Problem 11-02 The cost of equipment purchased by Skysong, Inc., on June 1, 2020, is $107,100. It is estimated that the machine will have a s6,300 salvage value at the end of its service ife. Its service life is estimated at 7 years, its total working hours are estimated at 50,400, and its total production is estimated at 630,000 units. During 2020, the machine was operated 6,420 hours and produced 58,850 units. During 2021, the machine was operated 5,885 hours and produced 51,300 units. Compute deprediation expense on the machine for the year ending December 31, 2020, and the vear ending December 31, 2021, using the folowing methods. (Round depreciation per unit to 2 decimal places, e.g. 15.25 and final answers to o decimal places, e.g. 45,892.) 2020 2021 (a) Straight-ine (b) Units-of-output (c) Working hours (4) Sum of-the-years'-digits (e) Double declining-balance (twice the straight-ine rate)l Click if you would like to Show Work for this question: geen Show Work

Problem 11-02 The cost of equipment purchased by Skysong, Inc., on June 1, 2020, is $107,100. It is estimated that the machine will have a s6,300 salvage value at the end of its service ife. Its service life is estimated at 7 years, its total working hours are estimated at 50,400, and its total production is estimated at 630,000 units. During 2020, the machine was operated 6,420 hours and produced 58,850 units. During 2021, the machine was operated 5,885 hours and produced 51,300 units. Compute deprediation expense on the machine for the year ending December 31, 2020, and the vear ending December 31, 2021, using the folowing methods. (Round depreciation per unit to 2 decimal places, e.g. 15.25 and final answers to o decimal places, e.g. 45,892.) 2020 2021 (a) Straight-ine (b) Units-of-output (c) Working hours (4) Sum of-the-years'-digits (e) Double declining-balance (twice the straight-ine rate)l Click if you would like to Show Work for this question: geen Show Work

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 9.4BE: Revision of depreciation Equipment with a cost of 180,000 has an estimated residual value of 14,400,...

Related questions

Question

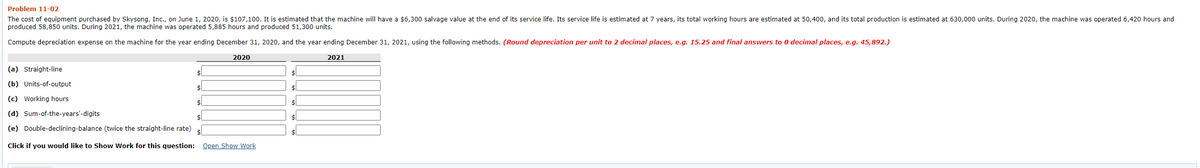

Transcribed Image Text:Problem 11-02

The cost of equipment purchased by Skysong, Inc., on June 1, 2020, is $107,100. It is estimated that the machine will have a $6,300 salvage value at the end of its service life. Its service life is estimated at 7 years, its total working hours are estimated at 50,400, and its total production is estimated at 630,000 units. During 2020, the machine was operated 6,420o hours and

produced 58,850 units. During 2021, the machine was operated 5,885 hours and produced 51,300 units.

Compute depreciation expense on the machine for the year ending December 31, 2020, and the year ending December 31, 2021, using the following methods. (Round depreciation per unit to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 45,892.)

2020

2021

(a) Straight-line

(b) Units-of-output

(c) Working hours

$1

(d) Sum-of-the-years'-digits

(e) Double-declining-balance (twice the straight-line rate)

Click if you would like to Show Work for this question: Open Show Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,