Preparing Financial Statements: *Income Statement *Statement of Change in Owner's Equity *Statement of Financial Position *Cash Flow Statement

Preparing Financial Statements: *Income Statement *Statement of Change in Owner's Equity *Statement of Financial Position *Cash Flow Statement

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 9MC

Related questions

Question

Preparing Financial Statements:

*Income Statement

*Statement of Change in Owner's Equity

*

*Cash Flow Statement

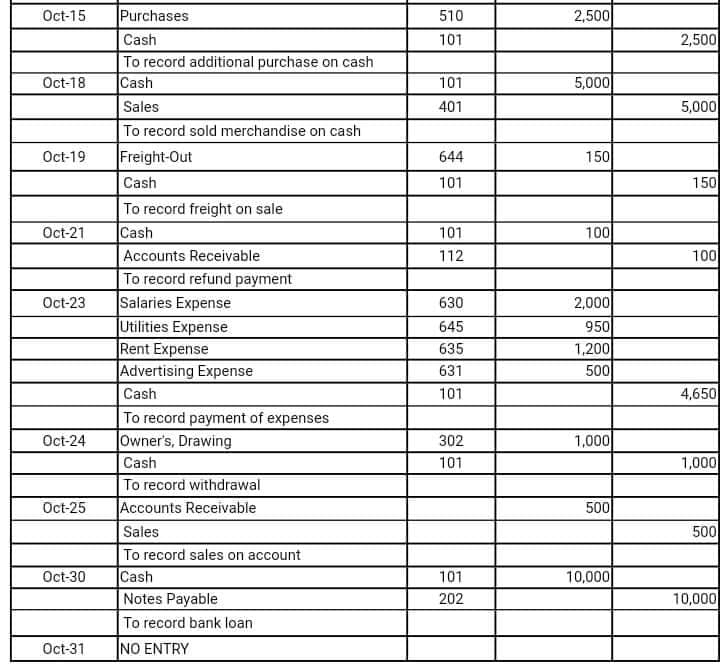

Transcribed Image Text:Oct-15

Purchases

510

2,500

Cash

101

2,500

To record additional purchase on cash

Cash

Oct-18

101

5,000

Sales

401

5,000

To record sold merchandise on cash

Freight-Out

644

150

Oct-19

Cash

101

150

To record freight on sale

Cash

Oct-21

101

100

Accounts Receivable

112

100

To record refund payment

Salaries Expense

Utilities Expense

Rent Expense

Advertising Expense

2,000

950

1,200

500

Oct-23

630

645

635

631

Cash

101

4,650

To record payment of expenses

Owner's, Drawing

Oct-24

302

1,000

Cash

101

1,000

To record withdrawal

Oct-25

Accounts Receivable

500

Sales

500

To record sales on account

Cash

Notes Payable

To record bank loan

NO ENTRY

Oct-30

101

10,000

202

10,000

Oct-31

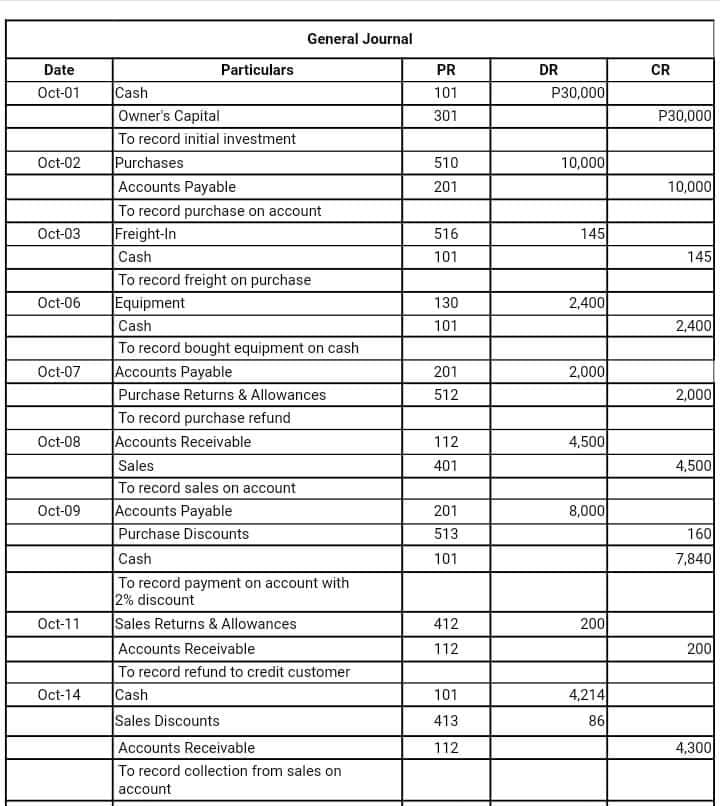

Transcribed Image Text:General Journal

Date

Particulars

PR

DR

CR

Oct-01

Cash

101

P30,000

P30,000

Owner's Capital

To record initial investment

Purchases

Accounts Payable

To record purchase on account

Freight-In

301

Oc-02

510

10,000

201

10,000

Oct-03

516

145

Cash

101

145

To record freight on purchase

Equipment

Oct-06

130

2,400

Cash

101

2,400

To record bought equipment on cash

Accounts Payable

Oc-07

201

2,000

Purchase Returns & Allowances

512

2,000

To record purchase refund

Accounts Receivable

Oct-08

112

4,500

Sales

401

4,500

To record sales on account

Accounts Payable

Purchase Discounts

Oct-09

201

8,000

513

160

Cash

101

7,840

To record payment on account with

2% discount

Sales Returns & Allowances

Accounts Receivable

To record refund to credit customer

Cash

Sales Discounts

Accounts Receivable

To record collection from sales on

account

Oct-11

412

200

112

200

Oct-14

101

4,214

413

86

112

4,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning