and sold 2,150 units during the month. Calculate the direct labor rate, efficiency, and spending variances. (Round your intermediate calculations to 2 decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) Direct Labor Rate Variance Direct Labor Efficiency Variance Total Direct Labor Spending Variance F F F

Chapter8: Standard Costs And Variances

Section: Chapter Questions

Problem 7PB: Marymount Company makes one product. In the month of April, it made 3,500 units. Workers were paid...

Related questions

Question

I need helo solving this problem

Transcribed Image Text:Paradise Corp. has determined a standard labor cost per unit of $12.50 (1 hour x $12.50 per hour). Last month, Paradise incurred 2,100 direct labor hours for which it paid $25,20O. The

company also produced and sold 2,150 units during the month.

Calculate the direct labor rate, efficiency, and spending variances. (Round your intermediate calculations to 2 decimal places. Indicate the effect of each variance by selecting

"F" for favorable, "U" for unfavorable.)

Direct Labor Rate Variance

Direct Labor Efficiency Variance

Total Direct Labor Spending Variance

F F F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning