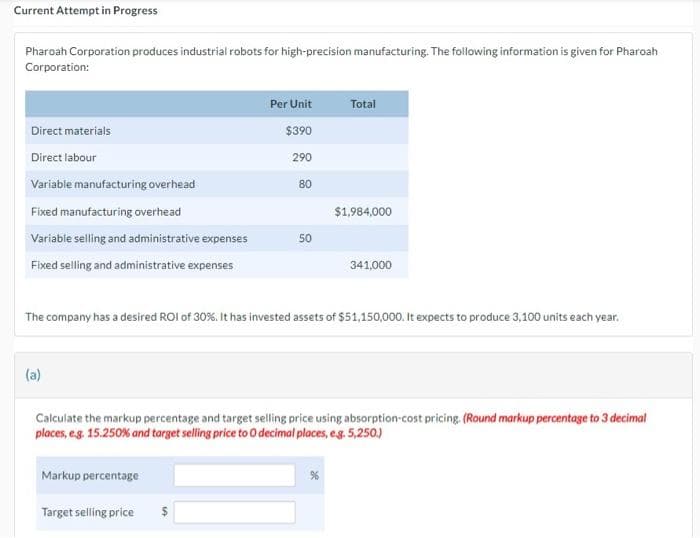

Pharoah Corporation produces industrial robots for high-precision manufacturing. The following information is given for Pharoah Corporation: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses (a) Per Unit $390 290 Markup percentage 80 Target selling price 50 Total The company has a desired ROI of 30%. It has invested assets of $51,150,000. It expects to produce 3,100 units each year. $1,984,000 341,000 Calculate the markup percentage and target selling price using absorption-cost pricing. (Round markup percentage to 3 decimal places, e.g. 15.250% and target selling price to O decimal places, e.g. 5,250.)

Pharoah Corporation produces industrial robots for high-precision manufacturing. The following information is given for Pharoah Corporation: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses (a) Per Unit $390 290 Markup percentage 80 Target selling price 50 Total The company has a desired ROI of 30%. It has invested assets of $51,150,000. It expects to produce 3,100 units each year. $1,984,000 341,000 Calculate the markup percentage and target selling price using absorption-cost pricing. (Round markup percentage to 3 decimal places, e.g. 15.250% and target selling price to O decimal places, e.g. 5,250.)

Chapter10: Inventory

Section: Chapter Questions

Problem 2MC: If a company has three lots of products for sale, purchase 1 (earliest) for $17, purchase 2 (middle)...

Related questions

Question

Hh1.

Transcribed Image Text:Current Attempt in Progress

Pharoah Corporation produces industrial robots for high-precision manufacturing. The following information is given for Pharoah

Corporation:

Direct materials

Direct labour

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling and administrative expenses

Fixed selling and administrative expenses

(a)

Per Unit

$390

Markup percentage

290

Target selling price

80

50

The company has a desired ROI of 30%. It has invested assets of $51,150,000. It expects to produce 3,100 units each year.

Total

$1,984,000

Calculate the markup percentage and target selling price using absorption-cost pricing. (Round markup percentage to 3 decimal

places, e.g. 15.250% and target selling price to O decimal places, e.g. 5,250.)

%6

341,000

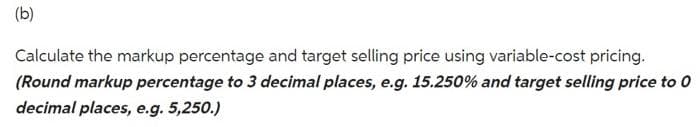

Transcribed Image Text:(b)

Calculate the markup percentage and target selling price using variable-cost pricing.

(Round markup percentage to 3 decimal places, e.g. 15.250% and target selling price to 0

decimal places, e.g. 5,250.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College