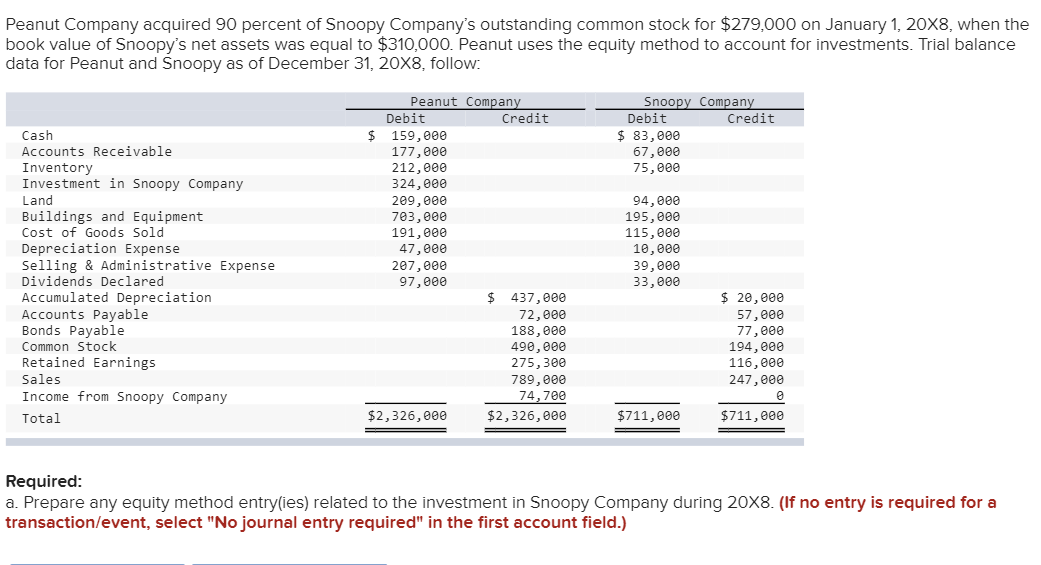

Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $279,000 on January 1, 20X8, whe book value of Snoopy's net assets was equal to $310,000. Peanut uses the equity method to account for investments. Trial balar data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 159,000 177,000 212,000 324,000 324,888 209,000 703,000 191,000 47,000 207,000 97,000 $2,326,000 Credit $ 437,000 72,000 188,000 490,000 275,300 789,000 74,700 $2,326,000 Snoopy Company Debit $ 83,000 67,000 75,000 94,000 195,000 115,000 10,000 39,000 33,000 $711,000 Credit $ 20,000 57,000 77,000 194,000 116,000 247,000 0 $711,000 Required: a. Prepare any equity method entry(ies) related to the investment in Snoopy Company during 20X8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $279,000 on January 1, 20X8, whe book value of Snoopy's net assets was equal to $310,000. Peanut uses the equity method to account for investments. Trial balar data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 159,000 177,000 212,000 324,000 324,888 209,000 703,000 191,000 47,000 207,000 97,000 $2,326,000 Credit $ 437,000 72,000 188,000 490,000 275,300 789,000 74,700 $2,326,000 Snoopy Company Debit $ 83,000 67,000 75,000 94,000 195,000 115,000 10,000 39,000 33,000 $711,000 Credit $ 20,000 57,000 77,000 194,000 116,000 247,000 0 $711,000 Required: a. Prepare any equity method entry(ies) related to the investment in Snoopy Company during 20X8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Ee 104.

Transcribed Image Text:Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $279,000 on January 1, 20X8, when the

book value of Snoopy's net assets was equal to $310,000. Peanut uses the equity method to account for investments. Trial balance

data for Peanut and Snoopy as of December 31, 20X8, follow:

Cash

Accounts Receivable

Inventory

Investment in Snoopy Company

Land

Buildings and Equipment

Cost of Goods Sold

Depreciation Expense

Selling & Administrative Expense

Dividends Declared

Accumulated Depreciation

Accounts Payable

Bonds Payable

Common Stock

Retained Earnings

Sales

Income from Snoopy Company

Total

Peanut Company

Debit

$ 159,000

177,000

212,000

324,000

324,888

209,000

703,000

191,000

47,000

207,000

97,000

$2,326,000

Credit

$ 437,000

72,000

188,000

490,000

275,300

789,000

74,700

$2,326,000

Snoopy Company

Debit

Credit

$ 83,000

67,000

75,000

94,000

195,000

115,000

10,000

39,000

33,000

$711,000

$ 20,000

57,000

77,000

194,000

116,000

247,000

0

$711,000

Required:

a. Prepare any equity method entry(ies) related to the investment in Snoopy Company during 20X8. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

Transcribed Image Text:b. Prepare a consolidation worksheet for 20X8. Assume the company prepares the optional Accumulated Depreciation Consolidation

Entry. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a

minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where

multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the

worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning