progress%3Dfalse -&inprogress=false ABP ECalculator A building with a book value of $41,219 is sold for $57,394 cash. Using the indirect method, choose how this transaction should be shown on the statement of cash flows. Select the correct answer. an increase of $41,219 from investing activities and an addition to net income of $16,175 an increase of $41,219 from investing activities an increase of $57,394 from investing activities an increase of $57,394 from investing activities and a deduction from net income of $16,175 4:05 PM 12/20/2019

progress%3Dfalse -&inprogress=false ABP ECalculator A building with a book value of $41,219 is sold for $57,394 cash. Using the indirect method, choose how this transaction should be shown on the statement of cash flows. Select the correct answer. an increase of $41,219 from investing activities and an addition to net income of $16,175 an increase of $41,219 from investing activities an increase of $57,394 from investing activities an increase of $57,394 from investing activities and a deduction from net income of $16,175 4:05 PM 12/20/2019

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 35E: Classification of Cash Flows The following are several items that might be disclosed on a companys...

Related questions

Question

100%

Transcribed Image Text:progress%3Dfalse

-&inprogress=false

ABP

ECalculator

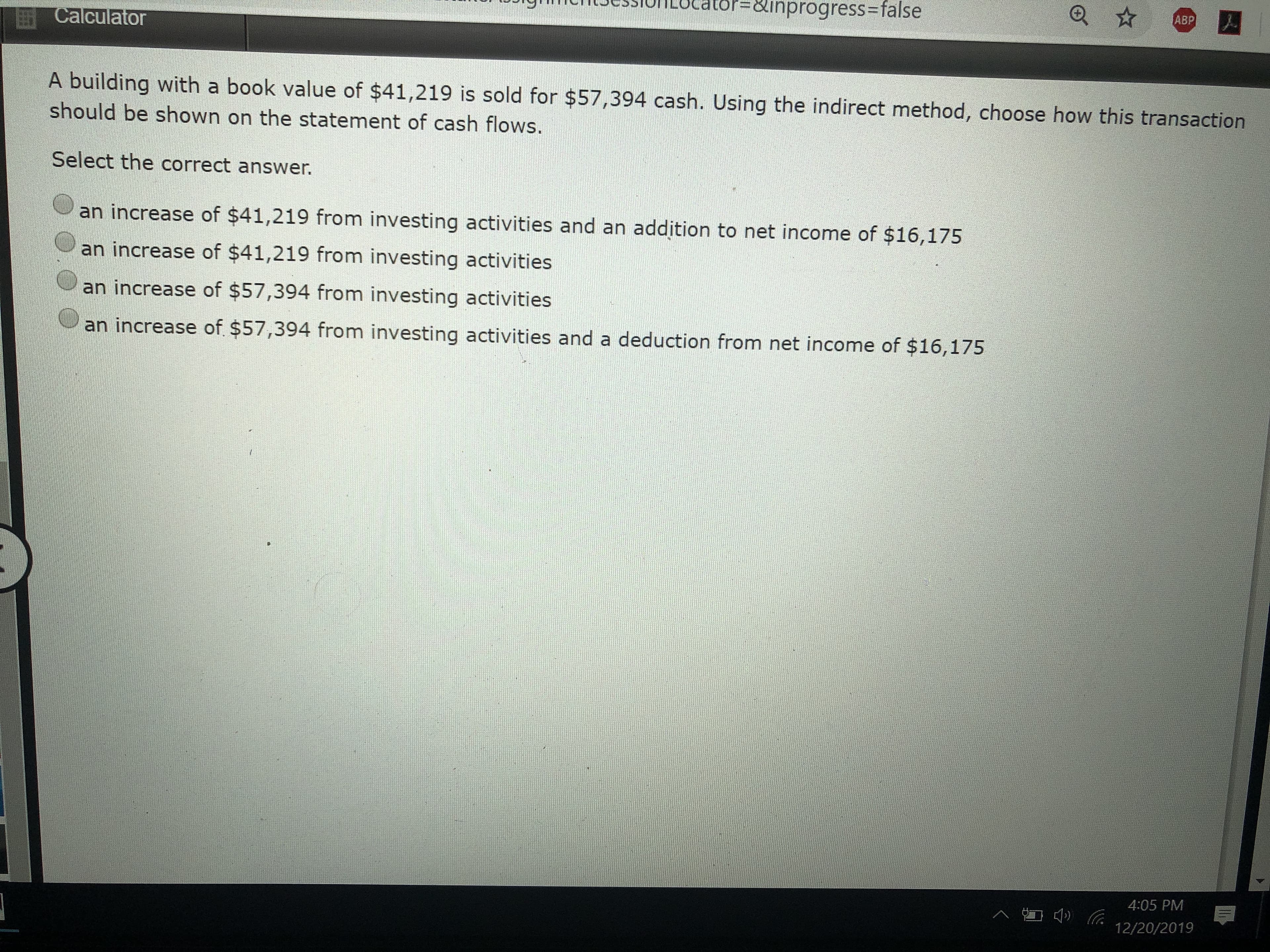

A building with a book value of $41,219 is sold for $57,394 cash. Using the indirect method, choose how this transaction

should be shown on the statement of cash flows.

Select the correct answer.

an increase of $41,219 from investing activities and an addition to net income of $16,175

an increase of $41,219 from investing activities

an increase of $57,394 from investing activities

an increase of $57,394 from investing activities and a deduction from net income of $16,175

4:05 PM

12/20/2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning