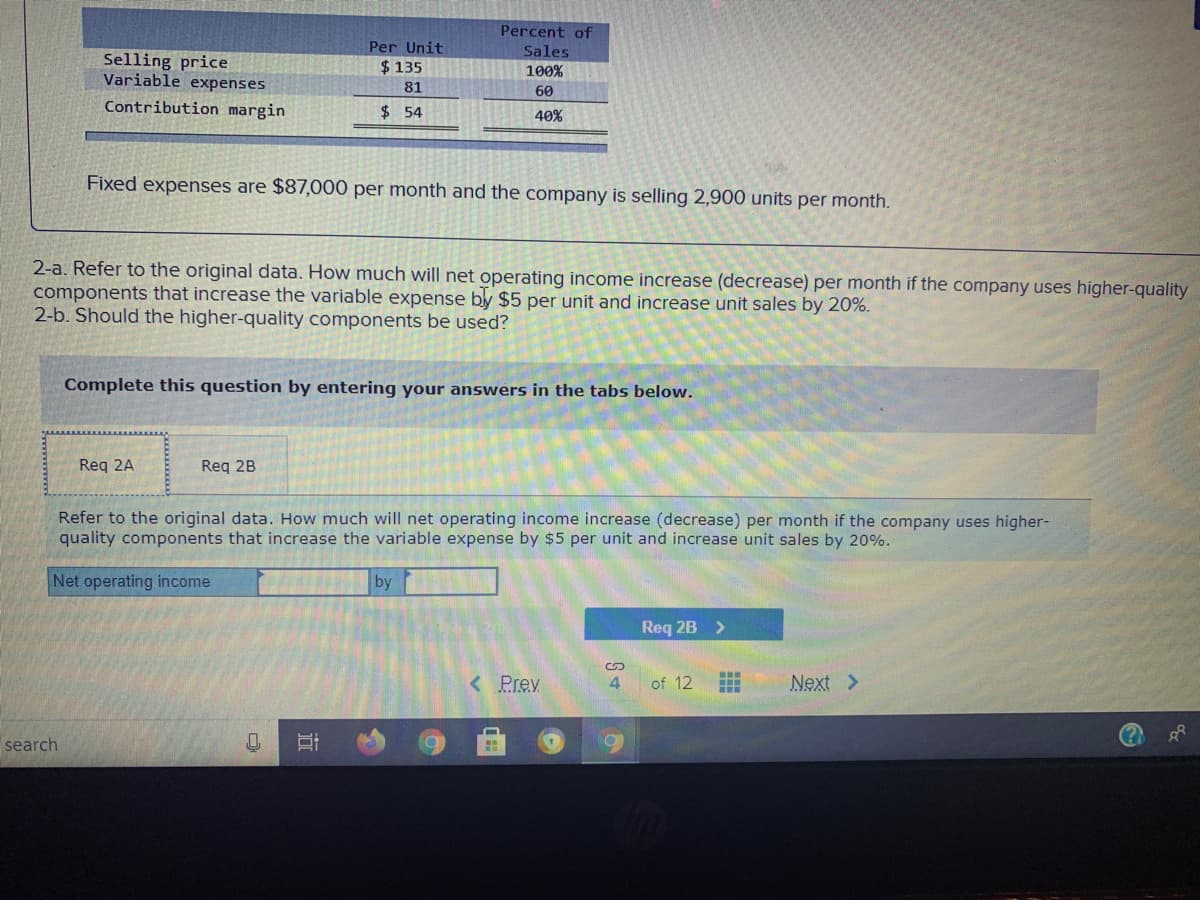

Percent of Per Unit Sales Selling price Variable expenses $ 135 100% 81 60 Contribution margin $54 40% Fixed expenses are $87,000 per month and the company is selling 2,900 units per month. 2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-qu components that increase the variable expense by $5 per unit and increase unit sales by 20%. 2-b. Should the higher-quality components be used? Complete this question by entering your answers in the tabs below. Req 2A Req 2B Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher- quality components that increase the variable expense by $5 per unit and increase unit sales by 20%. Net operating income by

Percent of Per Unit Sales Selling price Variable expenses $ 135 100% 81 60 Contribution margin $54 40% Fixed expenses are $87,000 per month and the company is selling 2,900 units per month. 2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-qu components that increase the variable expense by $5 per unit and increase unit sales by 20%. 2-b. Should the higher-quality components be used? Complete this question by entering your answers in the tabs below. Req 2A Req 2B Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher- quality components that increase the variable expense by $5 per unit and increase unit sales by 20%. Net operating income by

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter8: Tactical Decision-making And Relevant Analysis

Section: Chapter Questions

Problem 11MCQ: Garrett Company provided the following information: Common fixed cost totaled 46,000. Garrett...

Related questions

Question

Transcribed Image Text:Percent of

Per Unit

Sales

Selling price

Variable expenses

$ 135

100%

81

60

Contribution margin

$ 54

40%

Fixed expenses are $87,000 per month and the company is selling 2,900 units per month.

2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-quality

components that increase the variable expense by $5 per unit and increase unit sales by 20%.

2-b. Should the higher-quality components be used?

Complete this question by entering your answers in the tabs below.

Req 2A

Req 2B

Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-

quality components that increase the variable expense by $5 per unit and increase unit sales by 20%.

Net operating income

by

Req 2B >

<Prev

4.

of 12

Next >

search

近

![Required information

[The following information applies to the questions displayed below.]

Data for Hermann Corporation are shown below:

Percent of

Per Unit

Sales

Selling price

Variable expenses

$ 135

100%

81

60

Contribution margin

$ 54

40%

Fixed expenses are $87,00h per month and the company is selling 2,900 units per month.

2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-quality

components that increase the variable expense by $5 per unit and increase unit sales by 20%.

2-b. Should the higher-quality components be used?

Complete this question by entering your answers in the tabs below.

< Prev

of 12

Next >

ch

近](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F1ee194fd-3a41-4ec4-a386-affdd553f4eb%2Fa28a0861-40d8-4338-9a0c-4e7655b96264%2Fsxsvh2b_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Data for Hermann Corporation are shown below:

Percent of

Per Unit

Sales

Selling price

Variable expenses

$ 135

100%

81

60

Contribution margin

$ 54

40%

Fixed expenses are $87,00h per month and the company is selling 2,900 units per month.

2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the company uses higher-quality

components that increase the variable expense by $5 per unit and increase unit sales by 20%.

2-b. Should the higher-quality components be used?

Complete this question by entering your answers in the tabs below.

< Prev

of 12

Next >

ch

近

Expert Solution

Step 1

Given that:

Unit selling price = $135 per unit

Variable cost per unit = $81 per unit

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning