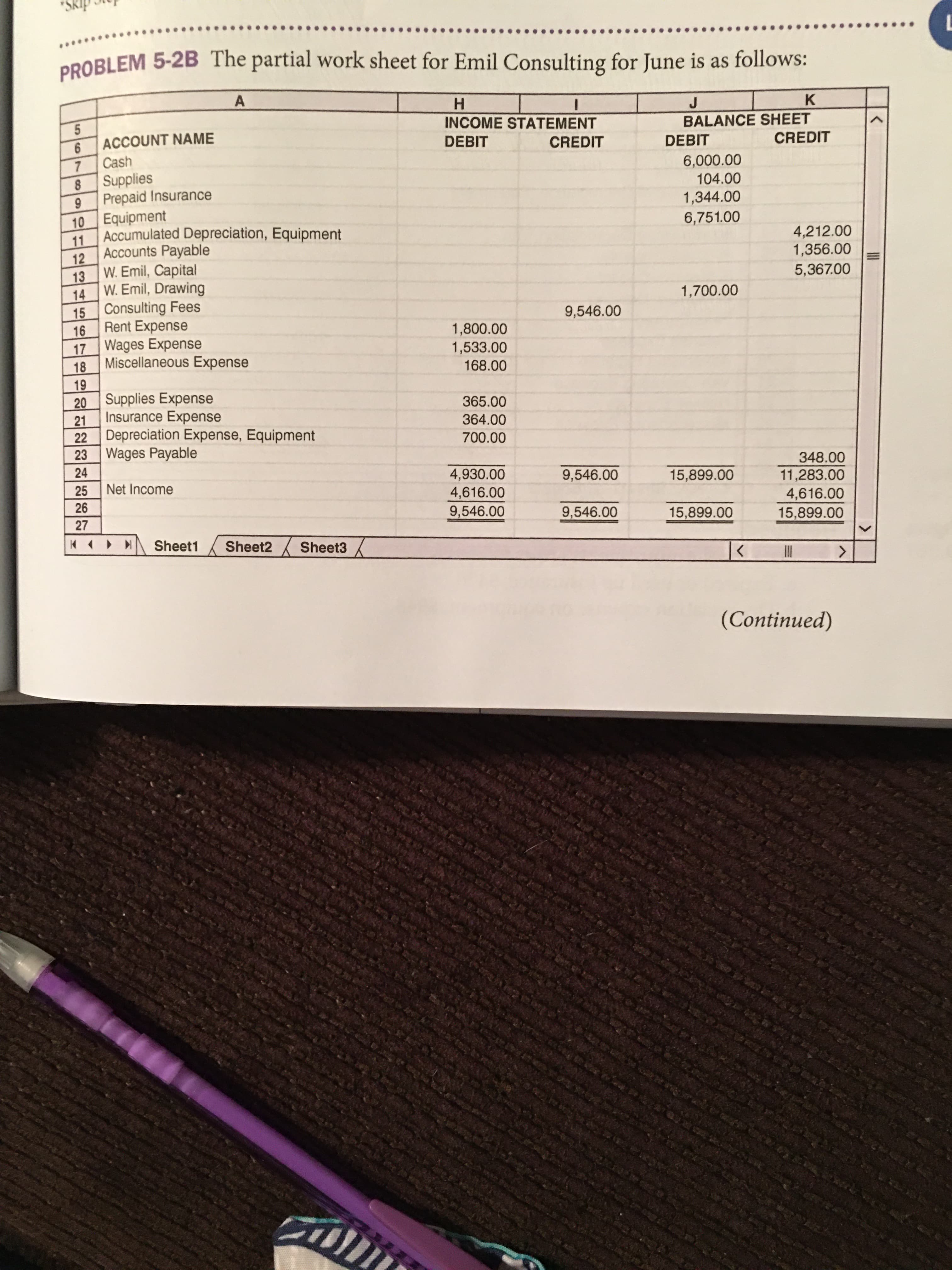

PROBLEM 5-2B The partial work sheet for Emil Consulting for June is as follows: H. INCOME STATEMENT BALANCE SHEET ACCOUNT NAME DEBIT CREDIT DEBIT CREDIT Cash 6,000.00 Supplies Prepaid Insurance 104.00 1,344.00 10 Equipment Accumulated Depreciation, Equipment 6,751.00 11 Accounts Payable 4,212.00 1,356.00 12 W. Emil, Capital 13 W. Emil, Drawing 15 Consulting Fees Rent Expense 5,367.00 14 1,700.00 9,546.00 16 17 Wages Expense Miscellaneous Expense 1,800.00 1,533.00 18 168.00 19 20 Supplies Expense Insurance Expense 365.00 21 Depreciation Expense, Equipment 23 Wages Payable 364.00 22 700.00 24 348.00 4,930.00 9,546.00 15,899.00 11,283.00 4,616.00 25 Net Income 4,616.00 26 9,546.00 9,546.00 15,899.00 15,899.00 27 Sheet1 Sheet2 Sheet3 <> (Continued) 567 09 The Accounting Cycle for a Service Business: Analyzing Business Transactions igure mary, entry, ,930 Required If you are using Working Papers, complete the following: 1. a. Write the owner's name on the Capital and Drawing T accounts. b. Record the account balances in the T accounts for owner's equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1l through 4. 3. Post the closing entries to the T accounts immediately after you journalize each de to see the effect of the closing entries. Number closing entries 1 through 4. *Skip Step 1 if using CengageNow or CLGL. ,3 of December

PROBLEM 5-2B The partial work sheet for Emil Consulting for June is as follows: H. INCOME STATEMENT BALANCE SHEET ACCOUNT NAME DEBIT CREDIT DEBIT CREDIT Cash 6,000.00 Supplies Prepaid Insurance 104.00 1,344.00 10 Equipment Accumulated Depreciation, Equipment 6,751.00 11 Accounts Payable 4,212.00 1,356.00 12 W. Emil, Capital 13 W. Emil, Drawing 15 Consulting Fees Rent Expense 5,367.00 14 1,700.00 9,546.00 16 17 Wages Expense Miscellaneous Expense 1,800.00 1,533.00 18 168.00 19 20 Supplies Expense Insurance Expense 365.00 21 Depreciation Expense, Equipment 23 Wages Payable 364.00 22 700.00 24 348.00 4,930.00 9,546.00 15,899.00 11,283.00 4,616.00 25 Net Income 4,616.00 26 9,546.00 9,546.00 15,899.00 15,899.00 27 Sheet1 Sheet2 Sheet3 <> (Continued) 567 09 The Accounting Cycle for a Service Business: Analyzing Business Transactions igure mary, entry, ,930 Required If you are using Working Papers, complete the following: 1. a. Write the owner's name on the Capital and Drawing T accounts. b. Record the account balances in the T accounts for owner's equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1l through 4. 3. Post the closing entries to the T accounts immediately after you journalize each de to see the effect of the closing entries. Number closing entries 1 through 4. *Skip Step 1 if using CengageNow or CLGL. ,3 of December

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 58APSA

Related questions

Question

100%

Transcribed Image Text:PROBLEM 5-2B The partial work sheet for Emil Consulting for June is as follows:

H.

INCOME STATEMENT

BALANCE SHEET

ACCOUNT NAME

DEBIT

CREDIT

DEBIT

CREDIT

Cash

6,000.00

Supplies

Prepaid Insurance

104.00

1,344.00

10 Equipment

Accumulated Depreciation, Equipment

6,751.00

11

Accounts Payable

4,212.00

1,356.00

12

W. Emil, Capital

13

W. Emil, Drawing

15 Consulting Fees

Rent Expense

5,367.00

14

1,700.00

9,546.00

16

17 Wages Expense

Miscellaneous Expense

1,800.00

1,533.00

18

168.00

19

20 Supplies Expense

Insurance Expense

365.00

21

Depreciation Expense, Equipment

23 Wages Payable

364.00

22

700.00

24

348.00

4,930.00

9,546.00

15,899.00

11,283.00

4,616.00

25

Net Income

4,616.00

26

9,546.00

9,546.00

15,899.00

15,899.00

27

Sheet1

Sheet2

Sheet3

<>

(Continued)

567 09

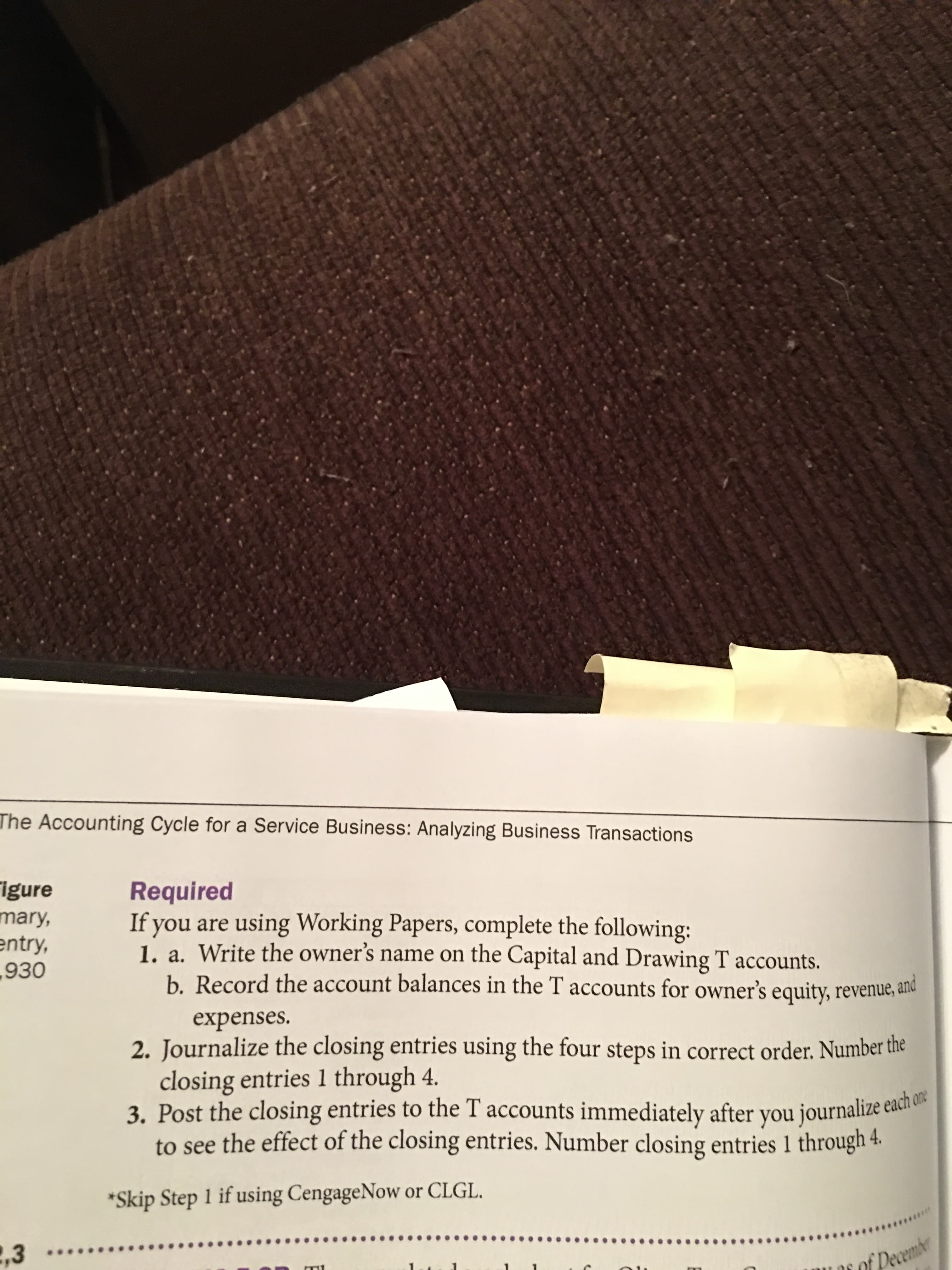

Transcribed Image Text:The Accounting Cycle for a Service Business: Analyzing Business Transactions

igure

mary,

entry,

,930

Required

If you are using Working Papers, complete the following:

1. a. Write the owner's name on the Capital and Drawing T accounts.

b. Record the account balances in the T accounts for owner's equity, revenue, and

expenses.

2. Journalize the closing entries using the four steps in correct order. Number the

closing entries 1l through 4.

3. Post the closing entries to the T accounts immediately after you journalize each de

to see the effect of the closing entries. Number closing entries 1 through 4.

*Skip Step 1 if using CengageNow or CLGL.

,3

of December

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 10 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning