Suppose Unicorn achieved sales in year six at the median level of comparables of approx., $1.6B, what is the compounded annual growth rate in sales for Unicorn from fiscal year one to fiscal year six to achieve these sales in year six?[1] [1] If you calculate the median sales of comparables in year six, the value is $1,577M.

Suppose Unicorn achieved sales in year six at the median level of comparables of approx., $1.6B, what is the compounded annual growth rate in sales for Unicorn from fiscal year one to fiscal year six to achieve these sales in year six?[1] [1] If you calculate the median sales of comparables in year six, the value is $1,577M.

Chapter10: Valuing Early-stage Ventures

Section: Chapter Questions

Problem 2EP

Related questions

Question

- Suppose Unicorn achieved sales in year six at the median level of comparables of approx., $1.6B, what is the compounded annual growth rate in sales for Unicorn from fiscal year one to fiscal year six to achieve these sales in year six?[1]

[1] If you calculate the median sales of comparables in year six, the value is $1,577M.

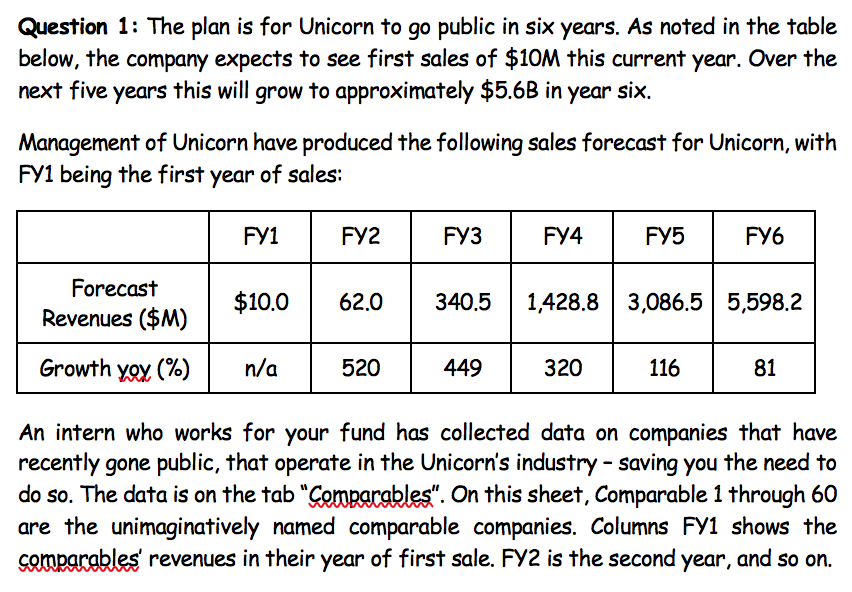

Transcribed Image Text:Question 1: The plan is for Unicorn to go public in six years. As noted in the table

below, the company expects to see first sales of $10M this current year. Over the

next five years this will grow to approximately $5.6B in year six.

Management of Unicorn have produced the following sales forecast for Unicorn, with

FY1 being the first year of sales:

FY1

FY2

FУЗ

FY4

FY5

FУ6

Forecast

$10.0

1,428.8 3,086.5 5,598.2

340.5

62.0

Revenues ($M)

Growth yoy (%)

n/a

116

520

449

320

81

An intern who works for your fund has collected data on companies that have

recently gone public, that operate in the Unicorn's industry - saving you the need to

do so. The data is on the tab "Coparables". On this sheet, Comparable 1 through 60

are the unimaginatively named comparable companies. Columns FY1 shows the

comparables' revenues in their year of first sale. FY2 is the second year, and so on.

Expert Solution

Step 1

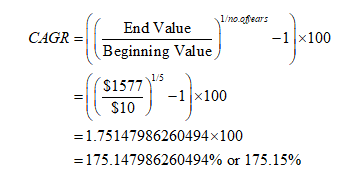

The median sales for FY6 is estimated to be $1577 million. Therefore, from $10 million in FY1 to $1577M in FY6, the compounded annual growth rate over 5 years can be calculated as below

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT