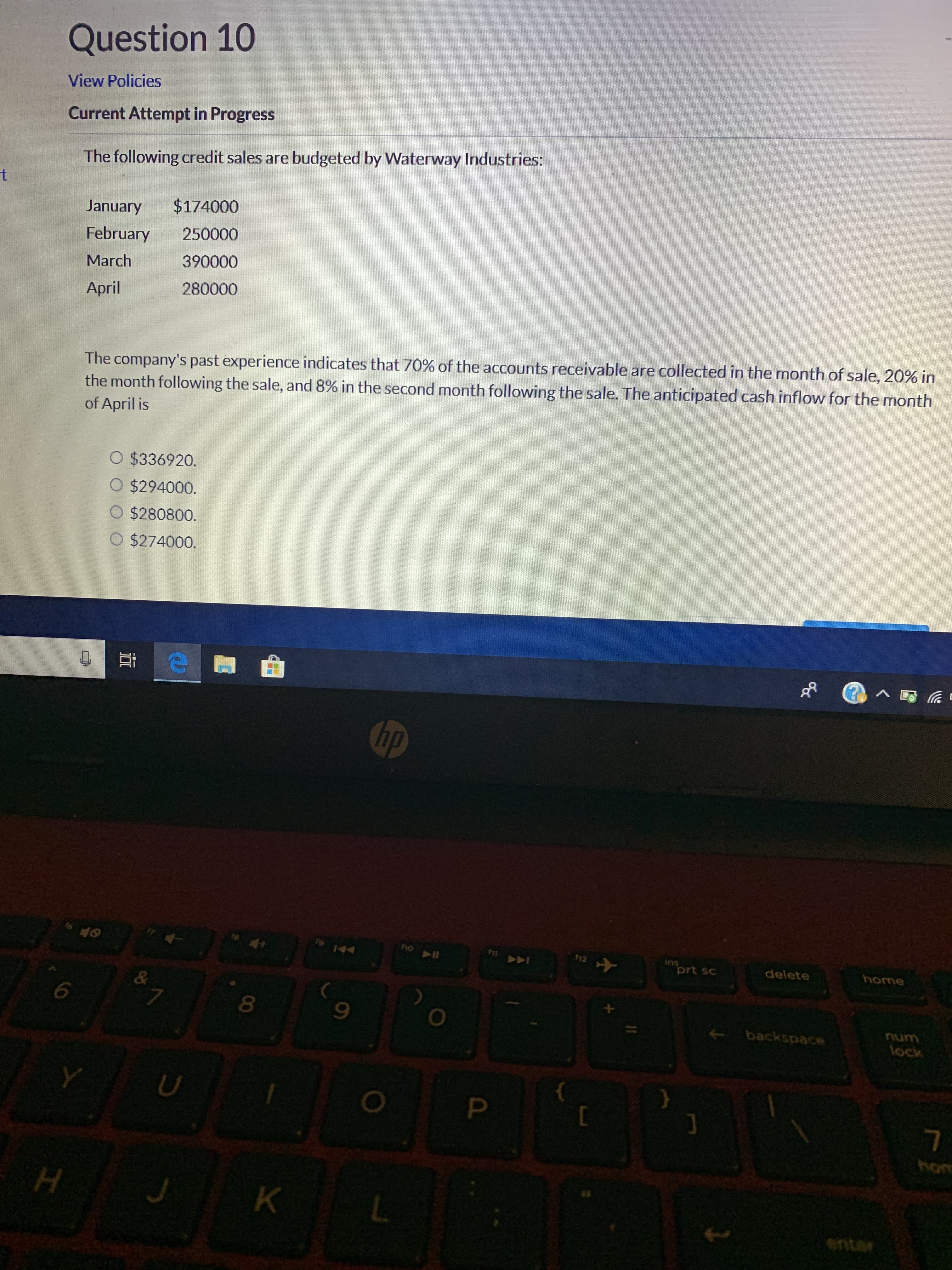

Question 10 View Policies Current Attempt in Progress The following credit sales are budgeted by Waterway Industries: t $174000 January 250000 February 390000 March 280000 April The company's past experience indicates that 70% of the accounts receivable are collected in the month of sale, 20% in the month following the sale, and 8% in the second month following the sale. The anticipated cash inflow for the month of April is O $336920. O $294000. O $280800. O $274000. hp holl 12 44 ins prt sc delete home & 6 7 backspace lock P C H K L nt

Q: QUESTION 32 Pasta Disasta, Inc. is preparing its master budget for its first quarter of business. It…

A: Financial budgets: Financial budgets are prepared in order to ascertain the resources required to…

Q: Question 7 View Policies Current Attempt in Progress A company has budgeted direct materials…

A: Budgeted cash payments are a part of cash budgets that represents the amount of cash that is…

Q: OBJECTIVE 3 Problem 8.37 Cash Budget, Pro Forma Balance Sheet Bernard Creighton is the controller…

A: A balance sheet is a financial statement that shows a company's assets, liabilities, share…

Q: General Electric Company had cash of $14,000 on hand on January 1. During the year, the company…

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If…

Q: QUESTION 3 Leaning Tower of Pizza, Inc. is preparing its master budget for its first year of…

A: A budget is prepared to estimate the expected revenue and expenses. The uncollectible amount of…

Q: FINAL REVISION QUESTION 1. The production budget for Zink Company shows units to be produced as…

A: Direct labor refers to those workers who are engaged in production process. The wages which are paid…

Q: xercise 8-1 Schedule of Expected Cash Collections [LO8-2] Silver Company makes a product that is…

A: A cash budget is an estimation of expected cash receipts and disbursements based on experience. It…

Q: Q.Production budget. Superior Industries sales budget shows quarterly sales for the next year as…

A: Production budget: Production budget is the estimation or projection of number of units the company…

Q: QUESTION 47 Leaning Tower of Pizza, Inc. is preparing its master budget for its first year of…

A: when goods are sold on credit it is important to manage the credit policy in the best interest of…

Q: Question 1 The marketing department of HASF Corporations has submitted the following sales forecast…

A: Let Budgeted unit sales of Q1 be XNow, Budgeted unit sales of Q2 will be 1.1X (X * 110%)Budgeted…

Q: Question 1 Syntex Corporation has the following Production Budget data: Expected Sales in Units…

A: Hi! Thank you for the question, As per the honor code, we'll answer the first question since the…

Q: EXERCISE 9-11 Production and Direct Materials Budgets [LO3, L04] The marketing department of Gaeber…

A: Production budget shows how many units needs to be produced to meet the expected demand and…

Q: C10.58 Solid State sells electronic products. The controller is responsible for preparing the master…

A: Introduction Accounts Receivables: Accounts Receivable (AR) is the term used to describe the money…

Q: A cash budget, by quarters, is given below for a retail company. (000 omitted). The company…

A: Cash budget is the budget showing all the cash receipts and outlays estimated for a future period.

Q: P4-12 Cash budget: Advanced The Green PLC has projected following unit sales for Janu- ary 2019 to…

A: The question is based on the concept of preparation of cash receipt and disbursement for a company.…

Q: Help

A: Sales are expected to increase by 10%. Fixed cost is expected to increase by 5%. Variable cost are…

Q: -/1 Question 11 View Policies Current Attempt in Progress A company's past experience indicates that…

A: Budgeted cash receipts are a part of cash budgets that represents the amount of cash that is…

Q: Required: prepare budget of purchase for each of the first three months of 2011 prepare separate…

A: The details of budget for the year 2011 are given. Required prepare budget of purchase for each…

Q: Exercise 6 (Selling and Administrative Budget) The budgeted unit sales of Helene Company for the…

A: The Numerical has covered the concept of Budgeting. Budgeting is a statement where we record the…

Q: In preparation for the quarterly cash budget, the following revenue and cost information have been…

A: A firm prepares cash budget to know the available funds at the end of the month in order to maintain…

Q: Question 9 View Policies Current Attempt in Progress The following information was taken from…

A: Cash budget shows the expected cash inflows and cash outflows for a budgeted period. Cash budget…

Q: Cathy’s Cookies produces cookies for resale at local grocery stores. The company is currently in the…

A: Sales (units) for the quarter = Prior year quarterly sales + 20% increase

Q: Exercise 9-45 Cash Budget The owner of a building supply company has requested a cash budget for…

A: Cash budget gives the detailed information regarding cash inflow and cash outflow during a…

Q: 13 What is the estimated cost of goods sold alnu 14. What is the estimated total selling and…

A: The cash collection schedule shows the expected cash collections for the period.

Q: EXERCISE 9-12 Sales and Production Budgets [L02, LO3] The marketing department of Jessi Corporation…

A: The estimation in which the number of units of sales budgeted is multiplied to its price to arrive…

Q: Advent used their historic collection percentages to budget for sales revenue for the first quarter…

A: January February March Total sales (a) $100,000 $175,000 $250,000 x credit sales % 80% 80%…

Q: -/1 Question 13 View Policies Current Attempt in Progress The following information is taken from…

A: The production budget refers to that budget which forecasts the production for the future accounting…

Q: Cash Budget Janet Wooster owns a retail store that sells new and used sporting equipment. Janet has…

A: A cash budget is a budget prepared at the beginning of the period that includes the cash to be spent…

Q: Question 20 /1 View Policies Current Attempt in Progress Vaughn Manufacturing budgets on an annual…

A: A Budget statement is a proper articulation of assessed income and costs dependent on tentative…

Q: Prepare a cash budget for two months. P10.50B (LO 4) Nigh Company prepares monthly cash budgets.…

A: Budgets are prepared in order to predict the financial outcomes of the upcoming transactions. Cash…

Q: QUESTION 7 BMW Limited manufactures a single product, Tune. The finance director prepares monthly…

A: Budgets are very important in business, they provide base for future that how much units needs to be…

Q: Capstone Inc. collects 35% of its sales on account in the month of the sale and 65% in the month…

A: Cash collection in October from September sales = September sales x 65% = $541,000 x 65% = $351,650

Q: e. Required: Using the new assumptions described above, complete the following requirements: 1.

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: 11. The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: % in the month of sale and 40% in the month following the sale. 3. The company pays for 50% of its…

A: A cash disbursement is a financial outflow made in exchange for goods or services. To reimburse a…

Q: allgate Company has forecast credit sales for the fourth quarter of the year: September…

A:

Q: Cash Receipts Budget and Accounts Receivable Aging Schedule Shalimar Company manufactures and sells…

A: The cash receipts budget is prepared to record the cash sales or cash collection from customers…

Q: Forty percent of Soft Company’s sales are for cash and 60% are on account. Fifty percent of the…

A: A schedule of expected cash receipts shows how much cash is received by the company during each…

Q: C. Budgeting No 1 ANGEL Trading Company presents the actual sales for the first three months of year…

A: SOLUTION CALCULATION TREND OF PERCENTAGE INCREASING - JAN TO FEB = 941000-880000 / 880000 *100. =…

Q: Prepare a cash budget for the first quarter of 2021. Clearly show the amounts for cash sales, credit…

A:

Q: Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has…

A: Opening cash balance a Total cash receipts b Total cash disbursements c Closing cash…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Forecast sales volume and sales budget Sentinel systems Inc. prepared the following sales budget for 20Y8: At the end of December 20Y8, the following unit sales data were reported for the year: Unit Sales Home Alert System Business Alert System United States 1,734 1,078 Europe 609 329 Asia 432 252 For the year ending December 31, 20Y9, unit sales are expected to follow the patterns established during the year ending October 31, 20Y8. The unit selling price for the Home: Alert System is expected to increase to 250, and the unit selling price for the Business Alert System is expected to be increased 820, effective January 1, 20Y9. Instructions 1. Compute the increase or decrease.ase of actual unit sales for the year ended October 31, 20Y8, over budget. Place your answers in a columnar table with the following format: 2. Assuming that the increase or decrease in actual sales to budget indicated in part (1) is to continue in 20Y9, compute the unit sales volume to be used for preparing the sales budget for the year ending December 31, 20Y9. Place your answers in a columnar table similar to that in part (1) but with the following column heads. Round budgeted units to the nearest unit. 20Y8 Percentage 20Y9 Actual Increase Budgeted Units (Decrease) Units (rounded) 3. Prepare a sales budget for the year ending December 31, 201Y9Forecast sates volume and sales budget For 20Y8, Raphael Frame Company prepared the sales budget that follows. At the end of December 20Y8, the following unit sales data were reported for the year: Unit Sales 8" 10" Frame 12" 16" Frame East 8,755 3,686 Central 6,510 3,090 West 12,348 5,616 For the year ending December 31, 20Y9, unit sales are expected to Follow the patterns established during the year ending December 31, 20Y8. The unit selling price for the 8" 10" the frame is expected to Increase to 17 and the unit selling price for the 12" 16" frame is expected to increase to 32, effective January 1, 20Y9. Instructions 1. Compute the increase or decrease of actual unit sales for the year ended December 31,. 20Y8, Over budget. Place your answers in a columnar table with the following format: 2. Assuming that the increase or decrease in actual sales to budget indicated in part (1) is to continue in 20Y9, compute the unit sales volume to lie used for preparing the sales budget for the year ending December 31, 20Y9. Place your answers in a columnar table similar to that in part (1) but with the following column heads. Round budgeted units to the nearest. 20Y8 Percentage 20Y9 Actual Increase Budgeted Units (Decrease) Units (rounded) 3. Prepare a sales budget for the year ending December 51. 20Y9.Forecast sales volume and sales budget Sentinel Systems Inc. prepared the following sales budget for 20Y8: Sentinel Systems Inc. Sales Budget For the Year Ending December 31, 20 Y8 Unit Sales Unit Selling Total Product and Area Volume Price Sales Home Alert System: United States 1,700 200 340,000 Europe 580 200 116,000 Asia 450 200 90,000 Total 2,730 546,000 Business Alert System: United States 980 750 735,000 Europe 350 750 262,500 Asia 240 750 180,000 Total 1,570 1,177,500 Total revenue from sales 1,723,500 At the end of December 20Y8, the following unit sales data were reported for the year: Unit Sales Home Alert System Business Alert System United States 1,734 1,078 Europe 609 329 Asia 432 252 For the year ending December 31, 20Y9, unit sales are expected to follow the patterns established during the year ending December 31, 20Y8. The unit selling price for the Home Alert System is expected to increase to 250, and the unit selling price for the Business Alert System is expected to be decreased to 820, effective January 1, 20Y9. Instructions 1. Compute the increase or decrease of actual unit sales for the year ended December 31, 20Y8, over budget. Place your answers in a columnar table with the following format: Unit Sales, Year Ended 20Y8 Increase (Decrease) Actual Over Budget Budget Actual Sales Amount Percent Home Alert System: United States Europe Asia Business Alert System: United States Europe Asia 2. Assuming that the increase or decrease in actual sales to budget indicated in part (1) is to continue in 20Y9, compute the unit sales volume to lie used for preparing the sales budget for the year ending December 31, 20Y9- Place your answers in a columnar table similar to that in part (1) but with the following column heads. Round budgeted units to the nearest unit. 20Y8 Actual Units Percentage Increase (Decrease) 20Y9 Budgeted Units (rounded) 3. Prepare a sales budget for the year ending December 31, 20Y9.

- Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January I, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Regina Soap Co.: Cash 85,000 Accounts Receivable........................................ 125,600 Finished Goods............................................ 69,300 Work in Process............................................ 32,500 Materials.................................................. 48,900 Prepaid Expenses.......................................... 2,600 Plant and Equipment....................................... 325,000 Accumulated DepreciationPlant and Equipment........... 156,200 Accounts Payable.......................................... 62,000 Common Stock. 10 par.................................... 180,000 Retained Earnings.......................................... 290,700 688,900 688,900 Factory output and sales for 20Y9 are expected to total 200,000 units of product, which are to be sold at 5.00 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Estimated Costs and Expenses Fixed Variable (Total for Year) (Per Unit Sold) Cost of goods manufactured and sold: Direct materials.................................. 1.10 Direct labor...................................... 0.65 Factory overhead: Depreciation of plant and equipment........... 40,000 Other factory overhead........................ 12,000 0.40 Selling expenses: Sales salaries and commissions.................... 46,000 0.45 Advertising...................................... 64,000 Miscellaneous selling expense................... 6,000 0 25 Administrative expenses: Office and officers salaries........................ 72,400 0.12 Supplies......................................... 5,000 0.10 Miscellaneous administrative expense............. 4,000 0.05 Balances of accounts receivable, prepaid expenses, anti accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 30,000 on 20Y9 taxable income will be paid during 20Y9. Regular quarterly cash dividends of 0.15 per share are expected to be declared and paid in March, June. September, and December on 18,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 75,000 cash in May. Instructions 1. Prepare a budgeted income statement for 20Y9. 2. Prepare a budgeted balance sheet as of December 31, 20Y9, with supporting calculations.Forecast sales volume and sales budget Sentinel Systems Inc. prepared the following sales budget for 2016: At the end of December 2016, the following unit sales data were reported for the year: For the year ending December 31 , 2017, unit sales are expected to follow the patterns established during the year ending December 31, 2016. The unit selling price for the Home Alert System is expected to increase to 250, and the unit selling price for the Business Alert System is expected to be decreased to 820, effective January 1, 2017. Instructions 1. Compute the increase or decrease of actual unit sales for the year ended December 31, 2016, over budget. Place your answers in a columnar table with the following format: 2. Assuming that the increase or decrease in actual sales to budget indicated in part (1) is to continue in 2017, compute the unit sales volume to be used for preparing the sales budget for the year ending December 31, 2017. Place your answers in a columnar table similar to that in part (1) but with the following column heads. Round budgeted units to the nearest unit. 3. Prepare a sales budget for the year ending December 31, 2017.Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 2017, the following tentative trial balance as of December 31, 2016, is prepared by the Accounting Department of Regina Soap Co.: Cash............................................................. 85,000 Accounts Receivable............................................... 125,600 Finished Goods................................................... 69,300 Work in Process................................................... 32,500 Materials......................................................... 48,900 Prepaid Expenses................................................. 2,600 Plant and Equipment.............................................. 325,000 Accumulated Depreciation Plant and Equipment.................. 156,200 Accounts Payable................................................. 62,000 Common Stock, 10 par........................................... 180,000 Retained Earnings................................................. 290,700 688,900 688,900 Factory output and sales for 2017 are expected to total 200,000 units of product, which are to be sold at 5.00 per unit. The quantities and costs of the inventories at December 31, 2017, are expected to remain unchanged from the balances at The beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Estimated Costs and Expenses Cost of goods manufactured and sold: Fixed (Total for Year) Direct materials................................................ 1.10 Direct labor.................................................... 0.65 Factory overhead: Depreciation of plant and equipment.......................... 40,000 Other factory overhead....................................... 12,000 0.40 Selling expenses: Sales salaries and commissions.................................. 46,000 0.45 Advertising.................................................... 64,000 Miscellaneous selling expense.................................. 6,000 0.25 Administrative expenses: Office and officers salaries...................................... 72,400 0.12 Supplies....................................................... 5,000 0.10 Miscellaneous administrative expense........................... 4,000 0.05 Balances, of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 30,000 on 2017 taxable income will be paid during 2017. Regular quarterly cash dividends of 0.15 per share are expected to be declared and paid in March, June, September, and December on 18,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 75,000 cash in May. Instructions 1. Prepare a budgeted income statement for 2017. 2. Prepare a budgeted balance sheet as of December 31, 2017, with supporting calculations.

- Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Mesa Publishing Co.: Cash. 26,000 Finished Goods.............................................. 16,900 Work in Process.............................................. 4,200 Materials.................................................... 6,400 Prepaid Expenses............................................ 600 Plant and Equipment......................................... 82,000 Accumulated DepreciationPlant and Equipment............. 32,000 Accounts Payable............................................ 14,800 Common Stock. 1.50 par..................................... 30,000 Retained Earnings............................................ 83,100 159,900 159,900 Factory output and sales for 20Y9 are expected to total 3,800 units of product, which are to be sold at 120 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Estimated Costs and Expenses Fixed Variable (Total for Year) (Per Unit Sold) Cost of goods manufactured and sold: Direct materials................................... 30.00 Direct labor....................................... 840 Factory overhead: Depreciation of plant and equipment............ 4,000 Other factory overhead......................... 1,400 4.80 Selling expenses: Sales salaries and commissions..................... 12,800 13.50 Advertising....................................... 13,200 Miscellaneous selling expense..................... 1,000 2.50 Administrative expenses: Office and officers salaries......................... 7,800 7.00 Supplies.......................................... 500 1.20 Miscellaneous administrative expense.............. 400 2.40 Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances, federal income tax of 35,000 on 20Y9 taxable income will be paid during 20Y9. Regular quarterly cash dividends of 0.20 per share are expected to be declared and paid in March, June, September, and December on 20,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 22,000 cash in May. Instructions 1. Prepare a budgeted income statement for 20Y9. 2. Prepare a budgeted balance sheet as of December 31, 20Y9, with supporting calculations.CASH BUDGETING Rework Problem 15-10 using a spreadsheet model. After completing Parts a through d, respond to the following: If Bowers customers began to pay late, collections would slow down, thus increasing the required loan amount. If sales declined, this also would have an effect on the required loan. Do a sensitivity analysis that shows the effects of these two factors on the maximum loan requirement.Forecast sales volume and sales budget For 20Y6, Raphael Frame Company prepared the sales budget that follows. At the end of December 20Y6, the following unit sales data were reported for the year: Unit Sales 8" 10" Frame 12" 16" Frame East 8,755 3,686 Central 6,510 3,090 West 12,348 5,616 Raphael Frame Company Sales Budget For the Year Ending December 31, 20Y6 Unit Sales Unit Selling Total Product and Area Volume Price Sales 8"10" Frame: East 8,500 16 136,000 Central 6,200 16 99,200 West 12,600 16 201,600 Total 27,300 436,800 12" x 16" Frame: East 3,800 30 5114,000 Central 3,000 30 90,000 West 5,400 30 162,000 Total 12,200 366,000 Total revenue from sales 802,800 For the year ending December 31, 20Y7, unit sales are expected to follow the patterns established during the year ending December 31, 20Y6. The unit selling price for the 8" 10"frame is expected to increase to 17, and the unit selling price for the 12" 16" frame is expected to increase to 32, effective January 1, 20Y7. Instructions 1. Compute the increase or decrease of actual unit sales for the year ended December 31, 20Y6, over budget. Place your answers in a columnar table with the following format: Unit Sales, Year Ended 20Y6 Increase (Decrease) Actual Over Budget Budget Actual Sales Amount Percent 8" 10" Frame: East Central West 12"16" Frame: East Central West 2. Assuming that the increase or decrease in actual sales to budget indicated in part (1) is to continue in 20Y7, compute the unit sales volume to be used for preparing the sales budget for the year ending December 31, 20Y7. Place your answers in a columnar table similar to that in part (1) but with the following column heads. Round budgeted units to the nearest unit. 20Y6 Percentage 20Y7 Actual Increase Budgeted Units (Decrease! Units (rounded) 3. Prepare a sales budget for the year ending December 31, 20Y7.

- Budgeted income statement and supporting budgets The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March 2016: a. Estimated sales for March: Batting helmet 1,200 units at 40 per unit Football helmet 6,500 units at 160 per unit b. Estimated inventories at March 1: Direct materials: Finished products: Plastic 90 lbs. Batting helmet........ 40 units at 25 per unit Foam lining 80 lbs. Football helmet....... 240 units at 77 per unit c. Desired inventories at March 31: Direct materials: Finished products: Plastic50 lbs. Batting helmet......... 50 units at 25 per unit Foam lining65 lbs. Football helmet........ 220 units at 78 per unit d. Direct materials used in production: In manufacture of batting helmet: Plastic 1.20 lbs. per unit of product Foam lining 0.50 lb. per unit of product In manufacture of football helmet: Plastic 3.50 lbs. per unit of product Foam lining 1.50 lbs. per unit of product e. Anticipated cost of purchases and beginning and ending inventor) of direct materials: Plastic 6.00 per lb. Foam lining 4.00 per lb. f. Direct labor requirements: Batting helmet: Molding Department 0.20 hr. at 20 per hr. Assembly Department 0.50 hr. at 14 per hr. Football helmet: Molding Department 0.50 hr. at 20 per hr. Assembly Department 1.80 hrs. at 14 per hr. g. Estimated factory overhead costs for March: Indirect factory wages 86,000 Power and light 4,000 Depreciation of plant and equipment 12,000 Insurance and property tax 2,300 h. Estimated operating expenses for March: Sales salaries expense 184,300 Advertising expense 87,200 Office salaries expense 32,400 Depreciation expenseoffice equipment 3,800 Telephone expenseselling 5,800 Telephone expenseadministrative 1,200 Travel expense-selling 9,000 Office supplies expense 1,100 Miscellaneous administrative expense 1,000 i. Estimated other income and expense for March: Interest revenue 940 Interest expense 872 j. Estimated tax rate: 30% Instructions 1. Prepare a sales budget for March. 2. Prepare a production budget for March. 3. Prepare a direct materials purchases budget for March. 4. Prepare a direct labor cost budget for March. 5. Prepare a factory overhead cost budget for March. 6. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be 15,300, and work in process at the end of March is desired to be 14,800. 7. Prepare a selling and administrative expenses budget for March. 8. Prepare a budgeted income statement for March.Integrity and evaluating budgeting systems The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided by 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be returned to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for the recent fiscal year. The chart was as follows: a. Interpret the chart. b. Suggest an improvement in the budget system.Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y8, the following tentative trial balance as of December 31, 20Y7, is prepared by the Accounting Department of Mesa Publishing Co.: Cash 26,000 Accounts Receivable 23,800 Finished Goods 16,900 Work in Process 4,200 Materials 6,400 Prepaid Expenses 600 Plant and Equipment 82.000 Accumulated DepreciationPlant and Equipment 32,000 Accounts Payable 14.800 Common Stock. 1.50 par 30,000 Retained Earnings 83,100 159,900 159,900 Factory output and sales for 20Y8 are expected to total 3,800 units of product, which are to be sold at 120 per unit. The quantities and costs of the inventories at December 31, 20Y8, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Estimated Costs and Expenses Fixed Variable (Total for Year) (Per Unit Sold) Cost of goods manufactured and sold: Direct materials 30.00 Direct labor B.40 Factory overhead: Depreciation of plant and equipment 4,000 Other factory overhead 1,400 4.30 Selling expenses: Sales salaries and commissions 12,800 13.50 Advertising 13,200 Miscellaneous selling expense 1,000 2.50 Administrative expenses: Office and officers salaries 7,800 7.00 Supplies 500 1.20 Miscellaneous administrative expense 400 2.40 Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 35,000 on 20Y8 taxable income will be paid during 20Y8. Regular quarterly cash dividends of 0.20 per share are expected to be declared and paid in March, June, September, and December on 20,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 22,000 cash in May. Instructions 1. Prepare a budgeted income statement for 20Y8. 2. Prepare a budgeted balance sheet as of December 31,20Y8, with supporting calculations.