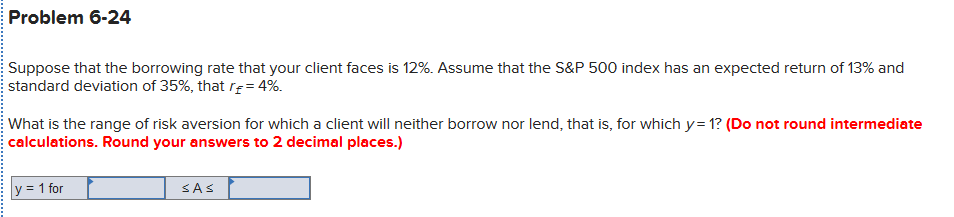

Problem 6-24 Suppose that the borrowing rate that your client faces is 12%. Assume that the S&P 500 index has an expected return of 13% and tandard deviation of 35%, that rg = 4%. Vhat is the range of risk aversion for which a client will neither borrow nor lend, that is, for which y= 1? (Do not round intermediate calculations. Round your answers to 2 decimal places.) y = 1 for SAS

Problem 6-24 Suppose that the borrowing rate that your client faces is 12%. Assume that the S&P 500 index has an expected return of 13% and tandard deviation of 35%, that rg = 4%. Vhat is the range of risk aversion for which a client will neither borrow nor lend, that is, for which y= 1? (Do not round intermediate calculations. Round your answers to 2 decimal places.) y = 1 for SAS

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter6: Interest Rates

Section: Chapter Questions

Problem 20SP: INTEREST RATE DETERMINATION AND YIELD CURVES a. What effect would each of the following events...

Related questions

Question

Transcribed Image Text:Problem 6-24

Suppose that the borrowing rate that your client faces is 12%. Assume that the S&P 500 index has an expected return of 13% and

standard deviation of 35%, that rĘ= 4%.

What is the range of risk aversion for which a client will neither borrow nor lend, that is, for which y= 1? (Do not round intermediate

calculations. Round your answers to 2 decimal places.)

y = 1 for

SAS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning