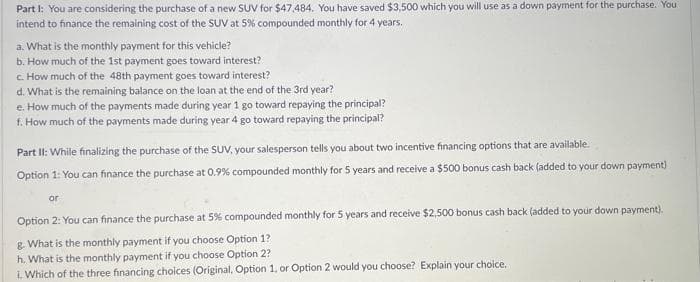

Part I: You are considering the purchase of a new SUV for $47,484. You have saved $3,500 which you will use as a down payment for the purchase. You intend to finance the remaining cost of the SUV at 5% compounded monthly for 4 years. a. What is the monthly payment for this vehicle? b. How much of the 1st payment goes toward interest? c. How much of the 48th payment goes toward interest? d. What is the remaining balance on the loan at the end of the 3rd year? e. How much of the payments made during year 1 go toward repaying the principal? f. How much of the payments made during year 4 go toward repaying the principal? Part II: While finalizing the purchase of the SUV, your salesperson tells you about two incentive financing options that are available. Option 1: You can finance the purchase at 0.9% compounded monthly for 5 years and receive a $500 bonus cash back (added to your down payment) or Option 2: You can finance the purchase at 5% compounded monthly for 5 years and receive $2,500 bonus cash back (added to your down payment). g. What is the monthly payment if you choose Option 1? h. What is the monthly payment if you choose Option 2? i. Which of the three financing choices (Original, Option 1, or Option 2 would you choose? Explain your choice.

Part I: You are considering the purchase of a new SUV for $47,484. You have saved $3,500 which you will use as a down payment for the purchase. You intend to finance the remaining cost of the SUV at 5% compounded monthly for 4 years. a. What is the monthly payment for this vehicle? b. How much of the 1st payment goes toward interest? c. How much of the 48th payment goes toward interest? d. What is the remaining balance on the loan at the end of the 3rd year? e. How much of the payments made during year 1 go toward repaying the principal? f. How much of the payments made during year 4 go toward repaying the principal? Part II: While finalizing the purchase of the SUV, your salesperson tells you about two incentive financing options that are available. Option 1: You can finance the purchase at 0.9% compounded monthly for 5 years and receive a $500 bonus cash back (added to your down payment) or Option 2: You can finance the purchase at 5% compounded monthly for 5 years and receive $2,500 bonus cash back (added to your down payment). g. What is the monthly payment if you choose Option 1? h. What is the monthly payment if you choose Option 2? i. Which of the three financing choices (Original, Option 1, or Option 2 would you choose? Explain your choice.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.19E

Related questions

Concept explainers

Question

Hd.25.a

Transcribed Image Text:Part I: You are considering the purchase of a new SUV for $47,484. You have saved $3,500 which you will use as a down payment for the purchase. You

intend to finance the remaining cost of the SUV at 5% compounded monthly for 4 years.

a. What is the monthly payment for this vehicle?

b. How much of the 1st payment goes toward interest?

c. How much of the 48th payment goes toward interest?

d. What is the remaining balance on the loan at the end of the 3rd year?

e. How much of the payments made during year 1 go toward repaying the principal?

f. How much of the payments made during year 4 go toward repaying the principal?

Part II: While finalizing the purchase of the SUV, your salesperson tells you about two incentive financing options that are available.

Option 1: You can finance the purchase at 0.9% compounded monthly for 5 years and receive a $500 bonus cash back (added to your down payment)

or

Option 2: You can finance the purchase at 5% compounded monthly for 5 years and receive $2,500 bonus cash back (added to your down payment).

g. What is the monthly payment if you choose Option 1?

h. What is the monthly payment if you choose Option 2?

i. Which of the three financing choices (Original, Option 1, or Option 2 would you choose? Explain your choice.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning