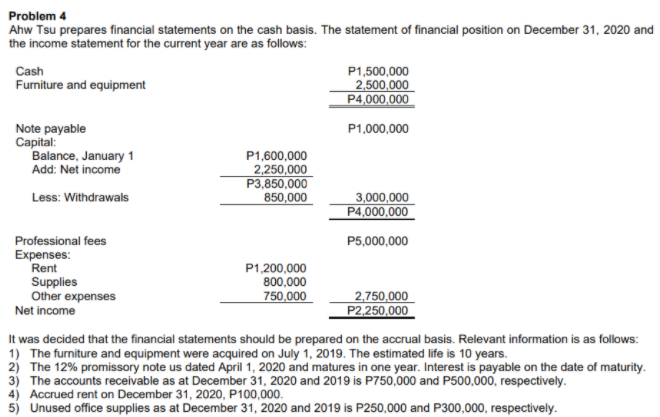

Problem 4 Ahw Tsu prepares financial statements on the cash basis. The statement of financial position on December 31, 2020 and the income statement for the current year are as follows: Cash Furniture and equipment P1,500,000 2,500,000 P4,000,000 Note payable Capital: Balance, January 1 Add: Net income P1,000,000 P1,600,000 2,250,000 P3,850,000 850,000 Less: Withdrawals 3,000,000 P4,000,000 Professional fees Expenses: Rent Supplies Other expenses Net income P5,000,000 P1,200,000 800,000 750,000 2,750,000 P2,250,000 It was decided that the financial statements should be prepared on the accrual basis. Relevant information is as follows: 1) The furniture and equipment were acquired on July 1, 2019. The estimated life is 10 years. 2) The 12% promissory note us dated April 1, 2020 and matures in one year. Interest is payable on the date of maturity. 3) The accounts receivable as at December 31, 2020 and 2019 is P750,000 and P500,000, respectively. 4) Accrued rent on December 31, 2020, P100,000. 5) Unused office supplies as at December 31, 2020 and 2019 is P250,000 and P300,000, respectively.

Problem 4 Ahw Tsu prepares financial statements on the cash basis. The statement of financial position on December 31, 2020 and the income statement for the current year are as follows: Cash Furniture and equipment P1,500,000 2,500,000 P4,000,000 Note payable Capital: Balance, January 1 Add: Net income P1,000,000 P1,600,000 2,250,000 P3,850,000 850,000 Less: Withdrawals 3,000,000 P4,000,000 Professional fees Expenses: Rent Supplies Other expenses Net income P5,000,000 P1,200,000 800,000 750,000 2,750,000 P2,250,000 It was decided that the financial statements should be prepared on the accrual basis. Relevant information is as follows: 1) The furniture and equipment were acquired on July 1, 2019. The estimated life is 10 years. 2) The 12% promissory note us dated April 1, 2020 and matures in one year. Interest is payable on the date of maturity. 3) The accounts receivable as at December 31, 2020 and 2019 is P750,000 and P500,000, respectively. 4) Accrued rent on December 31, 2020, P100,000. 5) Unused office supplies as at December 31, 2020 and 2019 is P250,000 and P300,000, respectively.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter7: Introduction To Financial Statement Analysis

Section: Chapter Questions

Problem 31P

Related questions

Question

REQUIREMENT:

Transcribed Image Text:Problem 4

Ahw Tsu prepares financial statements on the cash basis. The statement of financial position on December 31, 2020 and

the income statement for the current year are as follows:

Cash

Furniture and eguipment

P1,500,000

2,500,000

P4,000,000

P1,000,000

Note payable

Capital:

Balance, January 1

Add: Net income

P1,600,000

2,250,000

P3,850,000

850,000

Less: Withdrawals

3,000,000

P4,000,000

Professional fees

Expenses:

Rent

Supplies

Other expenses

P5,000,000

P1,200,000

800,000

750,000

2,750,000

P2,250,000

Net income

It was decided that the financial statements should be prepared on the accrual basis. Relevant information is as follows:

1) The furniture and equipment were acquired on July 1, 2019. The estimated life is 10 years.

2) The 12% promissory note us dated April 1, 2020 and matures in one year. Interest is payable on the date of maturity.

3) The accounts receivable as at December 31, 2020 and 2019 is P750,000 and P500,000, respectively.

Accrued rent on December 31, 2020, P100,000.

5) Unused office supplies as at December 31, 2020 and 2019 is P250,000 and P300,000, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning