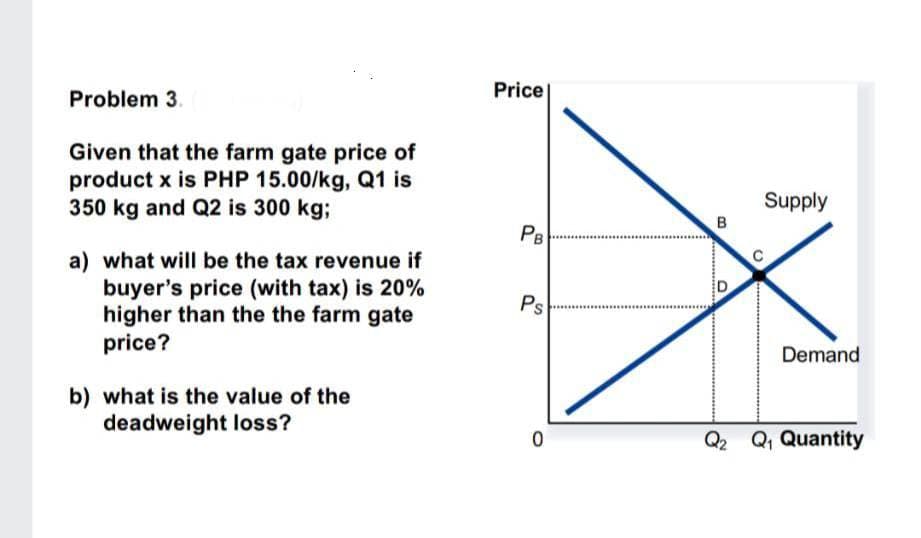

Problem 3. Given that the farm gate price of product x is PHP 15.00/kg, Q1 is 350 kg and Q2 is 300 kg; a) what will be the tax revenue if buyer's price (with tax) is 20% higher than the the farm gate price? b) what is the value of the deadweight loss? Price PB Ps 0 B D C Supply Demand Q2 Q₁ Quantity

Q: Suppose that the quantity demanded of Dell laptops in the US marker is 3000 and initial average…

A: The price elasticity is measured as the Percentage change in quantity demanded divided by the…

Q: 5. Q= 100/P² (P = 5

A: Demand refers to the quantity of a particular good or service that consumers are want to purchase…

Q: Provide me with an article abkey factors that policymakers should consider when determining the…

A: Public spending, also known as expenditure of government, it refers to the amount of money the…

Q: costs are given in the following table. At what price will they earn zero profits? Output D O $5 O…

A: Firm maximizes profit by producing at a point where marginal cost is equal to price.

Q: PRICE (Dollars per headset) 350 315 280 245 210 175 140 105 70 35 0 0 Demand Supply 40 80 120 100…

A: The overall benefit or value generated by an economic transaction or activity is termed 'total…

Q: Analyze your current organization’s primary stakeholders and provide examples of those stakeholders.…

A: Primary stakeholders are people or groups that are directly involved with an organization and can…

Q: Analyze the central bank policies of the countries below. USA (FED policy) - EU - UK - Turkey…

A: In economics, policies refer to the deliberate actions and measures undertaken by governments,…

Q: Use the New-Keynesian model with partial sticky price to briefly discuss the reasons of the current…

A: New Keynesian Economic theory is an evolving the field of macroeconomic school of thought that…

Q: Apply monetary and fiscal policy mixed instruments with the use of IS-LM graphical approach to…

A: A variety of internal and external elements may have contributed to macroeconomic unpredictability…

Q: Explain why the Ellis Island paradigm of U.S. immigration history excludes and cannot account for…

A: The Ellis Island paradigm of U.S. immigration history, which focuses on the experiences of European…

Q: Consider the simple economy that produces only three products. Use the information in the following…

A: CPI is a measure of the overall change in the price paid by the consumer on a basket or group of…

Q: Dix) is the price, in dollars per unit, that consumers are willing to pay for x units of an item,…

A: In terms of economics, the equilibrium point is the point at which the amount that consumers demand…

Q: Priest and Sons, a local manufacturer of a product that sells for $13.50 per unit. Variable cost per…

A: Break-even analysis is a financial tool used by businesses to determine the point at which their…

Q: Brazil relies on agriculture to help support their food supply and economy, how could Brazil utilize…

A: Sustainability refers to the capacity to endure and maintain a balanced and coordinated relationship…

Q: engineering design section within the engineering department of a regional n has developed several…

A:

Q: Explain the concept of externalities; include an example, as well as how the government takes action…

A: Externalities are a concept in economics that refer to the unintentional consequences of an economic…

Q: 22. Suppose a firm has a production technology given by the Cobb-Douglas production function:…

A: GivenProduction function: L represents labor, K represents capital and A represents…

Q: During a coffee-room debate among several young MBAs who had recently graduated, one of the young…

A: Cost estimation empowers businesses to uncover situations wherein expenses could potentially be cut…

Q: Explain the immigrant assimilation model and the melting pot concept that it central to it; explain…

A: Immigrant Assimilation ModelThe immigrant assimilation model is a sociological theory that describes…

Q: 1. The production technology of a firm is given by the following equation: Y = 15K SN-5 Assume K…

A: A) Y=15*K^0.5*L^0.5 Given K=25, Y=15*25^0.5*L^0.5 Y=15*5*L^0.5 Y=75*L^0.5 L=1, Y=75*1^0.5=75 L=2,…

Q: economics question 2 only lower part

A: World trade refers to the exchange of goods and services across international borders. It involves…

Q: A profit-maximising firm in a competitive market is currently producing 1,000 units of output. It…

A: A competitive industry refers to a industry in which there are many buyers and sellers dealing a…

Q: Represent the following games in a normal form and find their Nash equilibria. b) Firm A decides…

A: In game theory, a Nash equilibrium is what is going on in which every player's procedure is the…

Q: We are analyzing the effects of regime type on corruption with the following model: Corruption = 10…

A: A dummy variable is a variable that distinguishes different groups in the sample.

Q: If taxes are cut so that people have an increased incentive to work and businesses increased…

A: Tax is a financial charge or duty forced by a government on people, organizations, or different…

Q: Your aunt Janet bought a land for $125,000 cash 12 years ago. The inflation rate has avearged 4% per…

A: Inflation refers to the sustained increase in the general price level of goods and services in an…

Q: A price floor often results in: O a shortage of the product. black markets, or underground…

A: A price floor is a minimum price set by the government that is higher than the market's equilibrium…

Q: 2. What is the effect of a Federal Reserve open market sale? What happens to interest rates in the…

A: An open market sale refers to the process where a central bank sells government securities to…

Q: 1. "If it were not for the law of diminishing returns, a firm's average cost and average variable…

A: As further amounts of an input that is variable get added to a fixed input, the additional output or…

Q: Explain how beliefs and opinions can shape government economic policy decision making. Provide an…

A: Beliefs and opinions play a significant role in shaping government economic policy decision making.…

Q: Consider the following table. Which option correctly fills the blanks in the table? Perfect…

A: The residual demand curve represents the quantity of a good or service that consumers are willing to…

Q: will Australia’s terms of trade and external balance be impacted by global growth?

A: Terms of trade describe the proportion of the prices of the exports of any country as compared to…

Q: Scooter’s Scooters is a large American manufacturer of electric scooters operating out of Spokane.…

A: Scooter’s Scooters is a large American manufacturer of electric scooters operating out of Spokane.…

Q: The experience of the Global Financial Crisis made policymakers vigilant about ensuring the…

A: Deregulation of markets might not be the best idea in the crisis as global currency is also…

Q: Suppose an economy is given by: Population = 203 million Working-age population = 124 million Labor…

A: The labor force participation rate is calculated as the labor force divided by the total working-age…

Q: 3. Consider a model where a consumer, Mehdi, is deciding how to allocate their 24 hours each day…

A: Wage is cost of leisure. So change in wage , change cost of leisure and thus consumption of leisure…

Q: Economic growth in Canada is important because it determines the standard of living of all Canadian…

A: To determine how long it will take for Canada's real domestic output to double, we can use the rule…

Q: Consider the standard trade model with two goods and two factors, labour and capital (d) Explain…

A: " Export-biased growth refers to economic growth that happens when a country's production of exports…

Q: 4. Q = 100.5P+ .002Y (P = 10, Y = 5000)

A: Income elasticity of demand measures the responsiveness of the quantity demanded of a product to…

Q: Consider the recent monetary policies operated by the Bank of England, and comment on their impact…

A: The basic goals of monetary policy are to support sustainable economic development and preserve…

Q: Consider the following two mutually exclusive alternatives. A Cost Uniform annual benefit Useful…

A: Future worth is a financial concept that refers to the value of an investment or cash flow at a…

Q: Maintenance money for an athletic complex has been sought. Mr. Kendall, the Athletic Director, would…

A: Maintenance cost refers to the expenses incurred to preserve and sustain the functionality and value…

Q: task 1: A new colleague working with you on the unemployment statistics for this Policy Brief and is…

A: Dear student, you have asked multiple questions in a single post. In such a case, as per Bartleby's…

Q: 1000 A 500 0 500 1000 Rice (Intons) 1000 750 T-shirts and 750 tons of rice. 500 T-shirts and 1000…

A: Production Possibility Frontier (PPF) is the curve which shows different production combination of…

Q: Which of the following statements is true over the term of a fixed rate mortgage? Although monthly…

A: A mortgage is a formal arrangement wherein a bank, building society, or other lending institution…

Q: Regarding the Law on the Protection of Turkish Currency, adopted by the Turkish Grand National…

A: Commerce and Industry, investments, price inflation, monetary regulation, stability in the economy,…

Q: Graphically illustrate using the Supply and demand graph and explain the impact of the severe…

A: Demand refers to quantity of a goods or service that a consumer is willing and able to buy at a…

Q: 4.3 Starting from long-run equilibrium, use the basic aggregate demand and aggregate supply diagram…

A: Since you have posted multiple questions, we will provide the solution to only the first question as…

Q: Economics A consumer’s demands x, y for two different goods are chosen to maximize the utility…

A: In this case, we are discussing the topic about the Lagrange multiplier, utility maximization and…

Q: Chile and Argentina each produce jellybeans and peanut butter, using labor as their only resource.…

A: Opportunity cost is the cost of producing one good in terms of other. Opportunity cost shows the…

Step by step

Solved in 3 steps

- Consider an ad-valorem tax on a good X. The Demand for good X is constant elasticity with elasticity -2. The Supply for good Y is constant elasticity with elasticity 3. Consider the same setting as for the previous question. When a tax of 1% of the price is imposed on good X, then equilibrium quantity of X exchanged declines by what percentage?iven the following demand and supply functions Qd = 220−5P Qs = −20+3P if a per unit tax of 8 is imposed on the commodity, i. 1860 2575 i.determine the equilibrium price and quantity before the imposition of the tax. ii. Determine the equilibrium price and quantity after the imposition of the tax. iii. compare the results in (i) and (ii). error_outlineHomework solutions you need when you need them. Subscribe now.arrow_forward Question Asked Sep 2, 2020 1 views Given the following demand and supply functions Qd = 220−5P Qs = −20+3P if a per unit tax of 8 is imposed on the commodity, i. 1860 2575 i.determine the equilibrium price and quantity before the imposition of the tax. ii. Determine the equilibrium price and quantity after the imposition of the tax. iii. compare the results in (i) and (ii). iv. graph the results in (i) and (ii). Please I need solution for only iv Thank youWhich of the following statements is correct? O a.Total surplus before the tax ia imposed is $180. O b. After the tax is imposed, consumer surplus is 25 porcent of its pre-tax value O c. After the tax is imposed, producer surplut is 36 percent of its pro-tax value. 0 d. All of the above are coroct

- GIVEN FOR 1-4; The demand curve for prepaid internet services is given by Pd = 80 – 0.2Q andthe supply curve is given by Ps = 20 + 0.2Q, -------> answer by using TRUE or FALSE. If the statement is correct, write TRUE on your answer sheet. If the statement is incorrect, write FALSE. Explain why you answered TRUE or FALSE. Questions 1-4; 1. The consumer surplus (CS) is estimated at 2250. 2. An imposition of a tax of PHP10 per unit on prepaid internet services will result in aproducer surplus (PS) equivalent to 1262.5. 3. An imposition of a tax of PHP 10 per unit will reduce the CS by 687.5 and PS by 687.5.Thus, the net loss to society with the imposition of a tax is 1375. 4. The tax collected by the government with the imposition of this tax is equivalent to 1500.This tax revenue is a net loss to society.The supply and demand curves for bananas are as follows: QD = 3,750 - 725P QS = 920 + 690P where Q = millions of bushels and P = price per bushel. a) Calculate the equilibrium price and quantity that would prevail in the free market. b) The government has imposed a $2.80 per bushel support price. How much bananas will the government be forced to purchase? c) Calculate the change (gain/loss) in consumer surplus that would occur due to the support program. Does the consumer surplus increase or decrease under the program?6c Suppose that the government imposes a constant per-unit tax of 2 centon producers. In the diagram, show the effect of this tax on the prices ofplastic bags faced by buyers and sellers.

- a. The market demand and supply functions for VCR movie rentals are:QD=10-0.04P and QS=3.8P+4.Suppose that VCR movie rentals are taxed at $0.25 per unit. Calculate:i. the equilibrium quantity and price, point elasticity of demand in equilibrium andproducer surplus without tax.ii. the revenues generated by the tax, the loss in producer surplus and percentageof the burden of the tax falls on producers?b. Determine the "rule-of-thumb" price when the monopolist has a marginal cost of $25and the price elasticity of demand of -3.0.The demand and supply functions for a type of good are shown by the equation: Qd = 1500-10P and Qs = 20P-1200.Each item sold is subject to a tax of IDR 15.00 per unit.Define: a. Price and balance before tax.b. Price and balance after tax.c. Draw the two balances on a cross axis.d. Producer 's tax burden .e. Government revenue from taxes on the sale of the goods.7. Assuming a $6 per unit tax is imposed, what will be the quantity traded? (a) 4 (b) 8 (c) 12 (d) 14 (e) 18 8. Assuming a $6 per unit tax is imposed, how much revenue will the government collect? (a) $20 (b) $32 (c) $40 (d) $48 (e) $60 9. Assuming the government subsidizes this good to the tune of $6 per unit, what will be the total cost of the subsidy? (a) $112 (b) $96 (c) $56 (d) $42 (e) $14

- Market supply of Mandrake root is given by Q=4P. The government ofimposes a per unit tax of $5 and producers pay the tax. What is thehighest market price of Mandrake at which producers will sell at least 34units?Qd = 1,600 - 125P Qs = 440 + 165P Quantities are measured in millions of bushels; prices are measured in dollars per bushel. a. Calculate the equilibrium price and quantity that will prevail under a completely free market. b. Calculate the price elasticities of supply and demand at the equilibrium values. c. The government currently has a $4.50 bushel support price in place. What impact will this support price have on the market? Will the government be forced to purchase corn under a program that requires them to buy up any surpluses? If so, how much? 1四 "cause" causesA firm’s own MAC function = -29Q + 298. Suppose the emission tax is $95/ton/month. a. Draw the firms’ MAC curve and find the efficient level of emissions for the firm. b. Then what would be the total tax bill and total abatement cost at the efficient level of emissions? As a result, what would be the total cost for the firm? c.Explain why the firm would not reduce its emissions to 1 ton/month. Please explain each carefully.