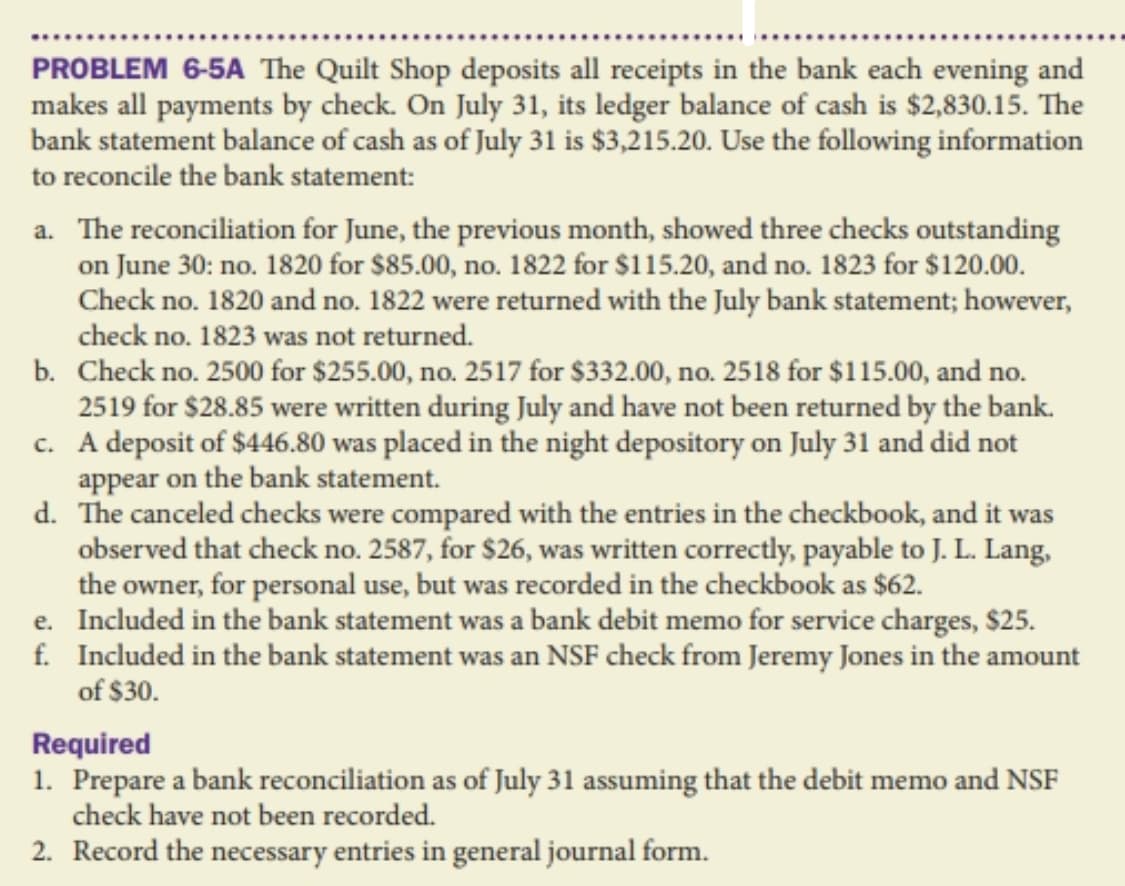

PROBLEM 6-5A The Quilt Shop deposits all receipts in the bank each evening and makes all payments by check. On July 31, its ledger balance of cash is $2,830.15. The bank statement balance of cash as of July 31 is $3,215.20. Use the following information to reconcile the bank statement: a. The reconciliation for June, the previous month, showed three checks outstanding on June 30: no. 1820 for $85.00, no. 1822 for $115.20, and no. 1823 for $120.00. Check no. 1820 and no. 1822 were returned with the July bank statement; however, check no. 1823 was not returned. b. Check no. 2500 for $255.00, no. 2517 for $332.00, no. 2518 for $115.00, and no. 2519 for $28.85 were written during July and have not been returned by the bank. c. A deposit of $446.80 was placed in the night depository on July 31 and did not appear on the bank statement. d. The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 2587, for $26, was written correctly, payable to J. L. Lang, the owner, for personal use, but was recorded in the checkbook as $62. e. Included in the bank statement was a bank debit memo for service charges, $25. f. Included in the bank statement was an NSF check from Jeremy Jones in the amount of $30. Required 1. Prepare a bank reconciliation as of July 31 assuming that the debit memo and NSF check have not been recorded. 2. Record the necessary entries in general journal form.

PROBLEM 6-5A The Quilt Shop deposits all receipts in the bank each evening and makes all payments by check. On July 31, its ledger balance of cash is $2,830.15. The bank statement balance of cash as of July 31 is $3,215.20. Use the following information to reconcile the bank statement: a. The reconciliation for June, the previous month, showed three checks outstanding on June 30: no. 1820 for $85.00, no. 1822 for $115.20, and no. 1823 for $120.00. Check no. 1820 and no. 1822 were returned with the July bank statement; however, check no. 1823 was not returned. b. Check no. 2500 for $255.00, no. 2517 for $332.00, no. 2518 for $115.00, and no. 2519 for $28.85 were written during July and have not been returned by the bank. c. A deposit of $446.80 was placed in the night depository on July 31 and did not appear on the bank statement. d. The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 2587, for $26, was written correctly, payable to J. L. Lang, the owner, for personal use, but was recorded in the checkbook as $62. e. Included in the bank statement was a bank debit memo for service charges, $25. f. Included in the bank statement was an NSF check from Jeremy Jones in the amount of $30. Required 1. Prepare a bank reconciliation as of July 31 assuming that the debit memo and NSF check have not been recorded. 2. Record the necessary entries in general journal form.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 44E

Related questions

Question

Transcribed Image Text:PROBLEM 6-5A The Quilt Shop deposits all receipts in the bank each evening and

makes all payments by check. On July 31, its ledger balance of cash is $2,830.15. The

bank statement balance of cash as of July 31 is $3,215.20. Use the following information

to reconcile the bank statement:

a. The reconciliation for June, the previous month, showed three checks outstanding

on June 30: no. 1820 for $85.00, no. 1822 for $115.20, and no. 1823 for $120.00.

Check no. 1820 and no. 1822 were returned with the July bank statement; however,

check no. 1823 was not returned.

b. Check no. 2500 for $255.00, no. 2517 for $332.00, no. 2518 for $115.00, and no.

2519 for $28.85 were written during July and have not been returned by the bank.

c. A deposit of $446.80 was placed in the night depository on July 31 and did not

appear on the bank statement.

d. The canceled checks were compared with the entries in the checkbook, and it was

observed that check no. 2587, for $26, was written correctly, payable to J. L. Lang,

the owner, for personal use, but was recorded in the checkbook as $62.

e. Included in the bank statement was a bank debit memo for service charges, $25.

f. Included in the bank statement was an NSF check from Jeremy Jones in the amount

of $30.

Required

1. Prepare a bank reconciliation as of July 31 assuming that the debit memo and NSF

check have not been recorded.

2. Record the necessary entries in general journal form.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning