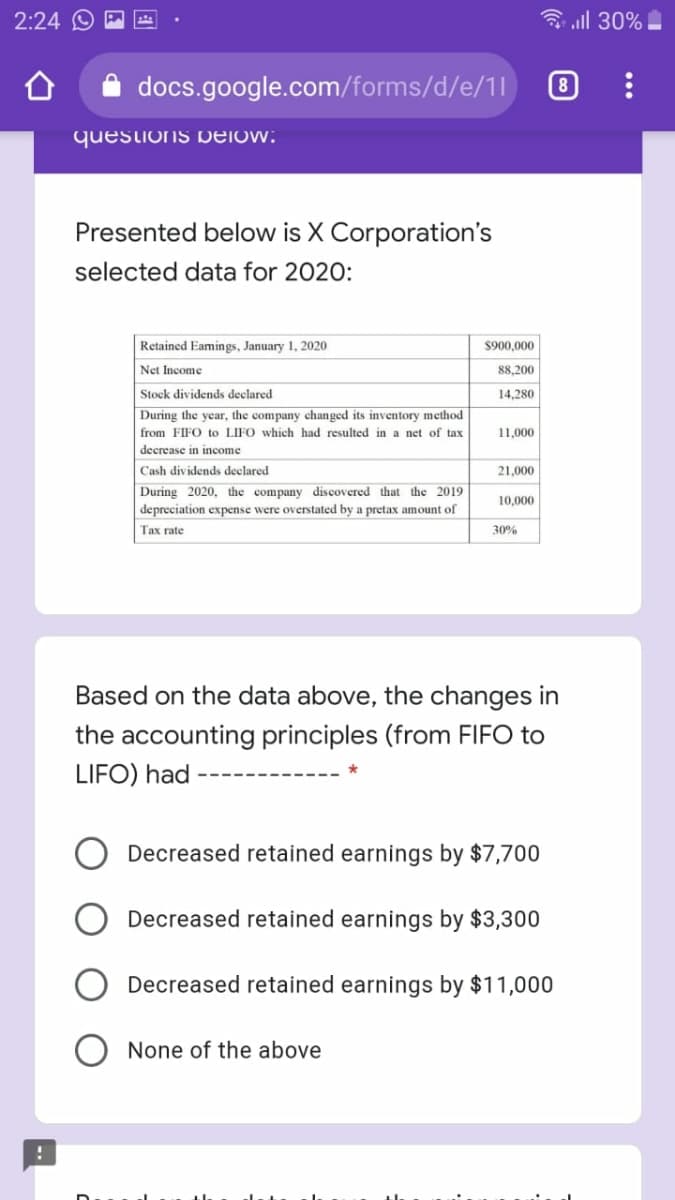

Presented below is X Corporation's selected data for 2020: Retained Eamings, January 1, 2020 $900,000 Net Income 88,200 Stock dividends deelared 14,280 During the year, the company changed its inventory method from FIFO to LIFO which had resulted in a net of tax 11,000 decrease in income Cash dividends deelared 21,000 During 2020, the company discovered that the 2019 depreciation expense were overstated by a pretax amount of 10,000 Tax rate 30% Based on the data above, the changes in the accounting principles (from FIFO to LIFO) had - Decreased retained earnings by $7,700 Decreased retained earnings by $3,300 Decreased retained earnings by $11,000 O None of the above

Presented below is X Corporation's selected data for 2020: Retained Eamings, January 1, 2020 $900,000 Net Income 88,200 Stock dividends deelared 14,280 During the year, the company changed its inventory method from FIFO to LIFO which had resulted in a net of tax 11,000 decrease in income Cash dividends deelared 21,000 During 2020, the company discovered that the 2019 depreciation expense were overstated by a pretax amount of 10,000 Tax rate 30% Based on the data above, the changes in the accounting principles (from FIFO to LIFO) had - Decreased retained earnings by $7,700 Decreased retained earnings by $3,300 Decreased retained earnings by $11,000 O None of the above

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 17E

Related questions

Question

Transcribed Image Text:2:24 O P

3 all 30% !

docs.google.com/forms/d/e/1l

8

questions Delow:

Presented below is X Corporation's

selected data for 2020:

Retained Eamings, January 1, 2020

$900,000

Net Income

88,200

Stock dividends declared

14,280

During the year, the company changed its inventory method

from FIFO to LIFO which had resulted in a net of tax

11,000

decrease in income

Cash dividends declared

21,000

During 2020, the company discovered that the 2019

depreciation expense were overstated by a pretax amount of

10,000

Тах гate

30%

Based on the data above, the changes in

the accounting principles (from FIFO to

LIFO) had

Decreased retained earnings by $7,700

Decreased retained earnings by $3,300

Decreased retained earnings by $11,000

None of the above

Transcribed Image Text:2:24 O P

all 30% !

docs.google.com/forms/d/e/1|

8

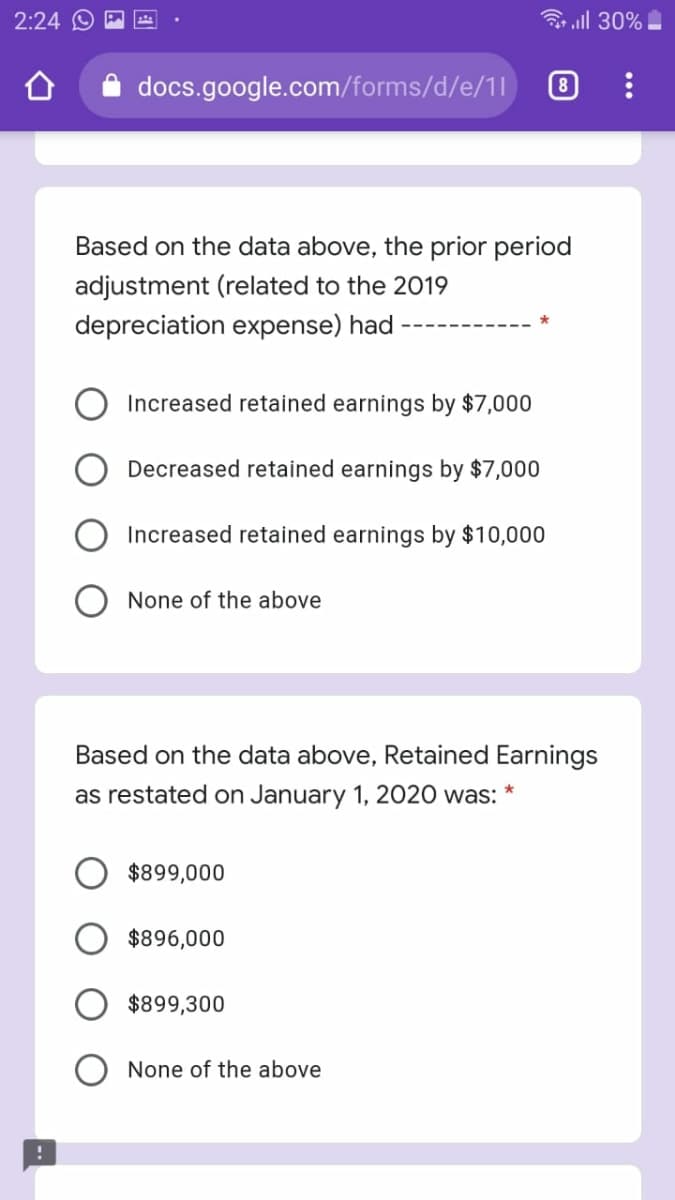

Based on the data above, the prior period

adjustment (related to the 2019

depreciation expense) had

Increased retained earnings by $7,000

Decreased retained earnings by $7,000

Increased retained earnings by $10,000

None of the above

Based on the data above, Retained Earnings

as restated on January 1, 2020 was:

$899,000

$896,000

$899,300

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning