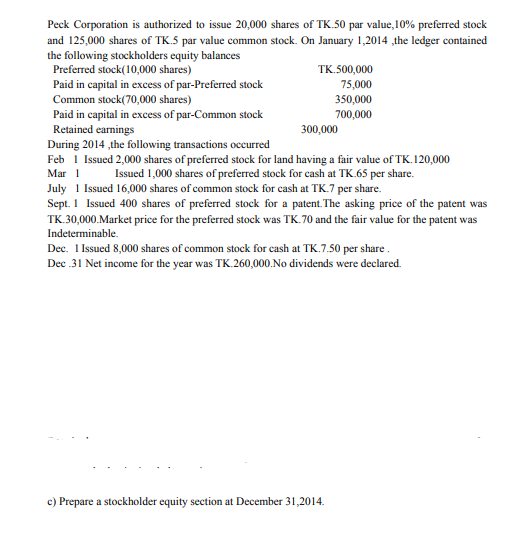

Peck Corporation is authorized to issue 20,000 shares of TK.50 par value,10% preferred stock and 125,000 shares of TK.5 par value common stock. On January 1,2014 ,the ledger contained the following stockholders equity balances Preferred stock(10,000 shares) TK.500,000 75,000 350,000 700,000 Paid in capital in excess of par-Preferred stock Common stock(70,000 shares) Paid in capital in excess of par-Common stock Retained earnings During 2014 ,the following transactions occurred Feb 1 Issued 2,000 shares of preferred stock for land having a fair value of TK. 120,000 300,000 Issued 1,000 shares of preferred stock for cash at TK.65 per share. Mar 1 July 1 Issued 16,000 shares of common stock for cash at TK.7 per share. Sept. 1 Issued 400 shares of preferred stock for a patent.The asking price of the patent was TK.30,000.Market price for the preferred stock was TK. 70 and the fair value for the patent was Indeterminable. Dec. 1 Issued 8,000 shares of common stock for cash at TK.7.50 per share. Dec 31 Net income for the year was TK. 260,000.No dividends were declared. c) Prepare a stockholder equity section at December 31,2014.

Peck Corporation is authorized to issue 20,000 shares of TK.50 par value,10% preferred stock and 125,000 shares of TK.5 par value common stock. On January 1,2014 ,the ledger contained the following stockholders equity balances Preferred stock(10,000 shares) TK.500,000 75,000 350,000 700,000 Paid in capital in excess of par-Preferred stock Common stock(70,000 shares) Paid in capital in excess of par-Common stock Retained earnings During 2014 ,the following transactions occurred Feb 1 Issued 2,000 shares of preferred stock for land having a fair value of TK. 120,000 300,000 Issued 1,000 shares of preferred stock for cash at TK.65 per share. Mar 1 July 1 Issued 16,000 shares of common stock for cash at TK.7 per share. Sept. 1 Issued 400 shares of preferred stock for a patent.The asking price of the patent was TK.30,000.Market price for the preferred stock was TK. 70 and the fair value for the patent was Indeterminable. Dec. 1 Issued 8,000 shares of common stock for cash at TK.7.50 per share. Dec 31 Net income for the year was TK. 260,000.No dividends were declared. c) Prepare a stockholder equity section at December 31,2014.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 1MP: Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--,...

Related questions

Question

c) Prepare a stockholder equity section at December 31,2014.

Transcribed Image Text:Peck Corporation is authorized to issue 20,000 shares of TK.50 par value,10% preferred stock

and 125,000 shares of TK.5 par value common stock. On January 1,2014 ,the ledger contained

the following stockholders equity balances

Preferred stock(10,000 shares)

Paid in capital in excess of par-Preferred stock

Common stock(70,000 shares)

Paid in capital in excess of par-Common stock

Retained earnings

During 2014 ,the following transactions occurred

Feb 1 Issued 2,000 shares of preferred stock for land having a fair value of TK. 120,000

Mar 1

TK.500,000

75,000

350,000

700,000

300,000

Issued 1,000 shares of preferred stock for cash at TK.65 per share.

July 1 Issued 16,000 shares of common stock for cash at TK.7 per share.

Sept. 1 Issued 400 shares of preferred stock for a patent. The asking price of the patent was

TK.30,000.Market price for the preferred stock was TK.70 and the fair value for the patent was

Indeterminable.

Dec. 1 Issued 8,000 shares of common stock for cash at TK.7.50 per share .

Dec .31 Net income for the year was TK.260,000.No dividends were declared.

c) Prepare a stockholder equity section at December 31,2014.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning