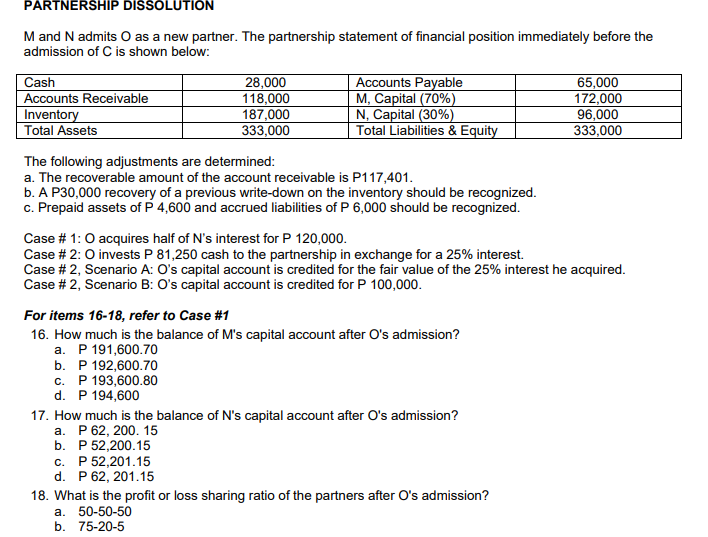

PARTNERSHIP DISSOLUTION M and N admits O as a new partner. The partnership statement of financial position immediately before the admission of C is shown below: Cash Accounts Receivable Inventory Total Assets 28,000 118,000 187,000 333,000 Accounts Payable M, Capital (70%) N, Capital (30%) Total Liabilities & Equity 65,000 172,000 96,000 333,000 The following adjustments are determined: a. The recoverable amount of the account receivable is P117,401. b. A P30,000 recovery of a previous write-down on the inventory should be recognized. c. Prepaid assets of P 4,600 and accrued liabilities of P 6,000 should be recognized. Case # 1:O acquires half of N's interest for P 120,000. Case # 2: O invests P 81,250 cash to the partnership in exchange for a 25% interest. Case # 2, Scenario A: O's capital account is credited for the fair value of the 25% interest he acquired. Case # 2, Scenario B: O's capital account is credited for P 100,000. For items 16-18, refer to Case #1 16. How much is the balance of M's capital account after O's admission? a. P 191,600.70 b. P 192,600.70 c. P 193,600.80 d. P 194,600 17. How much is the balance of N's capital account after O's admission? a. P 62, 200. 15 b. P 52,200.15 c. P 52,201.15 d. P 62, 201.15 18. What is the profit or loss sharing ratio of the partners after O's admission? a. 50-50-50 b. 75-20-5

PARTNERSHIP DISSOLUTION M and N admits O as a new partner. The partnership statement of financial position immediately before the admission of C is shown below: Cash Accounts Receivable Inventory Total Assets 28,000 118,000 187,000 333,000 Accounts Payable M, Capital (70%) N, Capital (30%) Total Liabilities & Equity 65,000 172,000 96,000 333,000 The following adjustments are determined: a. The recoverable amount of the account receivable is P117,401. b. A P30,000 recovery of a previous write-down on the inventory should be recognized. c. Prepaid assets of P 4,600 and accrued liabilities of P 6,000 should be recognized. Case # 1:O acquires half of N's interest for P 120,000. Case # 2: O invests P 81,250 cash to the partnership in exchange for a 25% interest. Case # 2, Scenario A: O's capital account is credited for the fair value of the 25% interest he acquired. Case # 2, Scenario B: O's capital account is credited for P 100,000. For items 16-18, refer to Case #1 16. How much is the balance of M's capital account after O's admission? a. P 191,600.70 b. P 192,600.70 c. P 193,600.80 d. P 194,600 17. How much is the balance of N's capital account after O's admission? a. P 62, 200. 15 b. P 52,200.15 c. P 52,201.15 d. P 62, 201.15 18. What is the profit or loss sharing ratio of the partners after O's admission? a. 50-50-50 b. 75-20-5

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

100%

Transcribed Image Text:PARTNERSHIP DISSOLUTION

M and N admits O as a new partner. The partnership statement of financial position immediately before the

admission of C is shown below:

Cash

Accounts Receivable

Inventory

Total Assets

28,000

118,000

187,000

333,000

Accounts Payable

M, Capital (70%)

N, Capital (30%)

Total Liabilities & Equity

65,000

172,000

96,000

333,000

The following adjustments are determined:

a. The recoverable amount of the account receivable is P117,401.

b. A P30,000 recovery of a previous write-down on the inventory should be recognized.

c. Prepaid assets of P 4,600 and accrued liabilities of P 6,000 should be recognized.

Case # 1:0 acquires half of N's interest for P 120,000.

Case # 2: O invests P 81,250 cash to the partnership in exchange for a 25% interest.

Case # 2, Scenario A: O's capital account is credited for the fair value of the 25% interest he acquired.

For items 16-18, refer to Case #1

16. How much is the balance of M's capital account after O's admission?

а. Р 191,600.70

b. Р 192,600.7о

с. Р 193,600.80

d. P 194,600

17. How much is the balance of N's capital account after O's admission?

а. Р62, 200. 15

b. Р52,200.15

с. Р 52,201.15

d. P 62, 201.15

18. What is the profit or loss sharing ratio of the partners after O's admission?

a. 50-50-50

b. 75-20-5

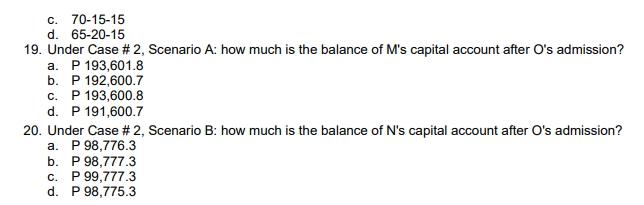

Transcribed Image Text:c. 70-15-15

d. 65-20-15

19. Under Case # 2, Scenario A: how much is the balance of M's capital account after O's admission?

а. Р 193,601.8

b. P 192,600.7

P 193,600.8

P 191,600.7

C.

d.

20. Under Case # 2, Scenario B: how much is the balance of N's capital account after O's admission?

а. Р98,776.3

b. P 98,777.3

c. P 99,777.3

d. P 98,775.3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College