provide the cost of good sold statement of jan 2022 from the beginning balances and journal entries given

provide the cost of good sold statement of jan 2022 from the beginning balances and journal entries given

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter5: Professional Auditing Standards And The Audit Opinion Formulation Process

Section: Chapter Questions

Problem 9RQSC: Assume that an organization asserts that it has $35 million in net accounts receivable. Describe...

Related questions

Question

provide the cost of good sold statement of jan 2022 from the beginning balances and

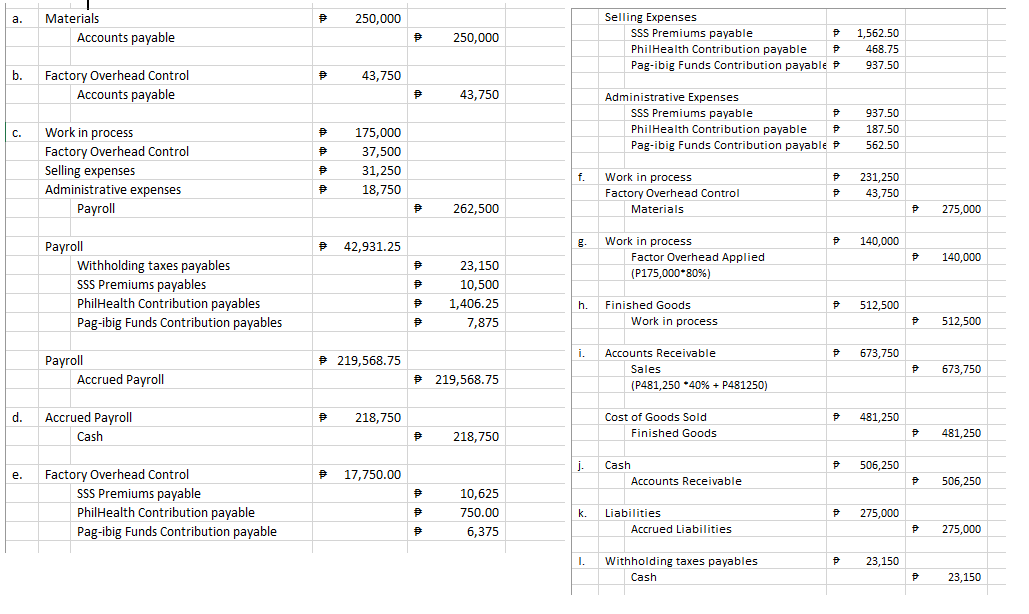

Transcribed Image Text:a.

b.

C.

d.

e.

Materials

Accounts payable

Factory Overhead Control

Accounts payable

Work in process

Factory Overhead Control

Selling expenses

Administrative expenses

Payroll

Payroll

Withholding taxes payables

SSS Premiums payables

PhilHealth Contribution payables

Pag-ibig Funds Contribution payables

Payroll

Accrued Payroll

Accrued Payroll

Cash

Factory Overhead Control

SSS Premiums payable

PhilHealth Contribution payable

Pag-ibig Funds Contribution payable

# 250,000

#

尹

#

175,000

37,500

# 31,250

#

18,750

43,750

# 42,931.25

#

€

219,568.75

218,750

17,750.00

P

#

€

#

P

#

€

P

p

#

250,000

43,750

262,500

23,150

10,500

1,406.25

7,875

219,568.75

218,750

10,625

750.00

6,375

f.

Selling Expenses

SSS Premiums payable

P 1,562.50

PhilHealth Contribution payable P 468.75

Pag-ibig Funds Contribution payable

937.50

j.

Administrative Expenses

k.

SSS Premiums payable

PhilHealth Contribution payable

Pag-ibig Funds Contribution payable

Work in process

Factory Overhead Control

Materials

Work in process

h. Finished Goods

Factor Overhead Applied

(P175,000*80%)

i. Accounts Receivable

Sales

Work in process

(P481,250*40% + P481250)

Cost of Goods Sold

Finished Goods

Cash

Accounts Receivable

Liabilities

Accrued Liabilities

I. Withholding taxes payables

Cash

P

P

P

P

P

P

P

P

937.50

187.50

562.50

231,250

43,750

P 673,750

P

140,000

512,500

481,250

506,250

P 275,000

23,150

P 275,000

P 140,000

P

P

P

P

P

P

512,500

673,750

481,250

506,250

275,000

23,150

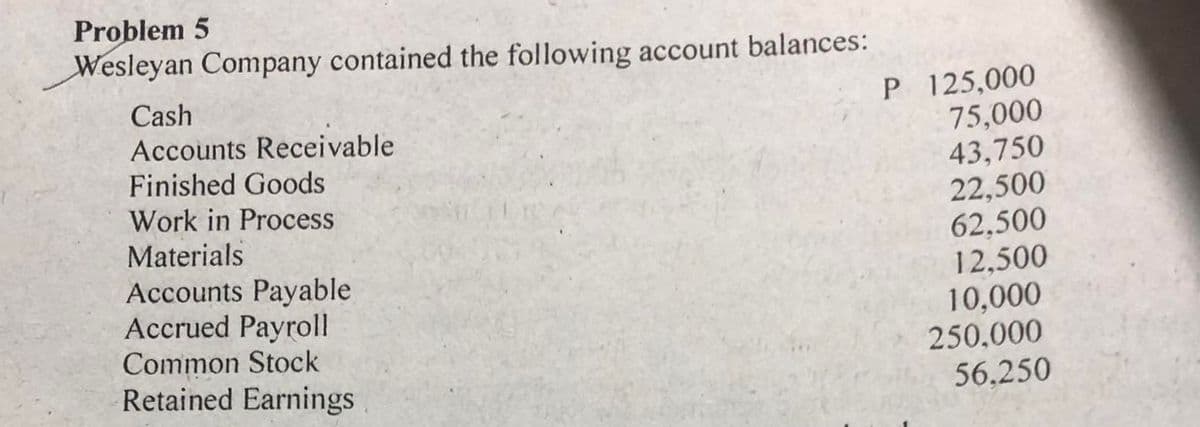

Transcribed Image Text:Problem 5

Wesleyan Company contained the following account balances:

Cash

Accounts Receivable

Finished Goods

Work in Process

Materials

Accounts Payable

Accrued Payroll

Common Stock

Retained Earnings

P 125,000

75,000

43,750

22,500

62.500

12,500

10,000

250,000

56,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning