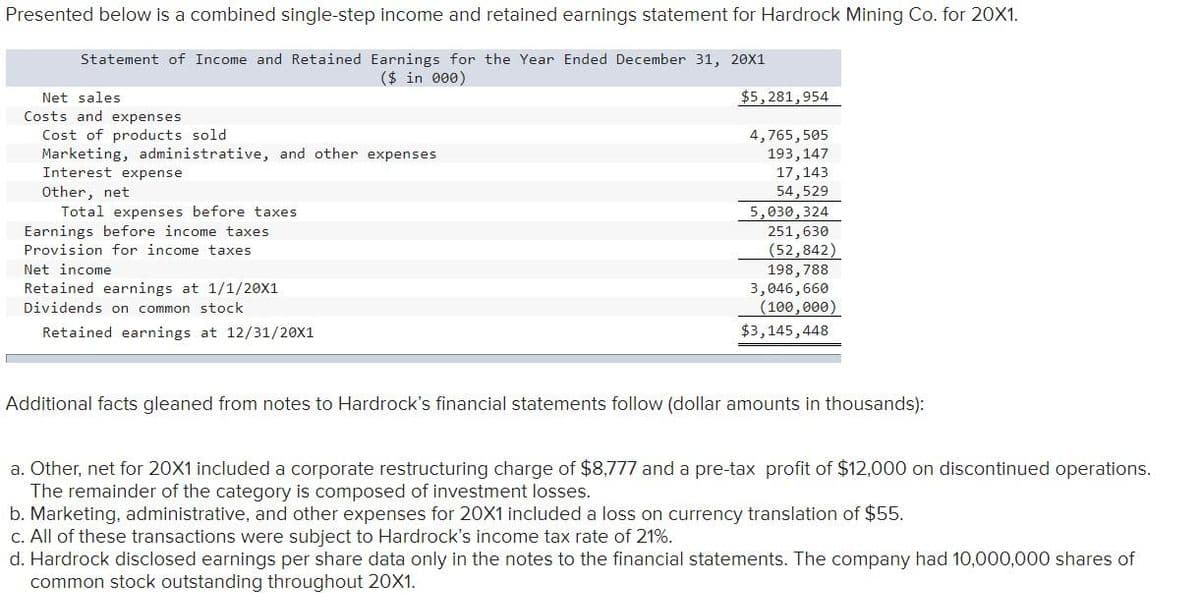

Presented below is a combined single-step income and retained earnings statement for Hardrock Mining Co. for 20X1. Statement of Income and Retained Earnings for the Year Ended December 31, 20X1 ($ in 000) Net sales $5,281,954 Costs and expenses Cost of products sold Marketing, administrative, and other expenses Interest expense 4,765,505 193,147 17,143 54,529 5,030,324 Other, net Total expenses before taxes Earnings before income taxes Provision for income taxes 251,630 (52,842) 198,788 3,046,660 (100,000) $3,145,448 Net income Retained earnings at 1/1/20X1 Dividends on common stock Retained earnings at 12/31/20X1 Additional facts gleaned from notes to Hardrock's financial statements follow (dollar amounts in thousands): a. Other, net for 20X1 included a corporate restructuring charge of $8 The remainder of the category is composed of investment losses. b. Marketing, administrative, and other expenses for 20X1 included a loss on currency translation of $55. C. All of these transactions were subject to Hardrock's income tax rate of 21%. d. Hardrock disclosed earnings per share data only in the notes to the financial statements. The company had 10,000,000 shares of common stock outstanding throughout 20X1. and a pre-tax profit of $12,000 on discontinued operations.

Presented below is a combined single-step income and retained earnings statement for Hardrock Mining Co. for 20X1. Statement of Income and Retained Earnings for the Year Ended December 31, 20X1 ($ in 000) Net sales $5,281,954 Costs and expenses Cost of products sold Marketing, administrative, and other expenses Interest expense 4,765,505 193,147 17,143 54,529 5,030,324 Other, net Total expenses before taxes Earnings before income taxes Provision for income taxes 251,630 (52,842) 198,788 3,046,660 (100,000) $3,145,448 Net income Retained earnings at 1/1/20X1 Dividends on common stock Retained earnings at 12/31/20X1 Additional facts gleaned from notes to Hardrock's financial statements follow (dollar amounts in thousands): a. Other, net for 20X1 included a corporate restructuring charge of $8 The remainder of the category is composed of investment losses. b. Marketing, administrative, and other expenses for 20X1 included a loss on currency translation of $55. C. All of these transactions were subject to Hardrock's income tax rate of 21%. d. Hardrock disclosed earnings per share data only in the notes to the financial statements. The company had 10,000,000 shares of common stock outstanding throughout 20X1. and a pre-tax profit of $12,000 on discontinued operations.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.8E: Income Statement Ratio The income statement of Holly Enterprises shows operating revenues of...

Related questions

Question

Transcribed Image Text:Presented below is a combined single-step income and retained earnings statement for Hardrock Mining Co. for 20X1.

Statement of Income and Retained Earnings for the Year Ended December 31, 20X1

($ in 000)

Net sales

$5,281,954

Costs and expenses

Cost of products sold

Marketing, administrative, and other expenses

Interest expense

4,765,505

193,147

17,143

54,529

Other, net

Total expenses before taxes

Earnings before income taxes

5,030,324

251,630

(52,842)

198,788

3,046,660

(100,000)

Provision for income taxes

Net income

Retained earnings at 1/1/20X1

Dividends on common stock

Retained earnings at 12/31/20X1

$3,145,448

Additional facts gleaned from notes to Hardrock's financial statements follow (dollar amounts in thousands):

a. Other, net for 20X1 included a corporate restructuring charge of $8,777 and a pre-tax profit of $12,000 on discontinued operations.

The remainder of the category is composed of investment losses.

b. Marketing, administrative, and other expenses for 20X1 included a loss on currency translation of $55.

C. All of these transactions were subject to Hardrock's income tax rate of 21%.

d. Hardrock disclosed earnings per share data only in the notes to the financial statements. The company had 10,000,000 shares of

common stock outstanding throughout 20X1.

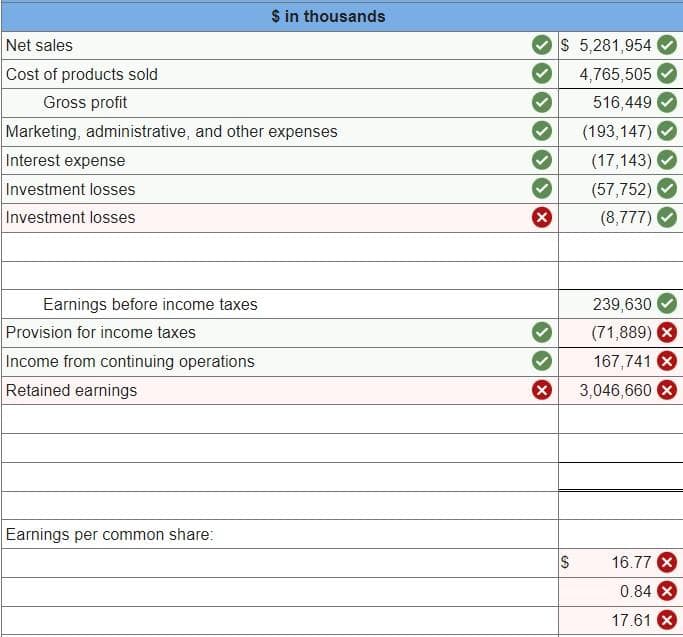

Transcribed Image Text:$ in thousands

Net sales

$ 5,281,954

Cost of products sold

4,765,505

Gross profit

516,449

Marketing, administrative, and other expenses

(193,147)

Interest expense

(17,143)

Investment losses

Investment losses

(57,752)

(8,777)

Earnings before income taxes

239,630

(71,889) X

167,741 X

Provision for income taxes

Income from continuing operations

Retained earnings

3,046,660 8

Earnings per common share:

16.77 X

0.84 X

17.61 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning