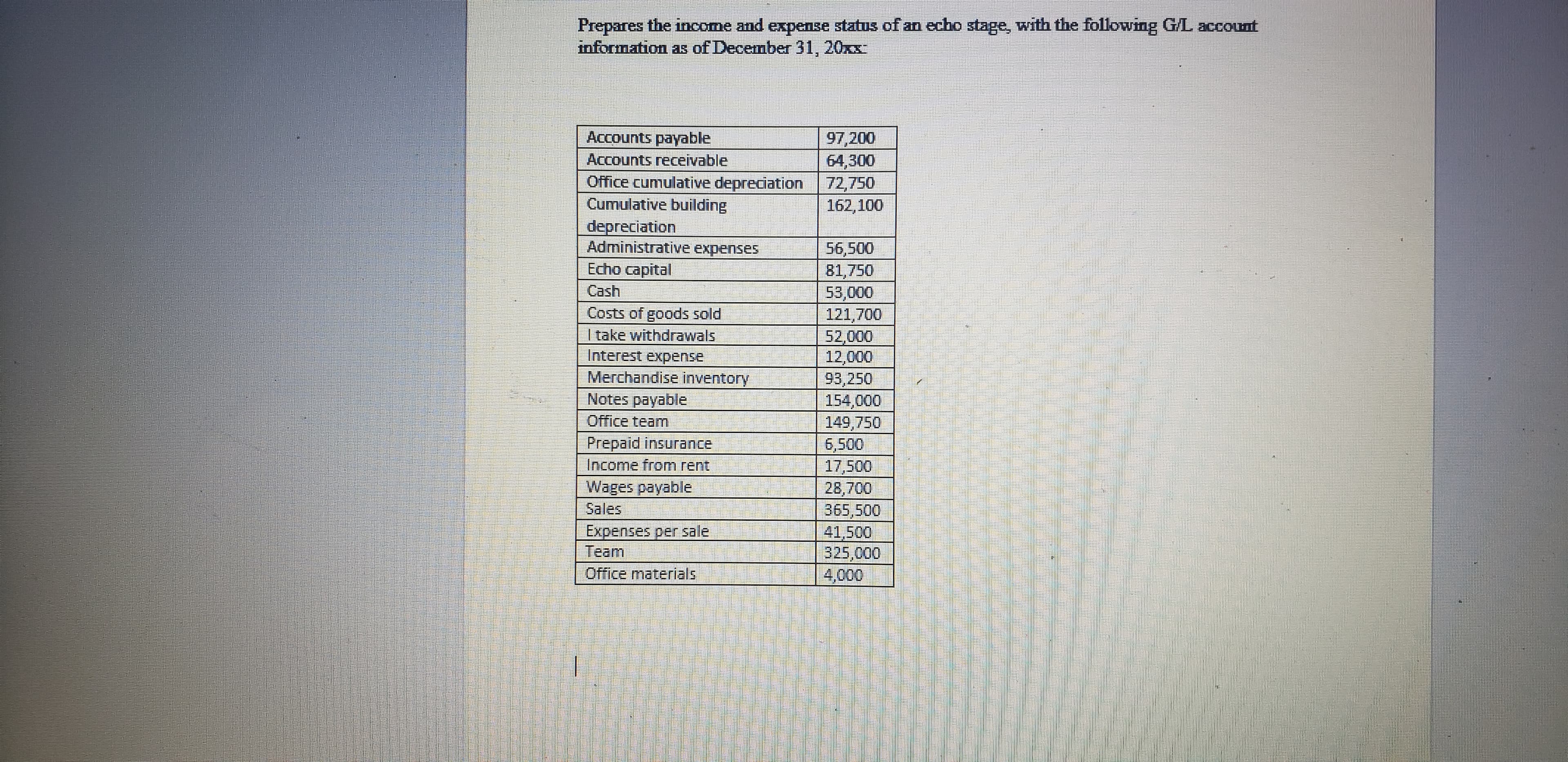

Prepares the income and expense status of an echo stage, with the following G/L account information as of December 31, 20xx Accounts payable Accounts receivable Office cumulative depreciation Cumulative building depreciation Administrative expenses Echo capital Cash 97,200 64,300 72,750 162,100 56,500 81,750 53,000 121,700 52,000 12,000 93,250 154,000 149,750 6,500 17,500 28,700 365,500 41,500 325,000 4,000 Costs of goods sold I take withdrawals Interest expense Merchandise inventory Notes payable Office team Prepaid insurance Income from rent Wages payable Sales Expenses per sale Team Office materials

Prepares the income and expense status of an echo stage, with the following G/L account information as of December 31, 20xx Accounts payable Accounts receivable Office cumulative depreciation Cumulative building depreciation Administrative expenses Echo capital Cash 97,200 64,300 72,750 162,100 56,500 81,750 53,000 121,700 52,000 12,000 93,250 154,000 149,750 6,500 17,500 28,700 365,500 41,500 325,000 4,000 Costs of goods sold I take withdrawals Interest expense Merchandise inventory Notes payable Office team Prepaid insurance Income from rent Wages payable Sales Expenses per sale Team Office materials

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 7PB: Using the following information, A. Make the December 31 adjusting journal entry for depreciation....

Related questions

Question

Transcribed Image Text:Prepares the income and expense status of an echo stage, with the following G/L account

information as of December 31, 20xx

Accounts payable

Accounts receivable

Office cumulative depreciation

Cumulative building

depreciation

Administrative expenses

Echo capital

Cash

97,200

64,300

72,750

162,100

56,500

81,750

53,000

121,700

52,000

12,000

93,250

154,000

149,750

6,500

17,500

28,700

365,500

41,500

325,000

4,000

Costs of goods sold

I take withdrawals

Interest expense

Merchandise inventory

Notes payable

Office team

Prepaid insurance

Income from rent

Wages payable

Sales

Expenses per sale

Team

Office materials

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning