A bridge is to be constructed now as part of a new road. Engineers have determined that traffic density on the new road will justify a two-lane road and a bridge at the present time. Because of uncertainty regarding future

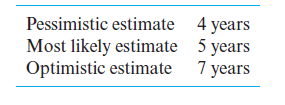

use of the road, the time at which an extra two lanes will be required is currently being studied. The two-lane bridge will cost $200,000 and the fourlane bridge, if built initially, will cost $350,000. The future cost of widening a two-lane bridge to four lanes will be an extra $200,000 plus $25,000 for every year that widening is delayed. The MARR used by the highway department is 12% per year. The following estimates have been made of the times at which the four-lane bridge will be required: In view of these estimates, what would you recommend? What difficulty, if any, do you have in interpreting your results? List some advantages and disadvantages of this method of preparing estimates.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps