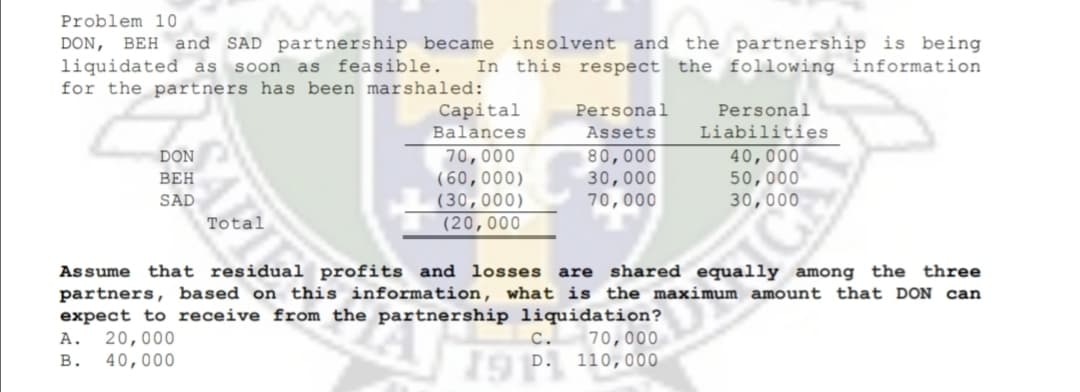

Problem 10 DON, BEH and SAD partnership became insolvent and the partnership is being In this respect the following information liquidated as soon for the partners has been marshaled: as feasible. Capital Balances Personal Personal Assets Liabilities 40,000 70,000 (60,000) (30,000) (20,000 80,000 30,000 70,000 DON ВЕН SAD 50,000 30,000 Total Assume that residual profits and losses are shared equally among the three partners, based on this information, what is the maximum amount that DON can expect to receive from the partnership liquidation? 20,000 40,000 70,000 110,000 A. c. 19 p. в.

Problem 10 DON, BEH and SAD partnership became insolvent and the partnership is being In this respect the following information liquidated as soon for the partners has been marshaled: as feasible. Capital Balances Personal Personal Assets Liabilities 40,000 70,000 (60,000) (30,000) (20,000 80,000 30,000 70,000 DON ВЕН SAD 50,000 30,000 Total Assume that residual profits and losses are shared equally among the three partners, based on this information, what is the maximum amount that DON can expect to receive from the partnership liquidation? 20,000 40,000 70,000 110,000 A. c. 19 p. в.

Chapter11: Invest Or Losses

Section: Chapter Questions

Problem 35P

Related questions

Question

Show the solution in good accounting form

Transcribed Image Text:Problem 10

DON, BEH and SAD partnership became insolvent and the partnership is being

liquidated as soon as feasible.

for the partners has been marshaled:

In this respect the following information

Capital

Personal

Personal

Balances

Assets

Liabilities

70,000

(60,000)

(30,000)

(20,000

80,000

30,000

70,000

40,000

50,000

30,000

DON

ВЕН

SAD

Total

that residual profits and losses are shared equally among the three

partners, based on this information, what is the maximum amount that DON can

expect to receive from the partnership liquidation?

20,000

40,000

Assume

c. 70,000

110,000

А.

В.

19 D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning