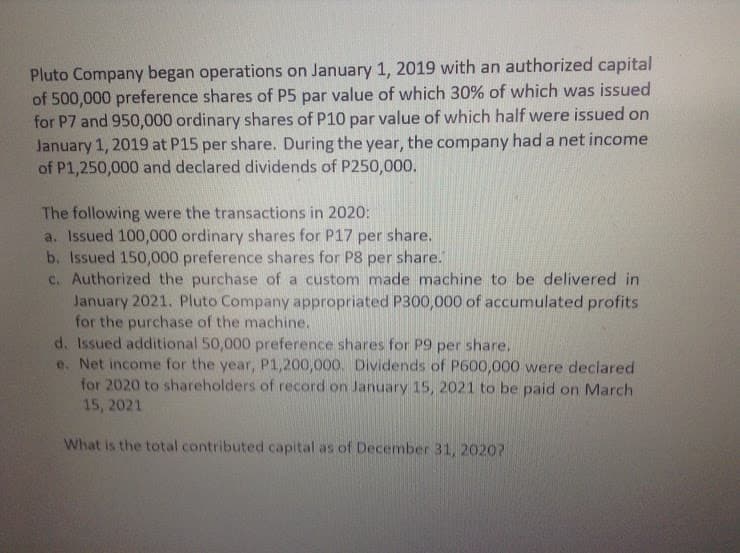

Pluto Company began operations on January 1, 2019 with an authorized capital of 500,000 preference shares of P5 par value of which 30% of which was issued for P7 and 950,000 ordinary shares of P10 par value of which half were issued on January 1, 2019 at P15 per share. During the year, the company had a net income of P1,250,000 and declared dividends of P250,000. The following were the transactions in 2020: a. Issued 100,000 ordinary shares for P17 per share. b. Issued 150, c. Authorized the purchase of a custom made machine to be delivered in January 2021. Pluto Company appropriated P300,000 of accumulated profits for the purchase of the machine. d. Issued additional 50,000 preference shares for P9 per share. e. Net income for the year, P1,200,000. Dividends of P600,000 were declared for 2020 to shareholders of record on January 15, 2021 to be paid on March 15, 2021 preference shares for P8 per share. What is the total contributed capital as of December 31, 2020?

Pluto Company began operations on January 1, 2019 with an authorized capital of 500,000 preference shares of P5 par value of which 30% of which was issued for P7 and 950,000 ordinary shares of P10 par value of which half were issued on January 1, 2019 at P15 per share. During the year, the company had a net income of P1,250,000 and declared dividends of P250,000. The following were the transactions in 2020: a. Issued 100,000 ordinary shares for P17 per share. b. Issued 150, c. Authorized the purchase of a custom made machine to be delivered in January 2021. Pluto Company appropriated P300,000 of accumulated profits for the purchase of the machine. d. Issued additional 50,000 preference shares for P9 per share. e. Net income for the year, P1,200,000. Dividends of P600,000 were declared for 2020 to shareholders of record on January 15, 2021 to be paid on March 15, 2021 preference shares for P8 per share. What is the total contributed capital as of December 31, 2020?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Question

What is the total contributed capital as of December 31, 2020

Transcribed Image Text:Pluto Company began operations on January 1, 2019 with an authorized capital

of 500,000 preference shares of P5 par value of which 30% of which was issued

for P7 and 950,000 ordinary shares of P10 par value of which half were issued on

January 1, 2019 at P15 per share. During the year, the company had a net income

of P1,250,000 and declared dividends of P250,000.

The following were the transactions in 2020:

a. Issued 100,000 ordinary shares for P17 per

b. Issued 150,000 preference shares for P8 per share."

c. Authorized the purchase of a custom made machine to be delivered in

January 2021. Pluto Company appropriated P300,000 of accumulated profits

for the purchase of the machine.

d. Issued additional 50,000 preference shares for P9 per share,

e. Net income for the year, P1,200,000. Dividends of P600,000 were declared

for 2020 to shareholders of record on January 15, 2021 to be paid on March

15, 2021

share.

What is the total contributed capital as of December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning