Q2: March transactions for Tribeca Company as follows; March 3: Purchased 500 units of inventory for $12,500, on credit terms of n/eom. (No discount will be provided for early payments) 6: Sold 300 units of inventory for $50 each to the Shine Company on credit terms of 3/15, n/30. (Calculate COGS). 10: Paid insurance in advance, $2,000. 12: Purchased 400 units inventory for cash $12,000, 15: Paid on account, $12,500 for March 3 purchases. 18: Sold 550 units of inventory for $50 cach on credit terms of 2/10, n/30 to the Bright Company. (Calculate COGS). 25: Collected on account from March 6 sales to Shine Company. (Is there any discount or not, explain your reason) 27: Collected on account from March 18 sales to Bright Company. (As there any discount or not, explain your reason, Show your calculations for the discount, total receivable, and cash collected.) Requirements: 3. Joumalize March transactions for Tribeca Company. Provide explanations. 4. Prepare FIFO Schedule for March. Company has 250 units of inventory from $18 cach at the

Q2: March transactions for Tribeca Company as follows; March 3: Purchased 500 units of inventory for $12,500, on credit terms of n/eom. (No discount will be provided for early payments) 6: Sold 300 units of inventory for $50 each to the Shine Company on credit terms of 3/15, n/30. (Calculate COGS). 10: Paid insurance in advance, $2,000. 12: Purchased 400 units inventory for cash $12,000, 15: Paid on account, $12,500 for March 3 purchases. 18: Sold 550 units of inventory for $50 cach on credit terms of 2/10, n/30 to the Bright Company. (Calculate COGS). 25: Collected on account from March 6 sales to Shine Company. (Is there any discount or not, explain your reason) 27: Collected on account from March 18 sales to Bright Company. (As there any discount or not, explain your reason, Show your calculations for the discount, total receivable, and cash collected.) Requirements: 3. Joumalize March transactions for Tribeca Company. Provide explanations. 4. Prepare FIFO Schedule for March. Company has 250 units of inventory from $18 cach at the

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

Please help me

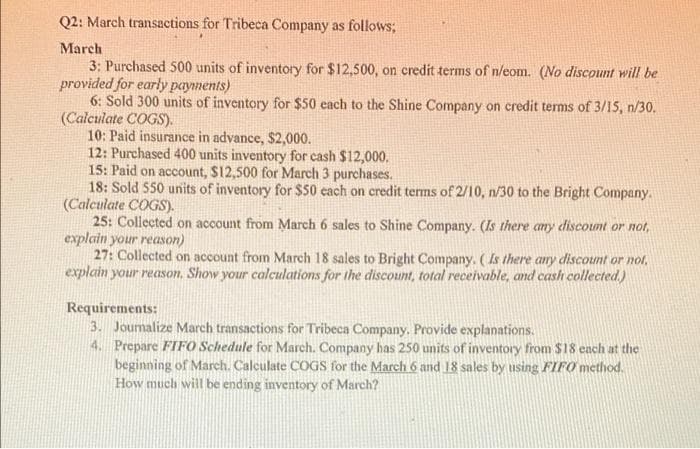

Transcribed Image Text:Q2: March transactions for Tribeca Company as follows;

March

3: Purchased 500 units of inventory for $12,500, on credit terms of n/eom. (No discount will be

provided for early payments)

6: Sold 300 units of inventory for $50 each to the Shine Company on credit terms of 3/IS, n/30.

(Calculate COGS).

10: Paid insurance in advance, $2,000.

12: Purchased 400 units inventory for cash $12,000.

15: Paid on account, $12,500 for March 3 purchases.

18: Sold 550 units of inventory for $50 cach on credit terms of 2/10, n/30 to the Bright Company.

(Calculate COGS).

25: Collected on account from March 6 sales to Shine Company. (Is there any discount or not,

explain your reason)

27: Collected on account from March 18 sales to Bright Company. (Is there any discount or not,

explain your reason, Show your calculations for the discount, total receivable, and cash collected)

Requirements:

3. Joumalize March transactions for Tribeca Company. Provide explanations.

4. Prepare FIFO Schedule for March. Company has 250 units of inventory from $18 each at the

beginning of March. Calculate COGS for the March 6 and 18 sales by using FIFO method.

How much will be ending inventory of March?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning