Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities LO P3 Skip to question [The following information applies to the questions displayed below.] Mead Inc. began operations in Year 1, following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 Jan. 20 Purchased Johnson & Johnson bonds for $25,000. Feb. 9 Purchased notes of Sony for $59,490. June 12 Purchased bonds of Mattel for $45,000. Dec. 31 Fair values for debt in the portfolio are Johnson & Johnson, $26,900; Sony, $49,050; and Mattel, $55,950. Year 2 Apr. 15 Sold all of the bonds of Johnson & Johnson for $28,000. July 5 Sold all of the bonds of Mattel for $39,000. July 22 Purchased notes of Sara Lee for $17,100. Aug. 19 Purchased bonds of Kodak for $18,450. Dec. 31 Fair values for debt in the portfolio are Kodak, $18,900; Sara Lee, $16,500; and Sony, $63,000. Year 3 Feb. 27 Purchased bonds of Microsoft for $161,000. June 21 Sold all of the notes of Sony for $61,200. June 30 Purchased bonds of Black & Decker for $54,900. Aug. 3 Sold all of the notes of Sara Lee for $13,800. Nov. 1 Sold all of the bonds of Kodak for $23,400. Dec. 31 Fair values for debt in the portfolio are Black & Decker, $57,300; and Microsoft, $159,500.

Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities LO P3 Skip to question [The following information applies to the questions displayed below.] Mead Inc. began operations in Year 1, following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 Jan. 20 Purchased Johnson & Johnson bonds for $25,000. Feb. 9 Purchased notes of Sony for $59,490. June 12 Purchased bonds of Mattel for $45,000. Dec. 31 Fair values for debt in the portfolio are Johnson & Johnson, $26,900; Sony, $49,050; and Mattel, $55,950. Year 2 Apr. 15 Sold all of the bonds of Johnson & Johnson for $28,000. July 5 Sold all of the bonds of Mattel for $39,000. July 22 Purchased notes of Sara Lee for $17,100. Aug. 19 Purchased bonds of Kodak for $18,450. Dec. 31 Fair values for debt in the portfolio are Kodak, $18,900; Sara Lee, $16,500; and Sony, $63,000. Year 3 Feb. 27 Purchased bonds of Microsoft for $161,000. June 21 Sold all of the notes of Sony for $61,200. June 30 Purchased bonds of Black & Decker for $54,900. Aug. 3 Sold all of the notes of Sara Lee for $13,800. Nov. 1 Sold all of the bonds of Kodak for $23,400. Dec. 31 Fair values for debt in the portfolio are Black & Decker, $57,300; and Microsoft, $159,500.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 2MC: During 2021, Anthony Company purchased debt securities as a long-term investment and classified them...

Related questions

Question

Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities LO P3

Skip to question

[The following information applies to the questions displayed below.]

Mead Inc. began operations in Year 1, following is a series of transactions and events involving its long-term debt investments in available-for-sale securities.

Year 1

| Jan. | 20 | Purchased Johnson & Johnson bonds for $25,000. | ||

| Feb. | 9 | Purchased notes of Sony for $59,490. | ||

| June | 12 | Purchased bonds of Mattel for $45,000. | ||

| Dec. | 31 | Fair values for debt in the portfolio are Johnson & Johnson, $26,900; Sony, $49,050; and Mattel, $55,950. |

Year 2

| Apr. | 15 | Sold all of the bonds of Johnson & Johnson for $28,000. | ||

| July | 5 | Sold all of the bonds of Mattel for $39,000. | ||

| July | 22 | Purchased notes of Sara Lee for $17,100. | ||

| Aug. | 19 | Purchased bonds of Kodak for $18,450. | ||

| Dec. | 31 | Fair values for debt in the portfolio are Kodak, $18,900; Sara Lee, $16,500; and Sony, $63,000. |

Year 3

| Feb. | 27 | Purchased bonds of Microsoft for $161,000. | ||

| June | 21 | Sold all of the notes of Sony for $61,200. | ||

| June | 30 | Purchased bonds of Black & Decker for $54,900. | ||

| Aug. | 3 | Sold all of the notes of Sara Lee for $13,800. | ||

| Nov. | 1 | Sold all of the bonds of Kodak for $23,400. | ||

| Dec. | 31 | Fair values for debt in the portfolio are Black & Decker, $57,300; and Microsoft, $159,500. |

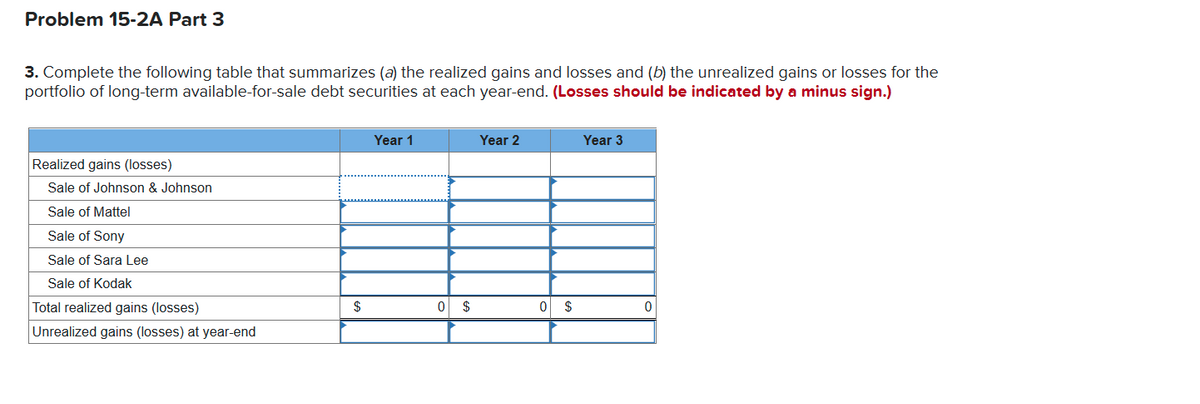

Transcribed Image Text:Problem 15-2A Part 3

3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the

portfolio of long-term available-for-sale debt securities at each year-end. (Losses should be indicated by a minus sign.)

Year 1

Year 2

Year 3

Realized gains (losses)

Sale of Johnson & Johnson

Sale of Mattel

Sale of Sony

Sale of Sara Lee

Sale of Kodak

Total realized gains (losses)

$

$

0 $

Unrealized gains (losses) at year-end

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning