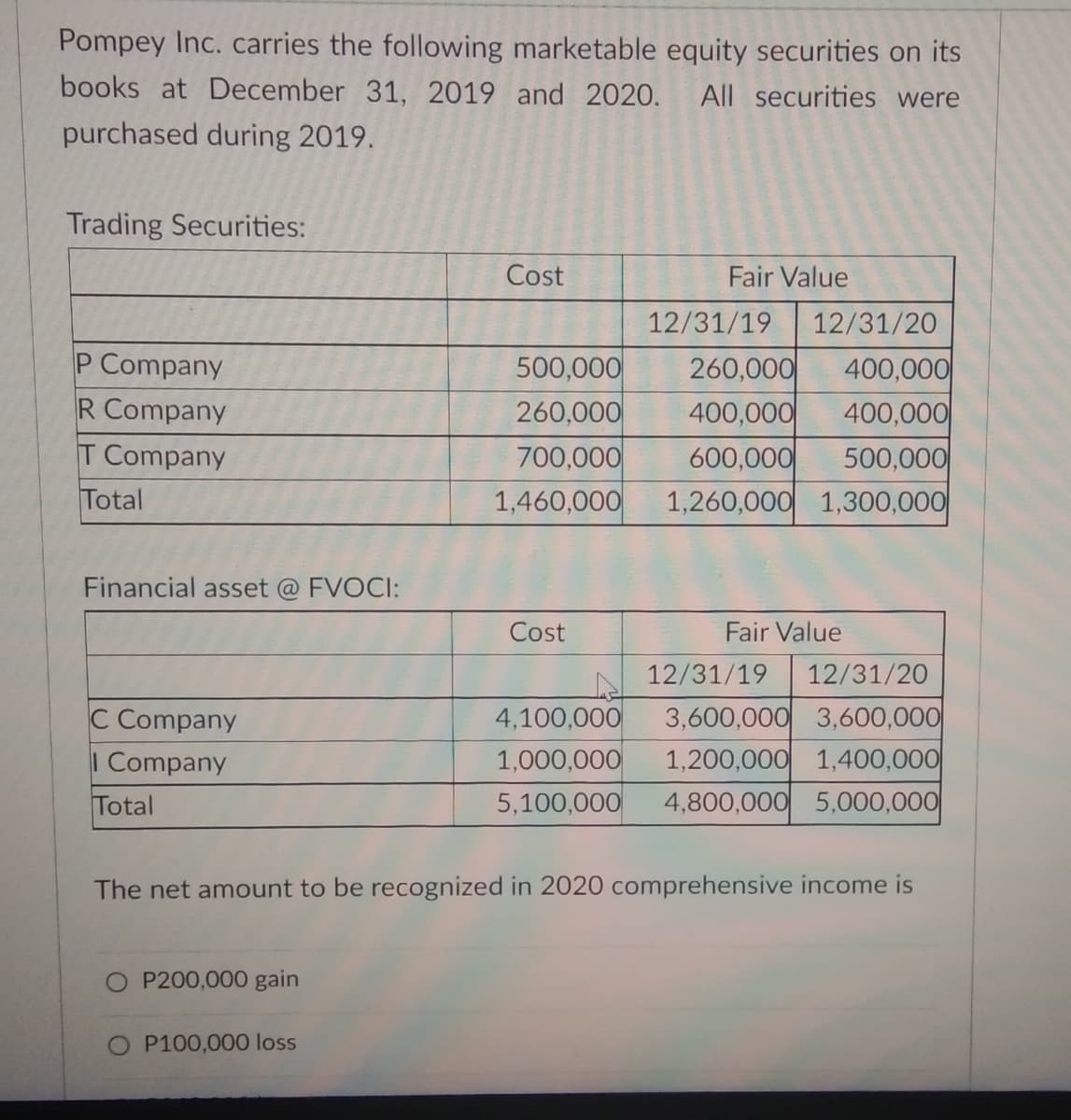

Pompey Inc. carries the following marketable equity securities on its books at December 31, 2019 and 2020. All securities were purchased during 2019. Trading Securities: Cost Fair Value 12/31/19 12/31/20 P Company R Company T Company 500,000 260,000 400,000 260,000 400,000 400,000 700,000 600,000 500,000 Total 1,460,000 1,260,000 1,300,000 Financial asset @ FVOCI: Cost Fair Value 12/31/19 12/31/20 3,600,000 3,600,000 1,200,000 1,400,000 4,800,000 5,000,000 4,100,000 C Company I Company 1,000,000 Total 5,100,000 The net amount to be recognized in 2020 comprehensive income is O P200,000 gain P100,000 loss

Pompey Inc. carries the following marketable equity securities on its books at December 31, 2019 and 2020. All securities were purchased during 2019. Trading Securities: Cost Fair Value 12/31/19 12/31/20 P Company R Company T Company 500,000 260,000 400,000 260,000 400,000 400,000 700,000 600,000 500,000 Total 1,460,000 1,260,000 1,300,000 Financial asset @ FVOCI: Cost Fair Value 12/31/19 12/31/20 3,600,000 3,600,000 1,200,000 1,400,000 4,800,000 5,000,000 4,100,000 C Company I Company 1,000,000 Total 5,100,000 The net amount to be recognized in 2020 comprehensive income is O P200,000 gain P100,000 loss

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 12RE: Refer to the information in RE13-11. Assume that on December 31, 2019, the investment in Cornett...

Related questions

Question

100%

Pompey Inc. Carries the following marketable equity

Transcribed Image Text:Pompey Inc. carries the following marketable equity securities on its

books at December 31, 2019 and 2020.

All securities were

purchased during 2019.

Trading Securities:

Cost

Fair Value

12/31/19

12/31/20

P Company

R Company

T Company

500,000

260,000

700,000

1,460,000

260,000

400,000

400,000

400,000

600,000

500,000

1,260,000 1,300,000

Total

Financial asset @ FVOCI:

Cost

Fair Value

12/31/19

12/31/20

3,600,000 3,600,000

1,200,000 1,400,000

4,800,000 5,000,000

4,100,000

C Company

I Company

Total

1,000,000

5,100,000

The net amount to be recognized in 2020 comprehensive income is

O P200,000 gain

P100,000 loss

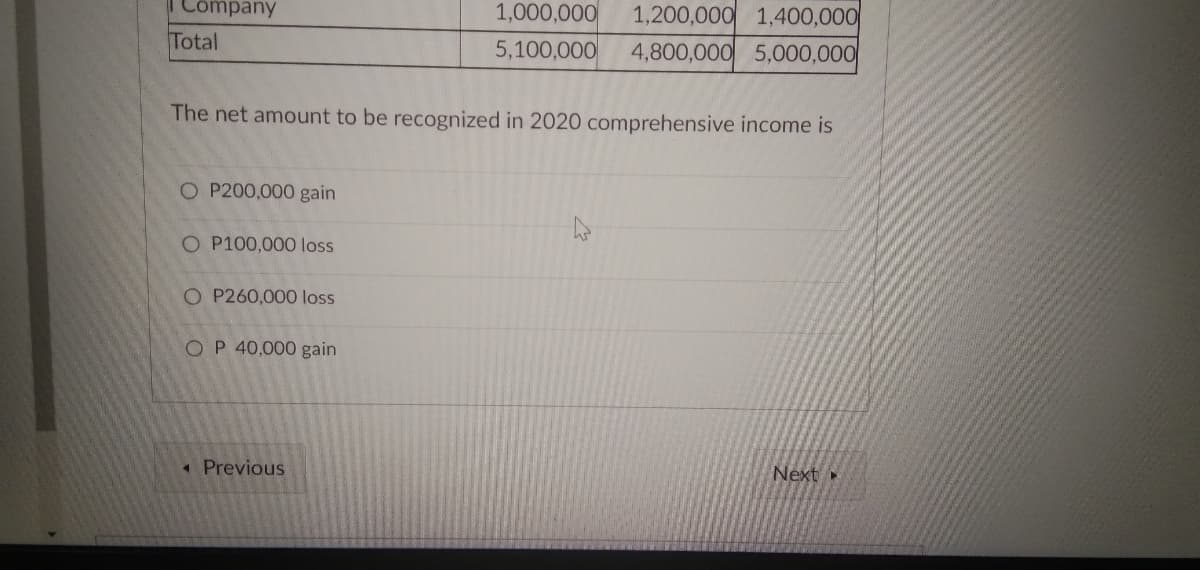

Transcribed Image Text:Company

1,000,000

1,200,000 1,400,000

Total

5,100,000

4,800,000 5,000,000

The net amount to be recognized in 2020 comprehensive income is

O P200,000 gain

O P100,000 loss

O P260,000 loss

OP 40,000 gain

«Previous

Next »

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning