Q1: Fill in the blanks a. The fundamental of accounting equation states that Assts = Liabilities + %3D b. Debts owed to other are called c. Assets are increased via while liabilities and capital are increased via d. Revenue is recognised when e. The steps taken by the accountant to maintain the books and prepare statements is referred to as the

Q1: Fill in the blanks a. The fundamental of accounting equation states that Assts = Liabilities + %3D b. Debts owed to other are called c. Assets are increased via while liabilities and capital are increased via d. Revenue is recognised when e. The steps taken by the accountant to maintain the books and prepare statements is referred to as the

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 1PA: Identify whether each of the following accounts would be considered a permanent account (yes/no) and...

Related questions

Question

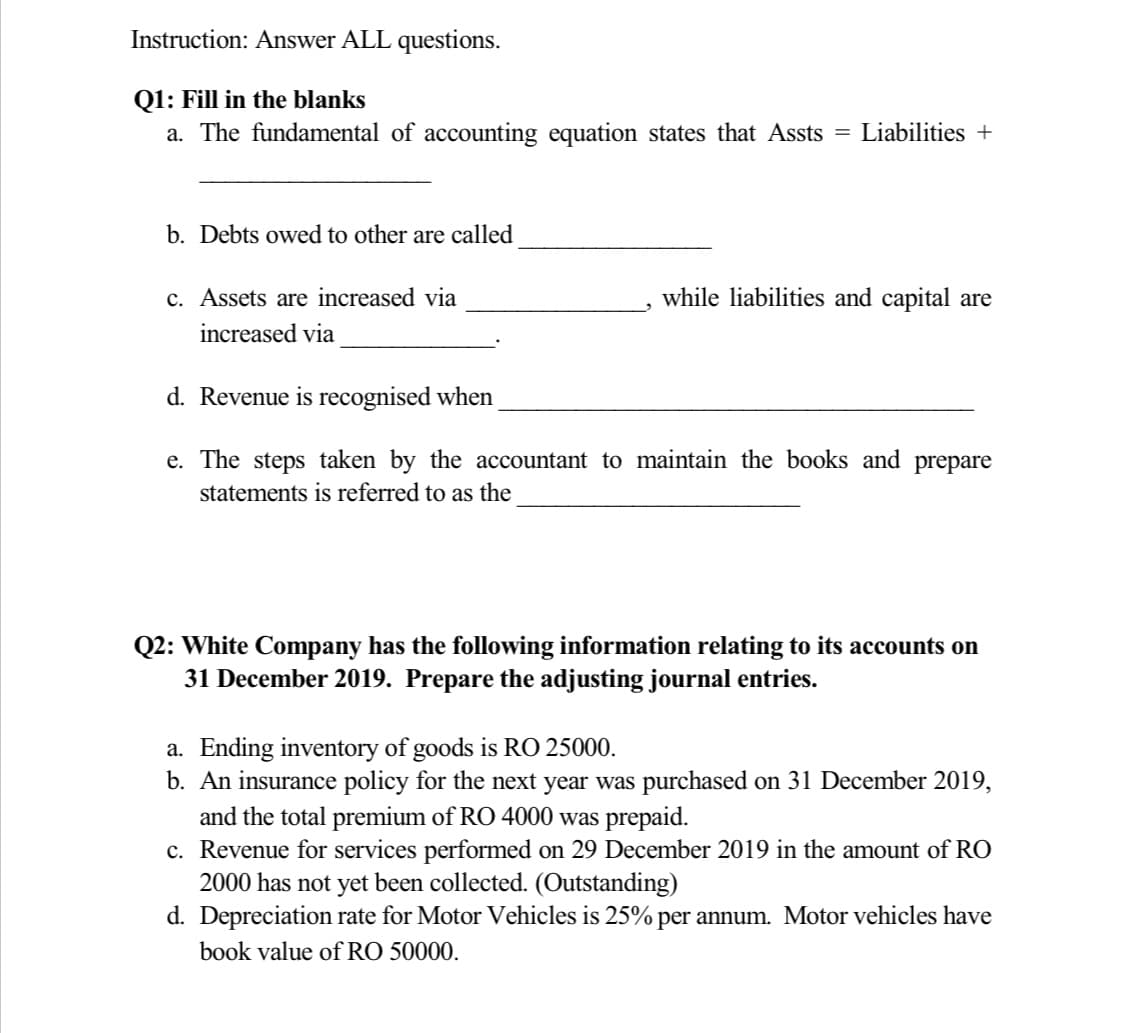

Transcribed Image Text:Instruction: Answer ALL questions.

Q1: Fill in the blanks

a. The fundamental of accounting equation states that Assts = Liabilities +

b. Debts owed to other are called

c. Assets are increased via

while liabilities and capital are

increased via

d. Revenue is recognised when

e. The steps taken by the accountant to maintain the books and prepare

statements is referred to as the

Q2: White Company has the following information relating to its accounts on

31 December 2019. Prepare the adjusting journal entries.

a. Ending inventory of goods is RO 25000.

b. An insurance policy for the next year was purchased on 31 December 2019,

and the total premium of RO 4000 was prepaid.

c. Revenue for services performed on 29 December 2019 in the amount of RO

2000 has not yet been collected. (Outstanding)

d. Depreciation rate for Motor Vehicles is 25% per annum. Motor vehicles have

book value of RO 50000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning