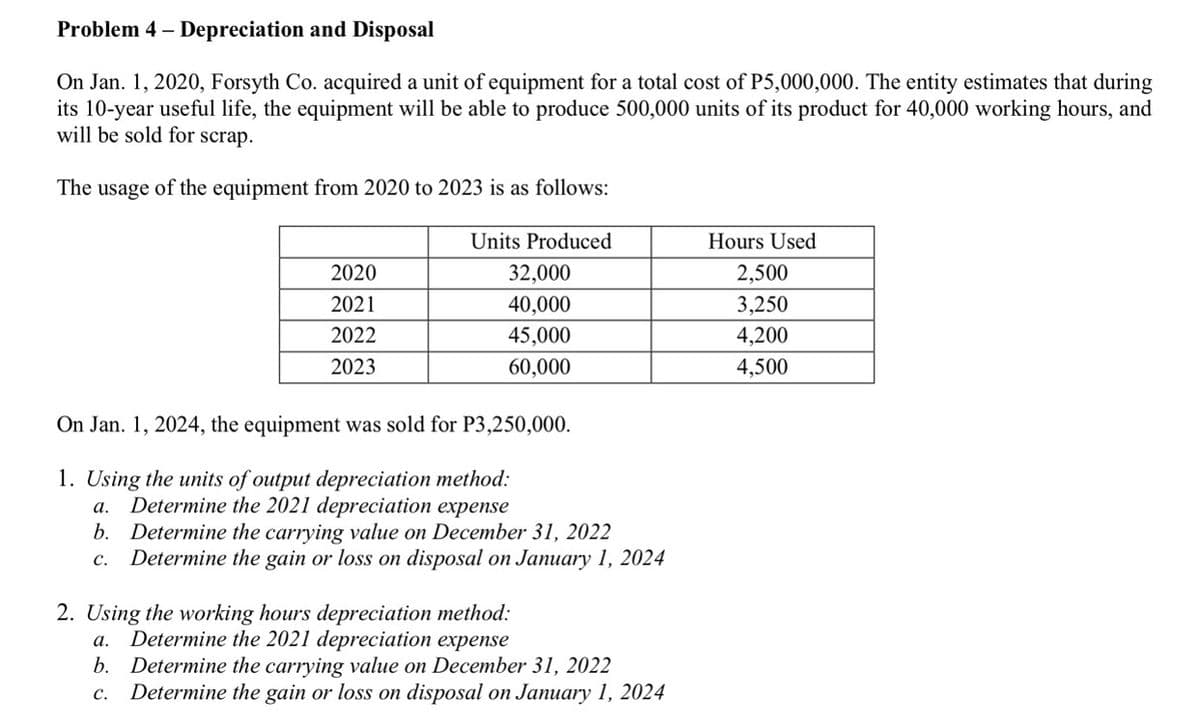

Problem 4 - Depreciation and Disposal On Jan. 1, 2020, Forsyth Co. acquired a unit of equipment for a total cost of P5,000,000. The entity estimates that during its 10-year useful life, the equipment will be able to produce 500,000 units of its product for 40,000 working hours, and will be sold for scrap. The usage of the equipment from 2020 to 2023 is as follows: Units Produced Hours Used 2020 32,000 2,500 2021 40,000 3,250 2022 45,000 4,200 2023 60,000 4,500 On Jan. 1, 2024, the equipment was sold for P3,250,000. 1. Using the units of output depreciation method: Determine the 2021 depreciation expense b. Determine the carrying value on December 31, 2022 Determine the gain or loss on disposal on January 1, 2024 а. с. 2. Using the working hours depreciation method: Determine the 2021 depreciation expense b. Determine the carrying value on December 31, 2022 Determine the gain or loss on disposal on January 1, 2024 a. с.

Problem 4 - Depreciation and Disposal On Jan. 1, 2020, Forsyth Co. acquired a unit of equipment for a total cost of P5,000,000. The entity estimates that during its 10-year useful life, the equipment will be able to produce 500,000 units of its product for 40,000 working hours, and will be sold for scrap. The usage of the equipment from 2020 to 2023 is as follows: Units Produced Hours Used 2020 32,000 2,500 2021 40,000 3,250 2022 45,000 4,200 2023 60,000 4,500 On Jan. 1, 2024, the equipment was sold for P3,250,000. 1. Using the units of output depreciation method: Determine the 2021 depreciation expense b. Determine the carrying value on December 31, 2022 Determine the gain or loss on disposal on January 1, 2024 а. с. 2. Using the working hours depreciation method: Determine the 2021 depreciation expense b. Determine the carrying value on December 31, 2022 Determine the gain or loss on disposal on January 1, 2024 a. с.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 71BPSB: Depreciation Schedules Dunn Corporation acquired a new depreciable asset for $135,000. The asset has...

Related questions

Question

Transcribed Image Text:Problem 4 – Depreciation and Disposal

On Jan. 1, 2020, Forsyth Co. acquired a unit of equipment for a total cost of P5,000,000. The entity estimates that during

its 10-year useful life, the equipment will be able to produce 500,000 units of its product for 40,000 working hours, and

will be sold for

scrap.

The usage of the equipment from 2020 to 2023 is as follows:

Units Produced

Hours Used

2020

32,000

2,500

2021

40,000

3,250

2022

45,000

4,200

2023

60,000

4,500

On Jan. 1, 2024, the equipment was sold for P3,250,000.

1. Using the units of output depreciation method:

Determine the 2021 depreciation expense

Determine the carrying value on December 31, 2022

Determine the gain or loss on disposal on January 1, 2024

а.

b.

с.

2. Using the working hours depreciation method:

Determine the 2021 depreciation expense

b. Determine the carrying value on December 31, 2022

Determine the gain or loss on disposal on January 1, 2024

а.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning