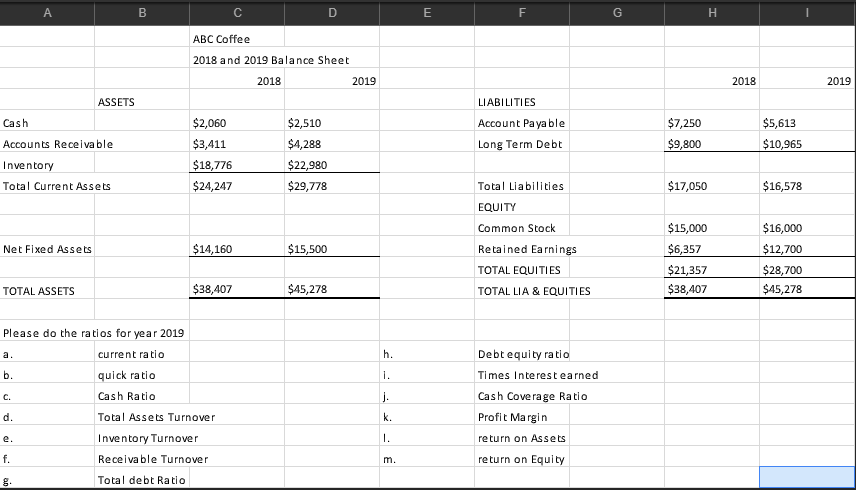

Please do the ratios for year 2019 a. current ratio h. Debt equity ra tio b. quick ratio i. Times Interestearned c. Cash Ratio j. Cash Coverage Ratio d. Total Assets Turnover k. Profit Margin e. Inventory Turnover return on Assets I. Receivable Turnover return on Equity m. Total debt Ratio

Q: a) Calculate on the following ratios for AZ Trading for 2020 and 2021: i. Debt-to-equity ratio ii.…

A: Solution:- a) Calculate on the following ratios for AZ Trading for 2020 and 2021 as follows:- i)Debt…

Q: explain each ratio of this list what happened in 2019, 2020, 2021? List Of Ratio 2019 2020 2021…

A: Ratio analysis is the technique used to analyze the financial health of the company. Different…

Q: Compute the following ratiosat December 31, 2019: i.Current ratio ii.Acid-test Ratio iii.Account…

A: Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise.…

Q: Required: Analyze Delima's financial statement. Include the following ratios for 2020 and discuss…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Ratio of liabilities to owner's equity The following data were taken from Mesa Company's balance…

A: The debt to equity ratio measures the risk associated to shareholders.

Q: Financial statement analysis The financial statements of Zach Industries for the year ended December…

A: In order to determine the time's interest earned ratio, the Earning before interest and taxed (EBIT)…

Q: Analyse the Assets-to-equity ratio of 1.87 in 2019 and 1.67 in 2020

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve…

Q: Compute the following ratios and measurements for 2020 a. Cash flow from operations to current…

A: Cash flow from operations shows the amount of cash generated by the business from its ordinary…

Q: What are the Liquidity Ratios, Asset Management Ratios and Debt Management Ratios for the periods…

A: Ratio Analysis: Ratio analysis helps in getting an idea about an entity's operational efficiency,…

Q: Required: Analyse Rara's financial statement. Include the following ratios for 2020 and discuss your…

A: Return on assets refers to the concept of profitability ratios which measures the ability of a…

Q: Ratios For Amazon.com, Inc. (AMZN)…

A: Ratio analysis includes the computation of ratios using elements of financial statements by keeping…

Q: What is the comparative statement of financial condition for 2019 and 2020 showing peso and…

A: Solution:- Preparation of the comparative statement of financial condition for 2019 and 2020…

Q: Explain the major financial ratios and financial cycles, debt ratio, debt to equity ratio, return on…

A: The below ratios are computed using the 2016 financial statements of Walmart Company.

Q: nalyse Delima’s financial statement. Include the following ratios for 2020 and discuss your findings…

A: Current Ratio is computed by dividing the current assets by current liabilities. Inventory turnover…

Q: The following data were taken from Alvarado Company's balance sheet: Dec. 31, 2019 Dec. 31, 2018…

A: The ratio of liabilities to owner’s equity is calculated to measure whether the company’s financing…

Q: Required: Compute the following for Year 2: Earnings per share of common stock…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Given the ratios for 2020 as follows debtor's collection period=46days stock days on hand=60days…

A:

Q: Required: a. Calculate the following ratios: i. Profitability ratios - Retum on Capital Employed,…

A: Ratio analysis is a quantitative method used to know the liquidity, operational efficiency, and…

Q: Analyze the financial statements of the company to you in terms of:…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Required: Compute and interpret the following financial ratios of the company for Year 5: a.…

A: Acid test Ratio Return on Assets (ROA) Return on common stockholders’ equity (ROE) Earnings per…

Q: Find return on assets and return on equity ratios for year 2017, 2018, and 2019.

A: Given:

Q: Use this data to compute the following ratios: 1.Current ratio (Dec 2020 )2.Acid-test Ratio (Dec…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: 2018 2019 Short-term solvency ratios a. Current ratio times times b. Quick ratio times times C. Cash…

A: The financial ratio is one of the most important tools for analyzing a company’s financial…

Q: Bethesda Mining Company reports the following balance sheet information for 2018 and 2019. Calculate…

A: Ratio Analysis is the financial analysis technique that evaluates the performance of the company. In…

Q: Search online for Tesla’s Annual Report for fiscal year 2020 that ended on December 31, 2020. Answer…

A: Ratios help analyse how the company is performing. They help investors get valuable insights about…

Q: 1. Using the financial statements above, prepare a common size income statement and balance sheet.…

A: Financial analysis is the process of assessing a company's performance in relation to its industry…

Q: Trend Analysis incorporates this into the calculations: income ratio debt ratio. Analysis year…

A: Trend analysis is the analysis of percentage change between two or more period. It shows the trend…

Q: The current ratio is estimated as follows: Current ratio Particulars Amount (2019) Amount (2020)…

A: Following is the answer to the question.

Q: Required: Analyse Rara's financial statement. Include the following ratios for 2020 and discuss your…

A: Return on Assets = Net IncomeTotal Assets Profit Margin = Net IncomeNet Sales Return on common…

Q: Following are the financial statements of AB Ltd. for 2010. From the aforementioned table,…

A: The accounting ratio compares financial data between companies which are used for analyzing the…

Q: following ratios for 2021. 1) Inventory turnover 2) Profit margin 3) Return on assets

A: As per the guidelines, only three subparts are allowed to be answered. Please submit the question…

Q: calculate liquidity ratio efficiency ratios leverage ratios coverage ratio profitability ratios use…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Solve and perform the different financial ratios using the financial statements of XYZ Company for…

A: We can use the below mention formula to calculate the Current and Quick Ratio Current Ratio -…

Q: inancial cycles, debt ratio, debt to equity ratio, return on assets, return on equity, current…

A: Financial ratio is a useful tool which helps companies by comparing two items in the financial…

Q: With a given information below: (A) Prepare Income Statement and Balance Sheet in the Year 2020. (B)…

A: Income Statement is the financial statement depicting the profitability position of an entity and…

Q: a) Evaluate the company’s liquidity and financial flexibility by calculating and analysing the…

A: Hi Student Since there are multiple subparts, we will answer only first three sub parts. If you want…

Q: 1) Total Fixed Liabilities / LTD. 2) Current Liabilities / STD. 3) Total Liabilities.

A: As per our protocol we provide solution to the one question only or up-to first three sub-parts only…

Q: REQUIRED Use the information given below to calculate the following ratios for 2019. (Where…

A: Financial Ratios are very important when it comes to see a firm's current financial status in…

Q: a. Given the debtor's collection period, stock days on hand and creditors payment period for 2020…

A: We know the basic formula to calculate the average collection period = Number of Days in One years /…

Q: Based on this information, compute (a) the current ratio, (b) the days sales outstanding (c) the…

A: Lozano Chip Company The current ratio = Current asset / Current liabilities = $2925000 / 1453500 =…

Q: Use the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year…

A: Profit margin is the ratio of company profit to its sales. It is a profitably ratio and tell the…

Q: Instructions: Compute the following ratios for 2016 with interpretation a) Current ratio. b)…

A: Current ratio is calculated by dividing the current assets with the current liabilities. This ratio…

Q: a. Compute profitability measures: RNOA, ROA and ROE for 2019 and 2018 using the numbers as reported…

A: Given in the Question: (Amount in Millions) Particulars 2019 2018 2017 Net…

Q: Explain the major financial ratios and financial cycles, debt ratio, debt to equity ratio, return on…

A: Step 1 Hello. Since your question has multiple parts, we will solve first question for you. If you…

Q: MODIFIED MATCHING TYPE: From the financial ratios listed in the box, group the financial ratios as…

A: Profitability ratio determines the profitability of the entity over a period of time with regard to…

Q: repare and Interpret a complete ratio analysis for the years 2019 & 2020 operations using the…

A: Ratio Analysis is used to analyse the financial condition of a company. Some examples are liquidity…

Q: Compute for Leverage Ratio for year 2018 - 2020: a. Debt Ratio b. Debt to Equity Ratio c. Time…

A: Debt ratio is the ratio which measures how much total assets has been financed from the debts of the…

Q: Calculate the following ratios for Avartar Sdn. Bhd. for years ended 31 March 2019 and 31 March…

A: Ratio analysis is one of important analysis used by the stakeholders of the company to analyze the…

Q: REQUIRED: a) Calculate the following ratios: i) Gross profit ii) Net profit before tax Current ratio…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Step by step

Solved in 3 steps

- Life-Positive’s Account Balances 2021 ($) 2022 ($) accounts payable 24,600.00 21,250.00Accounts receivable 15,700.00 12,340.00Cash 23,450.00 28,600.00Cost of goods sold 19,700.00 23,000.00Depreciation 3,090.00 4,590.00Dividends 5,800.00 10,800.00Interest 2,340.00 2,890.00Inventory 7,050.00 8,640.00Long-term debt 28,000.00 30,000.00Net fixed assets 41,500.00 48,000.00Other expenses 2,400.00 2,800.00Sales 58,000.00 62,500.00Short-term Notes Payable 2,890.00 2,340.00Shares outstanding 85,000.00 90,000.00 tax rate is 32% 4. Calculate the cash flow from assets, cash flow to creditors,and cash flow to stockholders…7.Lanson Corporation Co.'s trial balance included the following account balances at December 31, 2021: Accounts payable $26,800Bonds payable, due 2030 24,900Salaries payable 16,900Notes payable, due 2022 22,000Notes payable, due 2026 40,800 What amount should be included in the current liabilities section of Lanson's December 31, 2021, balance sheet? Group of answer choices $65,700 $43,700 $106,500 $68,600Godo At May 31, 2019, FOR Deliveries reported the following amounts (in millions) in its financial statements:20192018Total Assets$ 70,000$ 68,000Total Liabilities46,20042,160Interest Expense736750Income Tax Expense155260Net Income7806,275 Required: 1. Compute the debt-to-assets ratio and times interest earned ratio for 2019 and 2018. 2-a. In 2019, were creditors providing a greater (or lesser) proportion of financing for FOR’s assets? 2-b. In 2019, was FOR more (or less) successful at covering its interest costs, as compared to 2018?

- Orbit Limited : Statement of Financial Position as at 31 December 2022 2021 Non-current Assets R11 810 000 R7 560 000 Property, Plant, Equipment R10 025 000 R6 250 000 Investments R1 785 000 R1 310 000 Current Assets R4 190 000 R4 690 000 Inventories R 1 875 000 R2 350 000 Account Receivable R1 925 000 R2 200 000 Cash R390 000 R140 000 Toatal Assets R16 000 000 R12 250 000 Equities & Liabilities Equity ? ? Oridanary share capital R5 480 000 R3 680 000 Retained earnings ? ? Non-current Liabilities R4 500 000 R3 800 000 Loan (20% p.a) R4 500 000 R3 800 000 Current Liabilities R2 300 000 R1 500 000 Accounts payable? R2 300 000 R1 500 000 Calculate the increase in the retained earnings over the two-year period.G’s balance sheets for 2020 & 2021 and income statement for 2021 follow: 2020 2021 Cash $500,000 $800,000 Receivables from customers, net 600,000 600,000 Plant assets 2,800,000 2,902,583 Accumulated depreciation (900,000) (1,002,583) $3,000,000 $3,300,000 Accounts payable and other accrued liabilities 215,000 200,223 Defined benefit pension obligation 125,000 115,000 Lease liability 0 86,777 Common stock ($1 par value) 100,000 100,000 Additional paid-in-capital, common stock 677,000 677,000 Other comprehensive income 15,000 20,000 Retained earnings 1,868,000 2,101,000 $3,000,000 $3,300,000 Sales 2,950,000 Operating expenses 2,659,000 Income before taxes 291,000 Income tax expense 58,000 Net income $233,000 Additional information for G follows: During 2021, G neither purchased nor sold any plant assets. G’s plant assets caption on its balance sheet includes G’s right-of-use leased assets. On 01-01-21, G leased a machine with a useful life of 4 years. The…Life-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00 30,000.00 Net fixed assets 41,500.00 48,000.00 Other expenses 2,400.00 2,800.00 Sales 58,000.00 62,500.00 Short-term Notes Payable 2,890.00 2,340.00 Shares outstanding 85,000.00 90,000.00 The tax rate is 32% 1.Prepare a balance sheet for 2021 and 2022 for the company, clearly showing information about each line item. 2.Prepare an income statement for 2021 and 2022 for the company. 3.For the year ending 2022, determine the Net New Equity, Change in Net Working Capital, Net Capital Spending and Operating Cash flow. 4.Calculate the cash flow from assets, cash flow to creditors,…

- Life-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00 30,000.00 Net fixed assets 41,500.00 48,000.00 Other expenses 2,400.00 2,800.00 Sales 58,000.00 62,500.00 Short-term Notes Payable 2,890.00 2,340.00 Shares outstanding 85,000.00 90,000.00 The tax rate is 32% 1.Calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders for 2022. 2.what is the Dividends per Share and Earnings per Share for each year for Brown Company. 3.Briefly comment on the company’s cash flows for 2022 in light of an expansion plan which will be financed by both debt and…Life-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00…DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 49 $ 24 Accounts receivable 46 53 Less: Allowance for uncollectible accounts (3 ) (2 ) Dividends receivable 3 2 Inventory 65 60 Long-term investment 21 18 Land 85 60 Buildings and equipment 273 290 Less: Accumulated depreciation (70 ) (90 ) $ 469 $ 415 Liabilities Accounts payable $ 35 $ 43 Salaries payable 3 7 Interest payable 7 2 Income tax payable 8 9 Notes payable 25 0 Bonds payable 115 90 Less: Discount on bonds (4 ) (5 ) Shareholders' Equity Common stock 210 200 Paid-in capital—excess of par 24 20 Retained earnings 54 49 Less: Treasury stock (8 ) 0…

- What amount of interest revenue should be recorded in 2021? *a. 490,000b. 480,000c. 438,000d. 391,800What is the adjusted balance of accounts payable on December 31, 2021? a. P158,000 b. P138,000 c. P118,000 d. P108,000Sign Language Hearing Co Ltd Comparative Balance Sheet October 31, 2020, and 2021 2021 2020 Assets Cash and cash equivalent 320,000 275,000 Accounts Receivable 180,000 240,000 Prepaid expenses 240,000 220,000 Equipment, net 350,000 210,000 Total Assets 1,090,000 945,000 Liabilities Accounts payable 305,000 285,000 Accrued liabilities 285,000 305,000 Bond payable 195,000 95,000 Stockholders' Equity: Common Stock 95,000 55,000 Retained earnings 350,000 255,000 Treasury stock (140,000) (50,000) Total liabilities and stockholders' equity 1,090,000 945,000 Sign Language Hearing Co Ltd Income Statement Year Ended October…