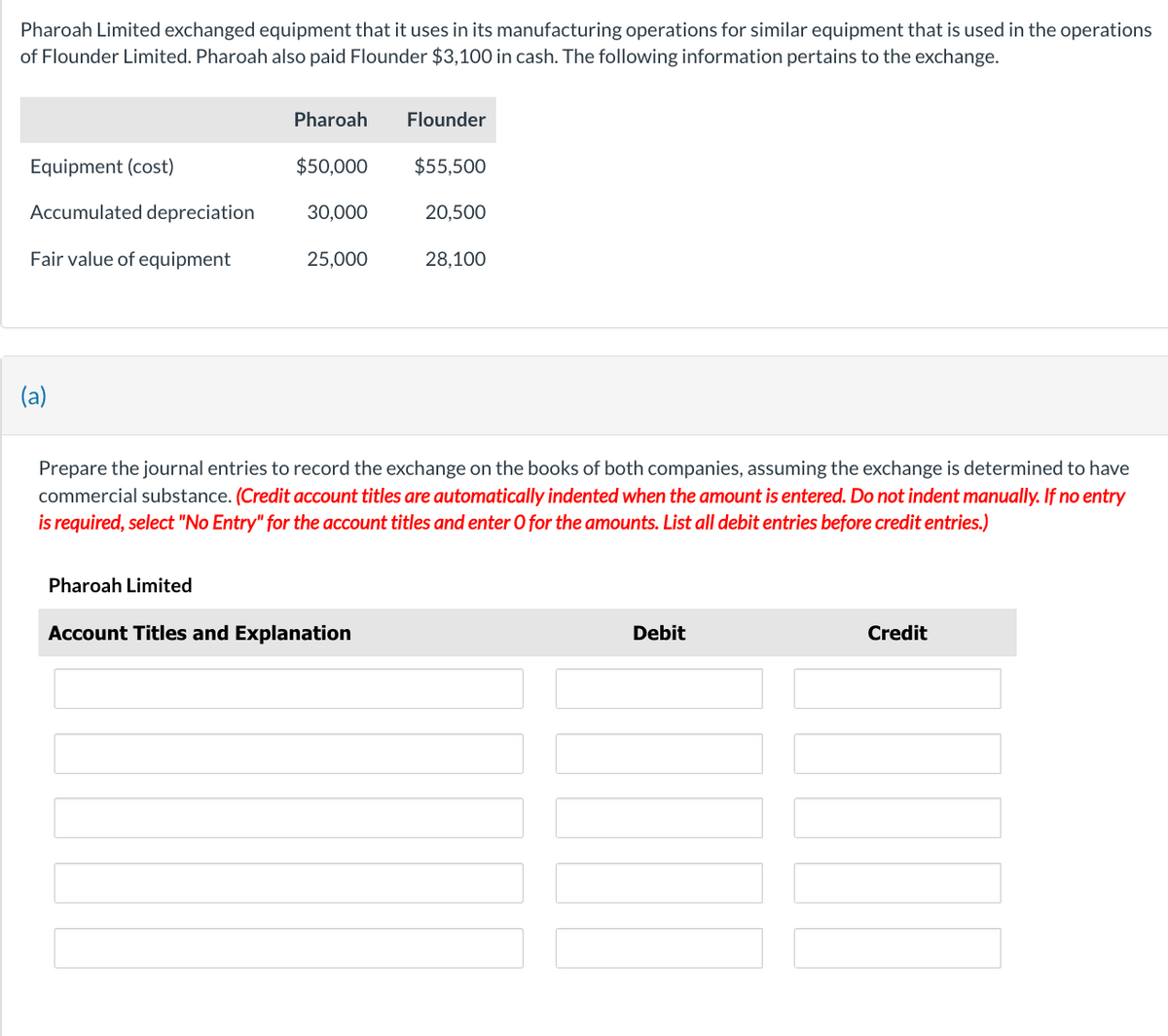

Pharoah Limited exchanged equipment that it uses in its manufacturing operations for similar equipment that is used in the operations of Flounder Limited. Pharoah also paid Flounder $3,100 in cash. The following information pertains to the exchange. Equipment (cost) Accumulated depreciation Fair value of equipment (a) Pharoah Pharoah Limited $50,000 30,000 25,000 Flounder $55,500 20,500 28,100 Prepare the journal entries to record the exchange on the books of both companies, assuming the exchange is determined to have commercial substance. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Accounts Payable

Accumulated Depreciation - Equipment

Accumulated Depreciation - Leasehold Improvements

Accumulated Depreciation - Machinery

Accumulated Depreciation - Vehicle Overhaul

Accumulated Depreciation - Vehicles

Advertising Expense

Asset Retirement Obligation

Buildings

Cash

Common Shares

Contributed Surplus - Donated Capital

Cost of Goods Sold

Deferred Revenue - Government Grants

Depreciation Expense

Donation Revenue

Equipment

Finance Expense

Gain on Disposal of Buildings

Gain on Disposal of Equipment

Gain on Disposal of Machinery

Gain on Disposal of Vehicles

Gain on Vehicle Overhaul

Gain or Loss in Value of Investment Property

GST Receivable

Interest Expense

Interest Payable

Inventory

Investment Property

Land

Land Improvements

Legal Expense

Loss on Disposal of Buildings

Loss on Disposal of Equipment

Loss on Disposal of Machinery

Loss on Disposal of Vehicles

Loss on Vehicle Overhaul

Machinery

Mineral Resources

Mortgage Payable

No Entry

Notes Payable

Office Expense

Prepaid Expenses

Prepaid Insurance

Purchase Discounts

Repairs and Maintenance Expense

Revaluation Gain or Loss

Revaluation Surplus (AOCI)

Revaluation Surplus (OCI)

Revenue - Government Grants

Salaries and Wages Expense

Sales Revenue

Service Revenue

Supplies

Tenant Deposits Liability

Vehicle Overhaul

Vehicles

Step by step

Solved in 3 steps