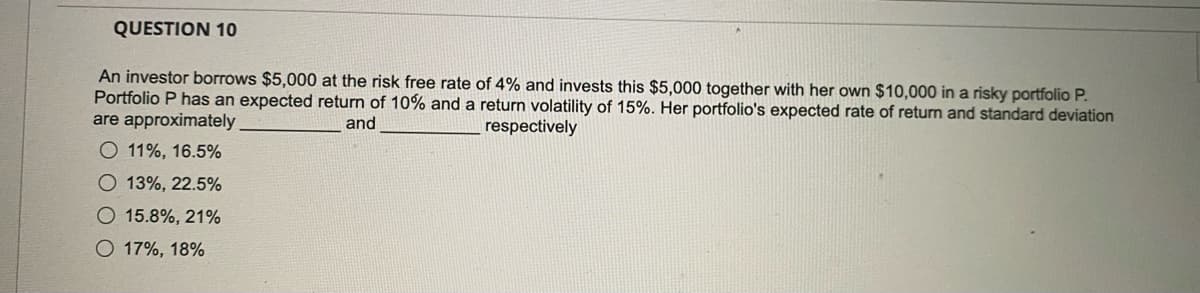

QUESTION 10 An investor borrows $5,000 at the risk free rate of 4% and invests this $5,000 together with her own $10,000 in a risky portfolio P. Portfolio P has an expected return of 10% and a return volatility of 15%. Her portfolio's expected rate of return and standard deviation respectively are approximately and O 11%, 16.5% O 13%, 22.5% O 15.8%, 21% O 17%, 18%

Q: Company's 5-year bonds are selling at P820. The bonds face amount is P1,000 and pays an annual…

A: Bonds are long term source of finance for the company and very cheap source of finance because after…

Q: If an investor purchases a 4%, 5-year TIPS at its par value of $1,000 and O $1,000.00 O $1,040.00 O…

A: Here, Particulars Values Years to maturity (NPER) 5.00 Yield to maturity (RATE) 4.00% Par…

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: In a typical capital budgeting decision, we have a project whose quantum and timing of cash flows…

Q: Consider an asset that costs $420,000 and is depreciated straight-line to zero over a 7-year…

A: No of years of economic life = 7,Salvage value = 0 So depreciation per year =(Book Value -Salvage…

Q: 4. Nick's Bird Cages has sales of $43 million, total assets of $29 million, and total debt of $9.5…

A: Solution:- Net income means the amount earned by a firm after incurring all expenses. We know, net…

Q: Simple Simon's Bakery purchases supplies on terms of 1.5/10, net 30. If Simple Simon's chooses to…

A: Trade credit refers to the purchase of goods or services by the customers from the seller and paid…

Q: QUESTION 2 Investors can form complete portfolios out of 2 assets. A T-bill with a return of 5%, and…

A:

Q: Cadeen Construction Company Limited (CCCL) has the following capital structure, which is considered…

A: Capital Asset Pricing Model (CAPM) is used to understand or determine the required return on a stock…

Q: respectively

A: C is risk-free so Beta =0, Take Wa as the Weight of A in the portfolio= 12000/50000=0.24 Weight…

Q: Round your answer to 2 decimal places, if necessary. Do not enter t entering your answer.

A: The future of amount is the amount that is being deposited and also amount of compouding interest…

Q: nuity with yearly payments of 674 that’s compounded annually with an interest rate of 5.4% will be…

A: Future value of the annuity includes the amount being deposited over the period of time and amount…

Q: Your firm is considering an expansion project that requires a fixed asset investment of $2.5 million…

A: Net present value (NPV): The net present value is a technique used for making the investment…

Q: You are getting a $100,000 mortgage and paying 2 points. What is the effective annual yield (in…

A: Here,

Q: Holtzman Clothiers's stock currently sells for $30.00 a share. It just paid a dividend of $1.75 a…

A: Compute the expected stock price after 1 year, using the equation as shown below: Stock…

Q: You are given the following information for Lighting Power Company. Assume the company's tax rate is…

A: Here, Cost of debt: No. of bonds outstanding 21,000.00 Coupon rate 7.00% Maturity period…

Q: You build a portfolio containing stocks ?A and ?B only and you have shorted ?B such that its…

A: Expected return of the portfolio means the mean of the probability distribution of investment…

Q: QUESTION 31 Leo offers to sell Mona a computer. Mona sends an acceptance via the mai. This…

A: As per Bartleby honor code, when multiple questions are asked, the expert is required only to solve…

Q: Ariel leased equipment worth $70,000 for 10 years. If the lease rate is 4.75% compounded monthly,…

A: Lease is amount paid to acquire the right to use the equipment during the life of assets. Lease are…

Q: am having difficulty recreating the formula below using the price function on excel Using EXCEL…

A: Price of bond is present value of coupon payment and present value of par value of bond that is paid…

Q: Tom Scott is the owner, president, and primary salesperson for Scott Manufacturing. Because of this,…

A: The cash flows indicate the inflows and outflows of cash. Cash flows are critical to the company's…

Q: A “three-against-nine” FRA has an agreement rate of 4.76 percent. You believe six-month LIBOR in…

A: FRA refers to an agreement between the customer and the bank for paying or receiving the…

Q: u are analyzing the cost of debt for a firm. You know that the firm’s 14-year maturity, 6.60 percent…

A: Yield to maturity is the rate of return realized when bond is held to maturity and all payments are…

Q: What is the IRR for the following project if its initial after-tax cost is R5 000 000 and it is…

A: IRR is the rate of return which the project generates over its useful life.

Q: Monica has decided that she wants to build enough retirement wealth that, if invested at 9 percent…

A: The concept of time value of money will be used. Firstly we will need to determine the value of the…

Q: Assume that the risk-free rate is 3.5% and the required return on the market is 11%. What is the…

A: An asset's expected returns are determined using the CAPM algorithm. It is predicated on the notion…

Q: For Part 2, can that be calculated using excel?

A: The price of bond is sum of present value of the future cash flow from its coupons and the present…

Q: Sunrise, Incorporated, is trying to determine its cost of debt. The firm has a debt issue…

A: Here, Particulars Values Coupon rate 6.00% Maturity period (NPER) 14.00 Current price of…

Q: Current assets Net Fixed assets Total assets Accounts payable and accurals. Short term debt Long…

A:

Q: Omicron Technologies made a before-tax profit of $50 million this year. The firm has no debt and 10…

A: A firm has surplus cash flows. It can pay special dividend or repurchase. We have to find various…

Q: Cooley Company's stock has a beta of 0.8 , the risk-free rate is 1.04 %, and the market risk premium…

A: The Capital Asset Pricing Model (CAPM) refers to the model which tells us how the financial markets…

Q: the following information to answer the questions. Bond A Bond B Face Value 1000 1000…

A: Price of bond is the present value of coupon payment and present value of par value of bond that is…

Q: D. At a certain interest rate the present values of the following two payment patterns. (i) P…

A: Future value of amount invested now is the amount invested and amount of interest being accumualted…

Q: The risk-free rate is 3.2 percent. Stock A has a beta = 1.9 and Stock B has a beta = 1.3. Stock A…

A: A potential investment's beta is a measurement of the risk an investment will bring to a portfolio…

Q: If you invest £100 now and expect to receive £133.1 in 2 years time, what is the Internal Rate of…

A: Note: In Option, a) 0 is being used instead of the bracket, and accordingly it is 15% and not…

Q: 2. The earnings, dividends, and stock price of BB Company are expected to grow at 7% per year after…

A: As per Bartleby honor code, when multiple questions are asked, the expert is required to solve the…

Q: DR 1 Future Value 2 Interest Rate 3 Part a 4 Present Value 5 Part b Payment 7 Part c 8 Future Value…

A: You have a very specific doubt about an input used in calculation of PV and FV. We need to…

Q: A six-year project has an initial cost of ${A} million with an expected revitalizatio cost of ${B}…

A: Data given: A=$9 million B=$ 3 million C=$3 million D=$ 4 million E=10%

Q: privileges

A: 1. The insolvent cannot do any contract without the consent of writing to the trustee. 2. The…

Q: Assume that you need $1,000 four years from today. Your bank compounds interest at an 8 percent…

A: Future Value $1,000.00 Interest Rate 8%

Q: a) Compute the predetermi determine the unit product cost of each product for the current year.…

A: A) Predetermined Overhead rate = Estimated Manufacturing Overhead/Total Direct labor Hours…

Q: Q19 Compute the present value of an $1,450 payment made in 10 years when the discount rate is 12…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The payment initially made…

Q: Consider a borrow-and-invest strategy in which you use $1 million of your own money and borrow…

A: Solution:- Risk premium refers to the expected extra returned over the above the risk free rate of…

Q: We are evaluating a project that costs $728,000, has a life of twelve years, and has no salvage…

A: NPV is defined as the sum of the present values of all future cash inflows less the sum of the…

Q: Calculate the weighted average cost of capital for Limp Linguini Noodle Makers Inc. under the…

A: We will compute the weighted cost of capital by multiplying the weight of each component with its…

Q: How many years (and months) will it take $2 million to grow to $6.20 million with an annual interest…

A: Initial value (I) = $2 million Future value (FV) = $6.20 million Interest rate (r) = 0.07 Period (n)…

Q: Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following…

A: Dollars/shares in millions FCF1 $ -14.00 FCF2 $ 30.00 FCF3 $ 47.00 Constant…

Q: Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in…

A: Covariance It is a measure of the degree to which two parameters move together with respect to their…

Q: It's June, the stock price for CXY is$105.11. CXY does not pay dividends. The November put option on…

A: A put option is being traded in the market. We have to find the arbitrage strategy possible here.

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: Capital Allocation Line is a graphical representation of all the possible portfolios with risk and…

Q: A firm has the balance sheet accounts, common stock, and paid-in capital in excess of par, with…

A: When the shares are sold for more than its face value, the excess is credit to "Paid in capital in…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Ch 13] Julia has $5,000.00 to invest in a portfolio. She will build the portfolio from threeassets: Stock A with an expected return of 16.0% and a standard deviation of 42% Stock B with an expected return of 12.0% and a standard deviation of 32% T-Bills with an expected return of 4.00% and a standard deviation of 0%.Assume that she can short sell T-bills, the risk-free asset (or borrow at the risk-free rate).Assume also that she will invest the same amount in Stock A and Stock B. How muchmoney will she invest in Stock A if her goal is to create a portfolio with an expected returnof 20.00%.$(to nearest $0.01)QUESTION 10 An investor wishes to construct a portfolio by borrowing 35 percent of his original wealth and investing all the money in a stock index. The return on the risk-free asset is 4.0 percent, and the expected return on the stock index is 15 percent. Calculate the expected return on the portfolio. a. 9.50 percent b. 18.25 percent c. 11.15 percent d. 15.00 percent e. 18.85 percentSubject: Financial strategy & policy 8-2: PORTFOLIO BETA An individual has $35,000 invested in a stock with a beta of 0.8 and another $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her portfolio’s beta? 8-3: REQUIRED RATE OF RETURN Assume that the risk-free rate is 6% and the expected return on the market is 13%. What is the required rate of return on a stock with a beta of 0.7? 8-4: EXPECTED AND REQUIRED RATES OF RETURN Assume that the risk-free rate is 5% and the market risk premium is 6%. What is the expected return for the overall stock market? What is the required rate of return on a stock with a beta of 1.2?

- Question 6 Suppose that an investor has £1,000,000 to invest in a portfolio containing stocks A, B and a risk-free asset. The investor must invest all her money, and she is using the Capital Asset Pricing Model (CAPM) to make predictions of the expected return-beta relationship. Her objective is to create a portfolio that has an expected return of 14% and which has a beta of 0.75. If stock A has an expected return of 30% and a beta of 1.9, stock B has an expected return of 20% and a beta of 1.4, and the risk-free rate is 8%, how much money will she invest in stock A? Explain your answer and show your calculations.Question 7 The Amelia Knight investment fund has a total capital of R120 000 invested in three shares: SharesReturnInvestedTechnological Sector25%R60 000Education Sector13%R30 000Mining Sector20%R30 000 The current risk-free rate is 5,5%. Market returns have the following estimated probability distribution for the next period: ProbabilityMarket return0,3–10%0,1 14%0,2 15%0,4 18% What is the beta coefficient of the investment fund? 1. 0,52 2. 0,80 3. 1,82 4. 4,92Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $300,000 1.30 B 150,000 1.70 C 500,000 0.70 D 50,000 -0.20 Total investment $1,000,000 The market's required return is 11% and the risk-free rate is 5%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places.

- Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $300,000 1.3 B 200,000 1.6 C 500,000 0.75 D 0 -0.15 Total investment 1,000,000 The market's required return is 11% and the risk-free rate is 3%. What is the portfolio's required return? Round your answer to 3 decimal places. Do not round intermediate calculations.%Problem 11-23 Analyzing a Portfolio You want to create a portfolio equally as risky as the market, and you have $2,400,000 to invest. Given this information, fill in the rest of the following table: (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Asset Investment Beta Stock A $360,000 1.00 Stock B $624,000 1.10 Stock C 1.20 Risk-free assetN2 10. There is a risky portfolio of multiple stocks with an expected return of 14% and a standard deviation of 21%. Jason invests 65% of his total wealth on this risky portfolio and the rest 35% on Treasury bills (so, he has constructed a ‘complete portfolio’ of a risky asset and a risk-free asset). One-year T-bill rate is 3%. a. Calculate the expected return and standard deviation of his complete portfolio b. Calculate his risk premium of the risky portfolio as well as of the complete portfolio c. Compute the Sharpe ratio d. Draw the capital allocation line