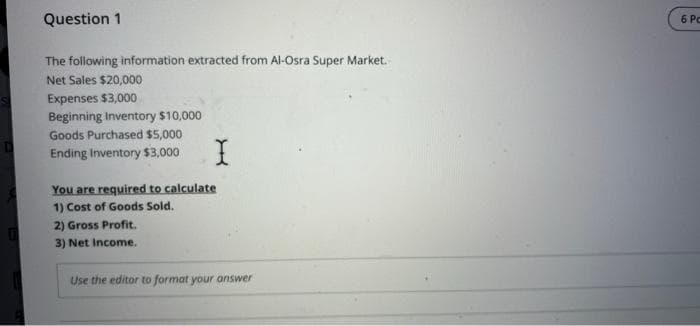

Question 1 The following information extracted from Al-Osra Super Market. Net Sales $20,000 Expenses $3,000 Beginning Inventory $10,000 Goods Purchased $5,000 Ending Inventory $3,000 You are required to calculate 1) Cost of Goods Sold. 2) Gross Profit. 3) Net Income. Use the editor to format your answer

Question 1 The following information extracted from Al-Osra Super Market. Net Sales $20,000 Expenses $3,000 Beginning Inventory $10,000 Goods Purchased $5,000 Ending Inventory $3,000 You are required to calculate 1) Cost of Goods Sold. 2) Gross Profit. 3) Net Income. Use the editor to format your answer

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.5BE: Inventory analysis A company reports the following: Cost of goods sold 435,000 Average inventory...

Related questions

Topic Video

Question

Transcribed Image Text:Question 1

6 Pc

The following information extracted from Al-Osra Super Market.

Net Sales $20,000

Expenses $3,000

Beginning Inventory $10,000

Goods Purchased $5,000

Ending Inventory $3,000

You are required to calculate

1) Cost of Goods Sold.

2) Gross Profit.

3) Net Income.

Use the editor to format your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning