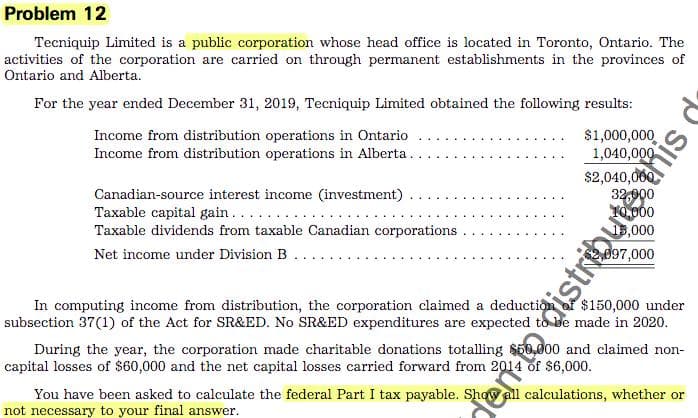

Problem 12 Tecniquip Limited is a public corporation whose head office is located in Toronto, Ontario. The activities of the corporation are carried on through permanent establishments in the provinces of Ontario and Alberta. For the year ended December 31, 2019, Tecniquip Limited obtained the following results: Income from distribution operations in Ontario Income from distribution operations in Alberta.. $1,000,000 1,040,000 Canadian-source interest income (investment) Taxable capital gain... . . . Taxable dividends from taxable Canadian corporations Net income under Division B d97,000 In computing income from distribution, the corporation claimed a deduction subsection 37(1) of the Act for SR&ED. No SR&ED expenditures are expected to be made in 2020. During the year, the corporation made charitable donations totalling $60,000 and claimed non- capital losses of $60,000 and the net capital losses carried forward from 2014 of $6,000. $150,000 under You have been asked to calculate the federal Part I tax payable. Shoy all calculations, whether or ento distributee thi SIL

Problem 12 Tecniquip Limited is a public corporation whose head office is located in Toronto, Ontario. The activities of the corporation are carried on through permanent establishments in the provinces of Ontario and Alberta. For the year ended December 31, 2019, Tecniquip Limited obtained the following results: Income from distribution operations in Ontario Income from distribution operations in Alberta.. $1,000,000 1,040,000 Canadian-source interest income (investment) Taxable capital gain... . . . Taxable dividends from taxable Canadian corporations Net income under Division B d97,000 In computing income from distribution, the corporation claimed a deduction subsection 37(1) of the Act for SR&ED. No SR&ED expenditures are expected to be made in 2020. During the year, the corporation made charitable donations totalling $60,000 and claimed non- capital losses of $60,000 and the net capital losses carried forward from 2014 of $6,000. $150,000 under You have been asked to calculate the federal Part I tax payable. Shoy all calculations, whether or ento distributee thi SIL

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 59P

Related questions

Question

100%

Transcribed Image Text:Problem 12

Tecniquip Limited is a public corporation whose head office is located in Toronto, Ontario. The

activities of the corporation are carried on through permanent establishments in the provinces of

Ontario and Alberta.

For the year ended December 31, 2019, Tecniquip Limited obtained the following results:

Income from distribution operations in Ontario

Income from distribution operations in Alberta.

$1,000,000

1,040,000

$2,040,060

Canadian-source interest income (investment)

Taxable capital gain.... ..

Taxable dividends from taxable Canadian corporations

d97,000

Net income under Division B

In computing income from distribution, the corporation claimed a deduction

subsection 37(1) of the Act for SR&ED. No SR&ED expenditures are expected to be made in 2020.

During the year, the corporation made charitable donations totalling $50,000 and claimed non-

capital losses of $60,000 and the net capital losses carried forward from 2014 of S6,000.

$150,000 under

You have been asked to calculate the federal Part I tax payable. Show

not necessary to your final answer.

calculations, whether or

this

ento distribute,t

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT