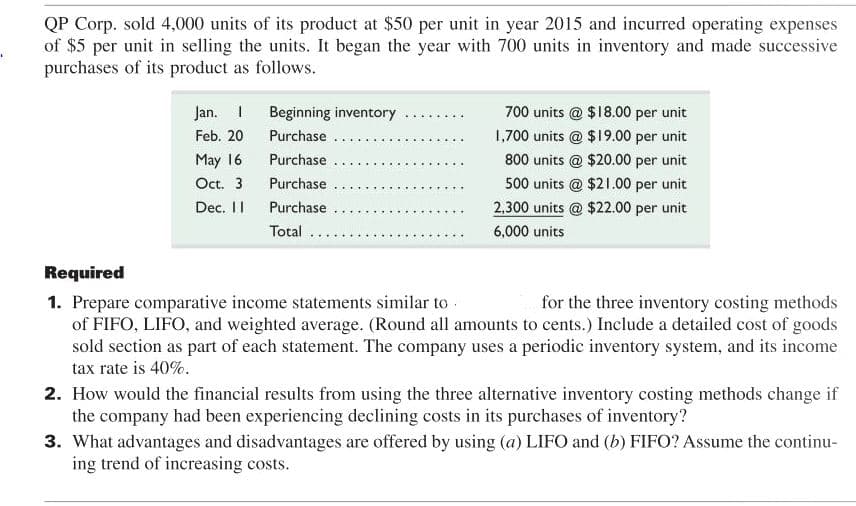

QP Corp. sold 4,000 units of its product at $50 per unit in year 2015 and incurred operating expenses of $5 per unit in selling the units. It began the year with 700 units in inventory and made successive purchases of its product as follows. Jan. I Beginning inventory 700 units @ $18.00 per unit Feb. 20 Purchase 1,700 units @ $19.00 per unit May 16 Oct. 3 Purchase 800 units @ $20.00 per unit Purchase 500 units @ $21.00 per unit Dec. II 2,300 units @ $22.00 per unit Purchase Total 6,000 units Required 1. Prepare comparative income statements similar to of FIFO, LIFO, and weighted average. (Round all amounts to cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is 40%. for the three inventory costing methods 2. How would the financial results from using the three alternative inventory costing methods change if the company had been experiencing declining costs in its purchases of inventory? 3. What advantages and disadvantages are offered by using (a) LIFO and (b) FIFO? Assume the continu- ing trend of increasing costs.

QP Corp. sold 4,000 units of its product at $50 per unit in year 2015 and incurred operating expenses of $5 per unit in selling the units. It began the year with 700 units in inventory and made successive purchases of its product as follows. Jan. I Beginning inventory 700 units @ $18.00 per unit Feb. 20 Purchase 1,700 units @ $19.00 per unit May 16 Oct. 3 Purchase 800 units @ $20.00 per unit Purchase 500 units @ $21.00 per unit Dec. II 2,300 units @ $22.00 per unit Purchase Total 6,000 units Required 1. Prepare comparative income statements similar to of FIFO, LIFO, and weighted average. (Round all amounts to cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is 40%. for the three inventory costing methods 2. How would the financial results from using the three alternative inventory costing methods change if the company had been experiencing declining costs in its purchases of inventory? 3. What advantages and disadvantages are offered by using (a) LIFO and (b) FIFO? Assume the continu- ing trend of increasing costs.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Question

100%

Help me to solve this Question, please.

Transcribed Image Text:QP Corp. sold 4,000 units of its product at $50 per unit in year 2015 and incurred operating expenses

of $5 per unit in selling the units. It began the year with 700 units in inventory and made successive

purchases of its product as follows.

Jan. I

Beginning inventory

700 units @ $18.00 per unit

Feb. 20

Purchase

1,700 units @ $19.00 per unit

May 16

Oct. 3

Purchase

800 units @ $20.00 per unit

Purchase

500 units @ $21.00 per unit

Dec. II

Purchase

2,300 units @ $22.00 per unit

Total

6,000 units

Required

1. Prepare comparative income statements similar to.

of FIFO, LIFO, and weighted average. (Round all amounts to cents.) Include a detailed cost of goods

sold section as part of each statement. The company uses a periodic inventory system, and its income

for the three inventory costing methods

tax rate is 40%.

2. How would the financial results from using the three alternative inventory costing methods change if

the company had been experiencing declining costs in its purchases of inventory?

3. What advantages and disadvantages are offered by using (a) LIFO and (b) FIFO? Assume the continu-

ing trend of increasing costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT