Please send answer in chart set up Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center).

Please send answer in chart set up

Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center).

| Investment Center | Sales | Income | Average Invested Assets |

||||||

| Electronics | $ | 39,840,000 | $ | 2,988,000 | $ | 16,600,000 | |||

| Sporting goods | 25,200,000 | 2,142,000 | 12,600,000 | ||||||

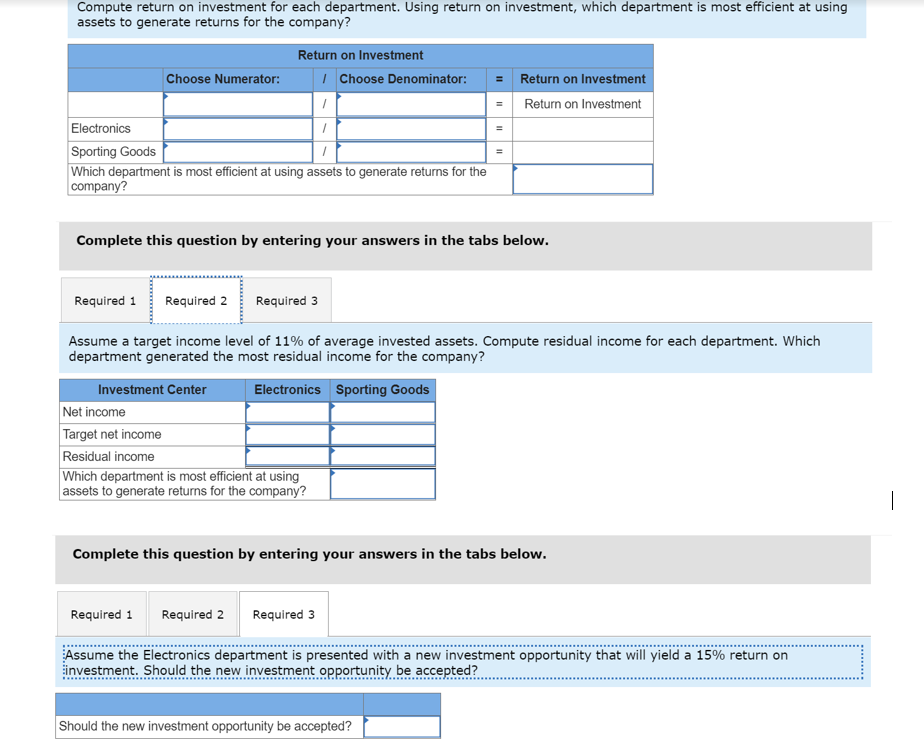

1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company?

2. Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company?

3. Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps