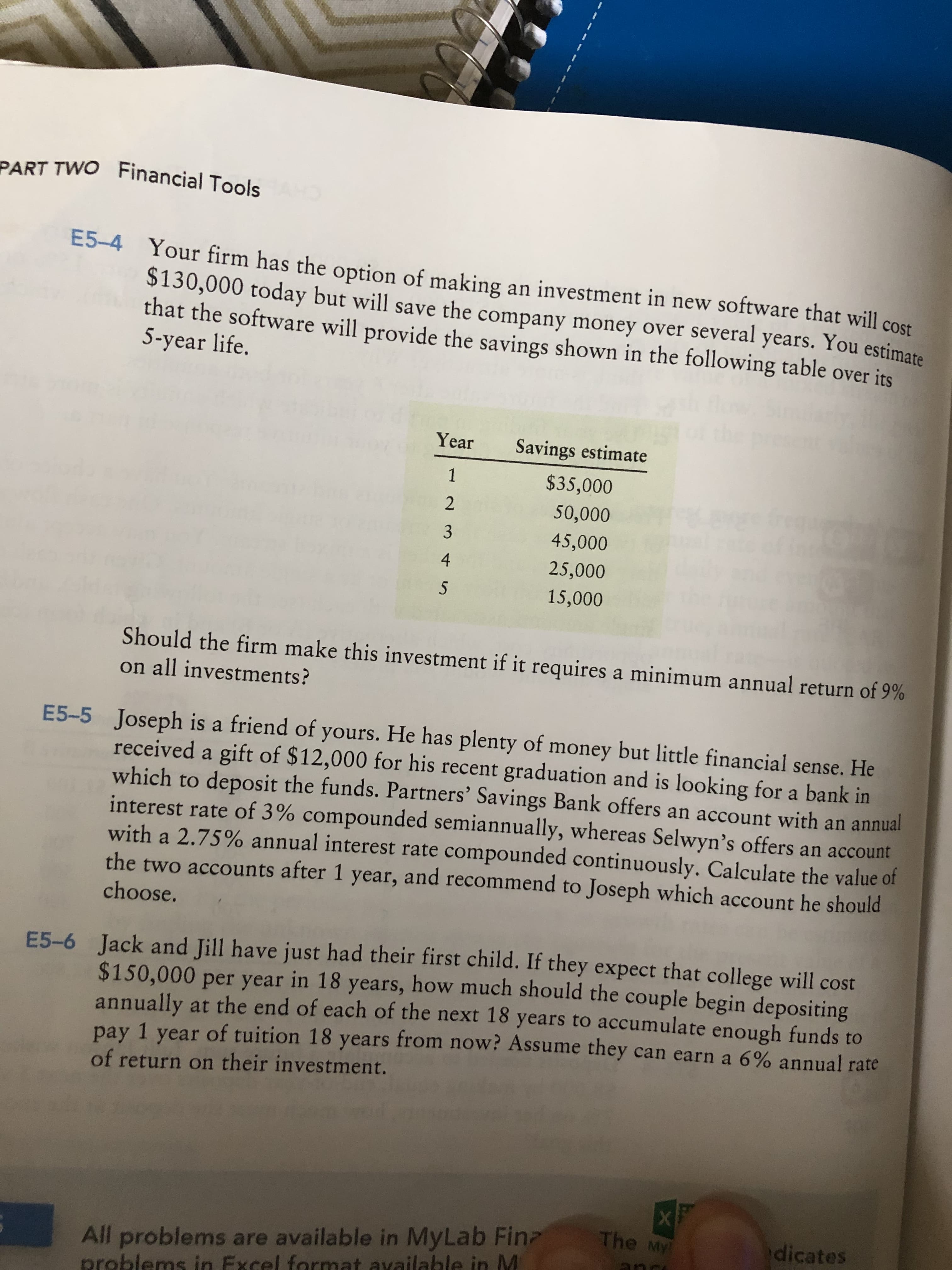

PART TWO Financial Tools E5-4 Your firm has the option of making $130,000 today but will save the company money over several years. You estimate that the software will provide the savings shown in the following table over its 5-year life. an investment in new software that will cost Year Savings estimate 1 $35,000 2 50,000 3 45,000 4 25,000 15,000 Should the firm make this investment if it requires a minimum annual return of 9% on all investments? Joseph is a friend of yours. He has plenty of money but little financial sense. He received a gift of $12,000 for his recent graduation and is looking for a bank in which to deposit the funds. Partners' Savings Bank offers an account with an annual interest rate of 3 % compounded semiannually, whereas Selwyn's offers an account with a 2.75% annual interest rate compounded continuously. Calculate the value of the two accounts after 1 year, and recommend to Joseph which account he should choose. E5-5 E5-6 Jack and Jill have just had their first child. If they expect that college will cost $150,000 per year in 18 years, how much should the couple begin depositing annually pay 1 year of tuition 18 years from now? Assume they can earn a 6% annual rate at the end of each of the next 18 years to accumulate enough funds to of return on their investment. X The My All problems are available in MyLab Fin problems in Excel format available in M dicates an

PART TWO Financial Tools E5-4 Your firm has the option of making $130,000 today but will save the company money over several years. You estimate that the software will provide the savings shown in the following table over its 5-year life. an investment in new software that will cost Year Savings estimate 1 $35,000 2 50,000 3 45,000 4 25,000 15,000 Should the firm make this investment if it requires a minimum annual return of 9% on all investments? Joseph is a friend of yours. He has plenty of money but little financial sense. He received a gift of $12,000 for his recent graduation and is looking for a bank in which to deposit the funds. Partners' Savings Bank offers an account with an annual interest rate of 3 % compounded semiannually, whereas Selwyn's offers an account with a 2.75% annual interest rate compounded continuously. Calculate the value of the two accounts after 1 year, and recommend to Joseph which account he should choose. E5-5 E5-6 Jack and Jill have just had their first child. If they expect that college will cost $150,000 per year in 18 years, how much should the couple begin depositing annually pay 1 year of tuition 18 years from now? Assume they can earn a 6% annual rate at the end of each of the next 18 years to accumulate enough funds to of return on their investment. X The My All problems are available in MyLab Fin problems in Excel format available in M dicates an

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 16P: REPLACEMENT CHAIN The Lesseig Company has an opportunity to invest in one of two mutually exclusive...

Related questions

Question

Questions E5-4 and E5-6

Transcribed Image Text:PART TWO

Financial Tools

E5-4

Your firm has the option of making

$130,000 today but will save the company money over several years. You estimate

that the software will provide the savings shown in the following table over its

5-year life.

an investment in new software that will cost

Year

Savings estimate

1

$35,000

2

50,000

3

45,000

4

25,000

15,000

Should the firm make this investment if it requires a minimum annual return of 9%

on all investments?

Joseph is a friend of yours. He has plenty of money but little financial sense. He

received a gift of $12,000 for his recent graduation and is looking for a bank in

which to deposit the funds. Partners' Savings Bank offers an account with an annual

interest rate of 3 % compounded semiannually, whereas Selwyn's offers an account

with a 2.75% annual interest rate compounded continuously. Calculate the value of

the two accounts after 1 year, and recommend to Joseph which account he should

choose.

E5-5

E5-6 Jack and Jill have just had their first child. If they expect that college will cost

$150,000 per year in 18 years, how much should the couple begin depositing

annually

pay 1 year of tuition 18 years from now? Assume they can earn a 6% annual rate

at the end of each of the next 18 years to accumulate enough funds to

of return on their investment.

X

The My

All problems are available in MyLab Fin

problems in Excel format available in M

dicates

an

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning