Question 1 Which of the following is not correct in relation to the reversal of an impairment loss of an individual asset? If the individual asset is recorded under the cost model, then the increase in the carrying amount is recognised immediately in profit or loss. Where the recoverable amount is less than the carrying amount of an individual asset, the reversal of a previous impairment loss requires adjusting the camying amount of the asset to recoverable amount. When reversing an impairment loss, the carrying amount cannot be increased to an amount in excess of the carrying amount that would have been determined had ne impairmert los been recognised. O For a depreciable asset there needs to be a calculation of carrying amount using the depreciation variables applied before the impairment loss to determine what the carrying amount would have been if there had been no impairment loss.

Question 1 Which of the following is not correct in relation to the reversal of an impairment loss of an individual asset? If the individual asset is recorded under the cost model, then the increase in the carrying amount is recognised immediately in profit or loss. Where the recoverable amount is less than the carrying amount of an individual asset, the reversal of a previous impairment loss requires adjusting the camying amount of the asset to recoverable amount. When reversing an impairment loss, the carrying amount cannot be increased to an amount in excess of the carrying amount that would have been determined had ne impairmert los been recognised. O For a depreciable asset there needs to be a calculation of carrying amount using the depreciation variables applied before the impairment loss to determine what the carrying amount would have been if there had been no impairment loss.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 4MC: Which of the following statements about capitalizing costs is correct? A. Capitalizing costs refers...

Related questions

Question

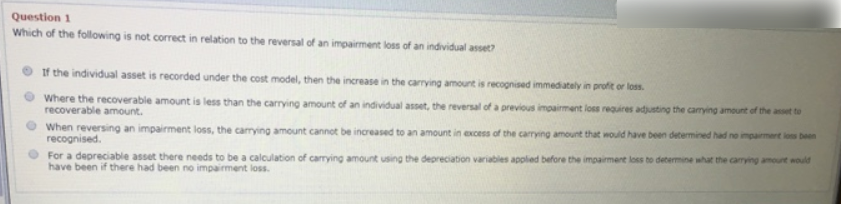

Transcribed Image Text:Question 1

Which of the following is not correct in relation to the reversal of an impairment loss of an individual asset?

If the individual asset is recorded under the cost model, then the increase in the carrying amount is recognised immediately in profit or loss.

Where the recoverable amount is less than the carrying amount of an individual asset, the reversal of a previous impairment loss requires adjusting the camying amount of the asset to

recoverable amount.

When reversing an impairment loss, the carrying amount cannot be increased to an amount in excess of the carrying amount that would have been determined had ne impairmert los been

recognised.

O For a depreciable asset there needs to be a calculation of carrying amount using the depreciation variables applied before the impairment loss to determine what the carrying amount would

have been if there had been no impairment loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning