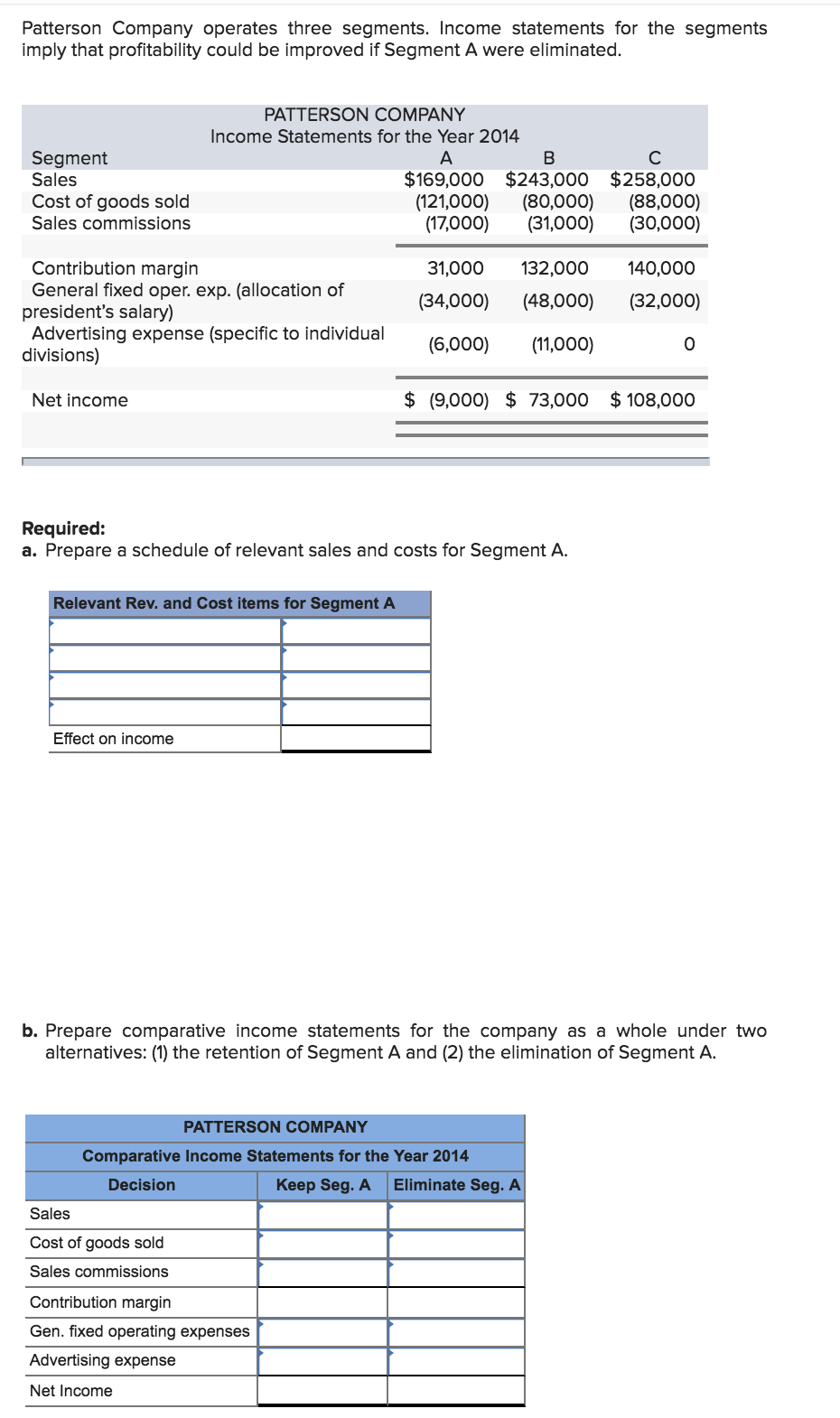

Patterson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. PATTERSON COMPANY Income Statements for the Year 2014 Segment Sales А В С $169,000 $243,000 $258,000 (80,000) (31,000) (121,000) (17,000) Cost of goods sold Sales commissions (88,000) (30,000) Contribution margin General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual divisions) 132,000 31,000 140,000 (34,000) (48,000) (32,000) (6,000) (11,000) (9,000) $73,000 $108,000 Net income Required: a. Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A Effect on income b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. PATTERSON COMPANY Comparative Income Statements for the Year 2014 Eliminate Seg. A Keep Seg.A Decision Sales Cost of goods sold Sales commissions Contribution margin Gen. fixed operating expenses Advertising expense Net Income

Patterson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. PATTERSON COMPANY Income Statements for the Year 2014 Segment Sales А В С $169,000 $243,000 $258,000 (80,000) (31,000) (121,000) (17,000) Cost of goods sold Sales commissions (88,000) (30,000) Contribution margin General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual divisions) 132,000 31,000 140,000 (34,000) (48,000) (32,000) (6,000) (11,000) (9,000) $73,000 $108,000 Net income Required: a. Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A Effect on income b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. PATTERSON COMPANY Comparative Income Statements for the Year 2014 Eliminate Seg. A Keep Seg.A Decision Sales Cost of goods sold Sales commissions Contribution margin Gen. fixed operating expenses Advertising expense Net Income

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 16E

Related questions

Question

Transcribed Image Text:Patterson Company operates three segments. Income statements for the segments

imply that profitability could be improved if Segment A were eliminated.

PATTERSON COMPANY

Income Statements for the Year 2014

Segment

Sales

А

В

С

$169,000 $243,000 $258,000

(80,000)

(31,000)

(121,000)

(17,000)

Cost of goods sold

Sales commissions

(88,000)

(30,000)

Contribution margin

General fixed oper. exp. (allocation of

president's salary)

Advertising expense (specific to individual

divisions)

132,000

31,000

140,000

(34,000)

(48,000)

(32,000)

(6,000)

(11,000)

(9,000) $73,000

$108,000

Net income

Required:

a. Prepare a schedule of relevant sales and costs for Segment A.

Relevant Rev. and Cost items for Segment A

Effect on income

b. Prepare comparative income statements for the company as a whole under two

alternatives: (1) the retention of Segment A and (2) the elimination of Segment A.

PATTERSON COMPANY

Comparative Income Statements for the Year 2014

Eliminate Seg. A

Keep Seg.A

Decision

Sales

Cost of goods sold

Sales commissions

Contribution margin

Gen. fixed operating expenses

Advertising expense

Net Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 4 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning